The beauty of legacy planning

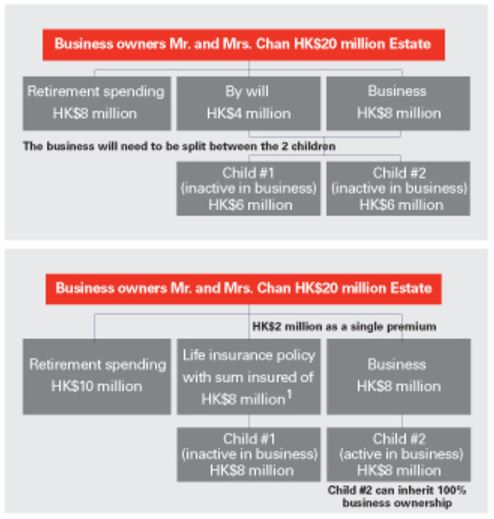

Scenario : Mr. and Mrs. Chan’s total estate assets worth HK$20 million with HK$8 million as their business. They would like to enjoy the retirement and ensure their children receive an equal share of their estate after they pass away.

Without Legacy Planning:

Mr. and Mrs Chan have to ensure they spend no more than HK$8 million during their retirement such that HK$12 million will be available in their will or business for their children's inheritance.

With Legacy Planning:

A HK$8 million worth lift insurance policy can be bought by either Mr. or Mrs. Chan assuming HK$2 million to be paid as a single premium. This will make HK$10 million available for Mr. and Mrs. Chan's retirement - 25% more than the scenario with no legacy planning. Besides, without the need to split the business, each of their children will inherit HK$8million worth of their estate.

1The sum assured varies from product to product based on a given premium amount, and the premium amount is based on life insured’s gender, age, smoking habit, sum assured and underwriting considerations. Please refer to relevant product materials for the details.

Benefits:

- Provides long term financial security - protects yourself and your heirs financially and sustainably.

- Maximises your liquidity with insurance planning - Helps to ensure liquidity during retirement and surplus can be transferred to your heirs or for charity purposes

Get started

Future Planner

Want to review your future planning and see if you're on track to achieving your goals? Get started with Future Planner to gain insights into your planning and see what areas may need more attention.

Risk Profiling Questionnaire

Want to understand your investment needs and risk appetite? Please log on to HSBC Personal Internet Banking or the latest version of HSBC HK Mobile Banking app, and it will take you just a few minutes to complete the Risk Profiling Questionnaire.