Understanding your needs

Every day we strive to provide the best for our families: a safe and comfortable home, the best education and awesome vacations. But life is unpredictable. No matter how hard we try, unexpected events can undermine everything we have worked for. With careful planning, you can safeguard your family financially against whatever mishaps the future may hold.

Potential threats to your family’s well-being

- A survey1 shows that there are substantial consistencies in the attitudes towards protection across Hong Kong respondents.

- 81% of the respondents agree that it is important to do all that is possible to protect family from adverse events.

- Another survey2 shows that majority of the Hong Kong respondents are worried about the potential impact of getting serious illness and inability to pay medical expenses.

- A global medical survey3 also indicates that cardiovascular disease and cancer are the major reasons for medical claims today, and are expected to continue to be over the next five years.

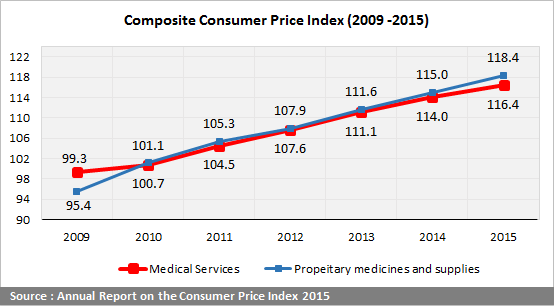

- Medical expense is on the rise, are you well prepared for it?

Loss of Income

There are several potential scenarios that could cost you your paycheck

- Inability to work during treatment and recovery periods which may take years

- Inability to meet the demands of your job even after recovering from the illness

- Inability to work at all due to poor health, causing you to end your career prematurely

1Source: 2013 HSBC Global Insurance and Protection Needs Survey

2Source: 2012 Swiss Re Health Protection Gap: Asia Pacific

3Source: Towers Watson 2014 Global Medical Trends Survey Report

Get Started

Future Planner

Want to review your future planning and see if you're on track to achieving your goals? Get started with Future Planner to gain insights into your planning and see what areas may need more attention.

Risk Profiling Questionnaire

Want to understand your investment needs and risk appetite? Please log on to HSBC Personal Internet Banking or the latest version of HSBC HK Mobile Banking app, and it will take you just a few minutes to complete the Risk Profiling Questionnaire.