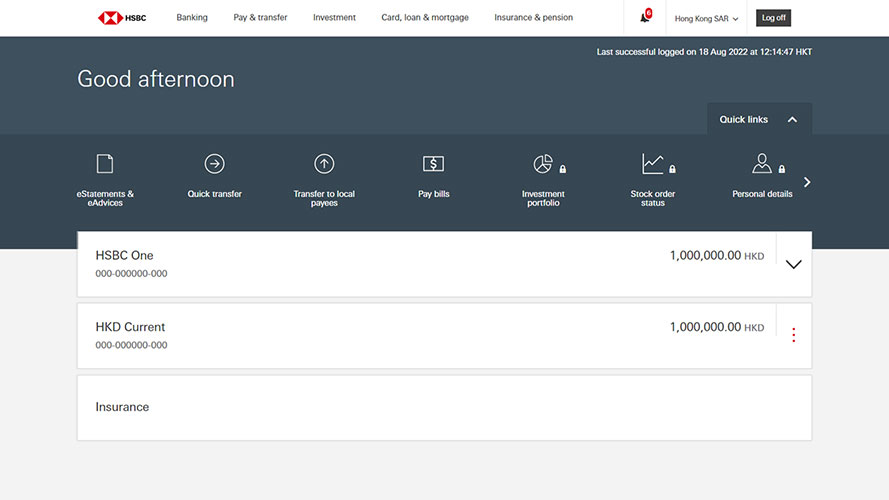

Refreshed account summary page

The new account summary page will be rolled out in phases from September 2022 to give you an improved, seamless online banking experience. The refreshed design allows you to choose everyday banking services without any hassle. Here's what else you can look forward to!

- A more organised top menu with a new tab "Pay & transfer" to find payment service with ease

- "Quick Links" for accessing frequently used features

We have also moved the transfer, stock and foreign exchange widget to Quick Links, so you can get your transactions done even quicker.

Accounts at a glance

A simpler design for account summary gives you a better overview of your account balance, credit card balance, and more – all in one place. You can view your account details and transaction history with one tap on the accounts.

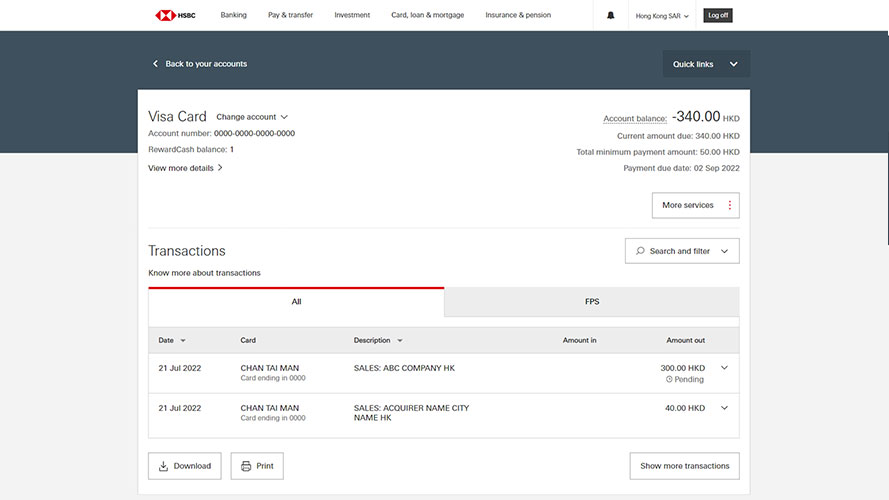

Want to track your daily credit spending more conveniently? Just select any credit card account and view pending transactions.

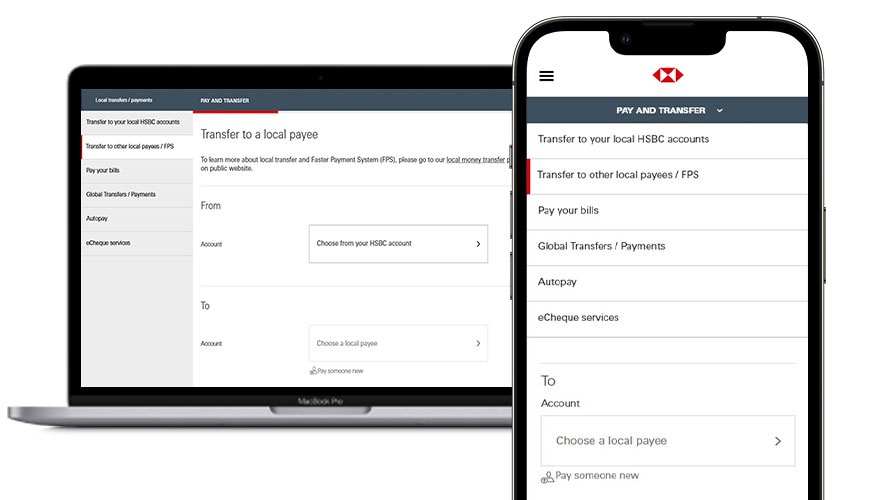

Pay and transfer even faster

With a refreshed design and navigation menu, you can manage your transfers locally and globally without hassle. What's more? We've introduced some more enhancements to make your transfers even smoother:

- streamlined access within the 'Pay & Transfer' section

- search payees or pay a new payee easily

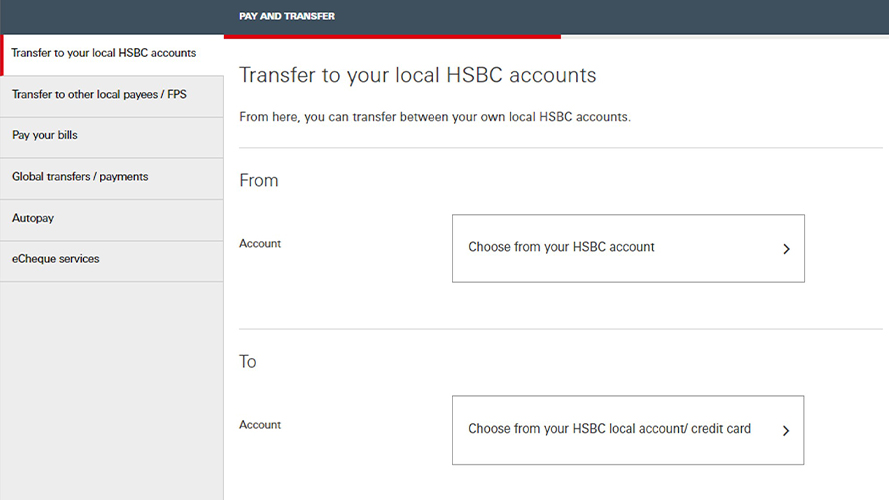

Transfer to your local HSBC accounts

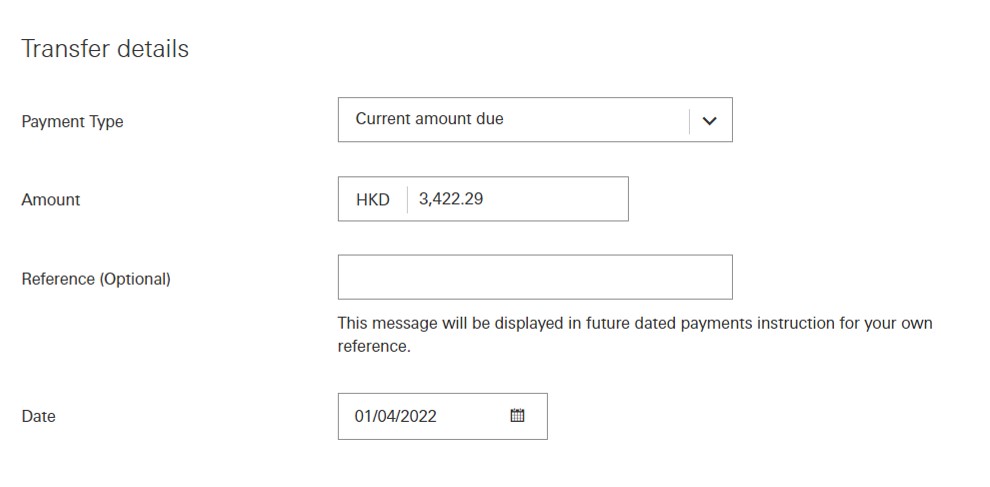

You can transfer money between your HSBC accounts with just a few steps so you can manage your wealth easily and not miss any market opportunities:

- locate your accounts easily with our new account search feature

- choose to pay your full credit card statement balance, minimum payment, current amount due, or your own designated amount

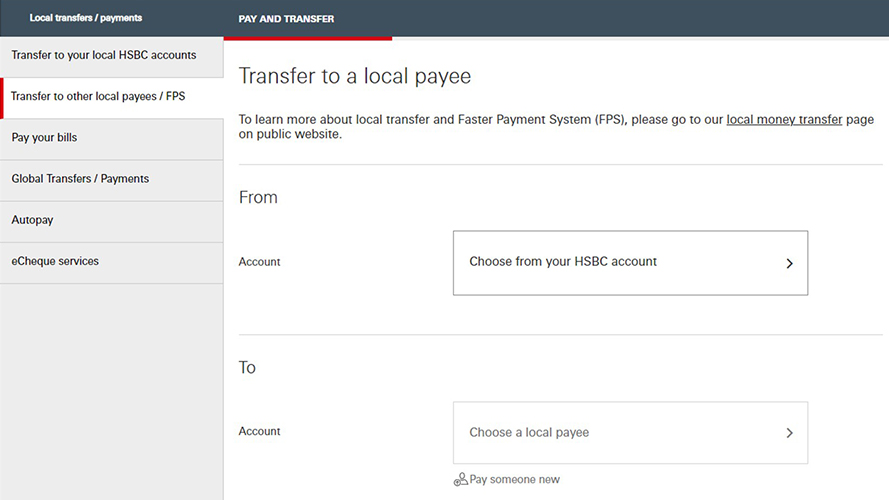

Transfer to other local payees / FPS

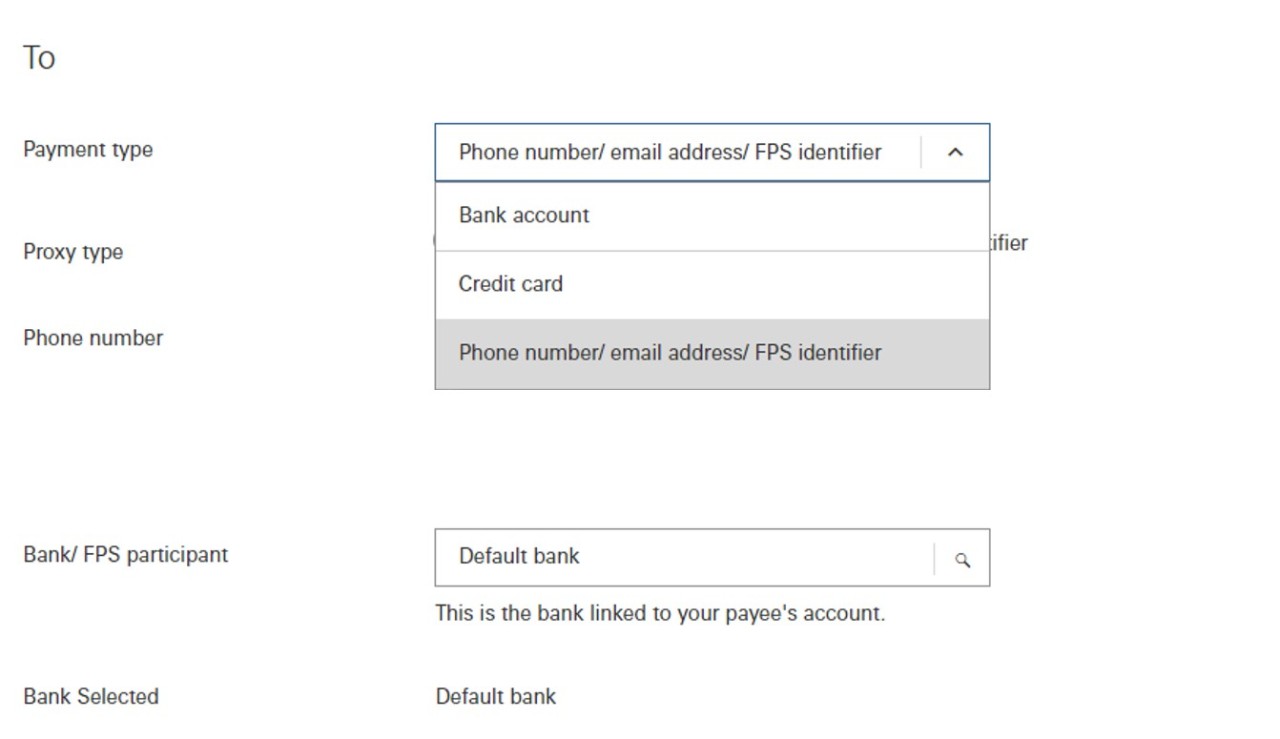

Need to transfer to your family and friends? You can now make faster transfers online via their account number or Faster Payment System (FPS)!

- Select your payment type, then directly input payee details as indicated

- See your remaining transfer limit

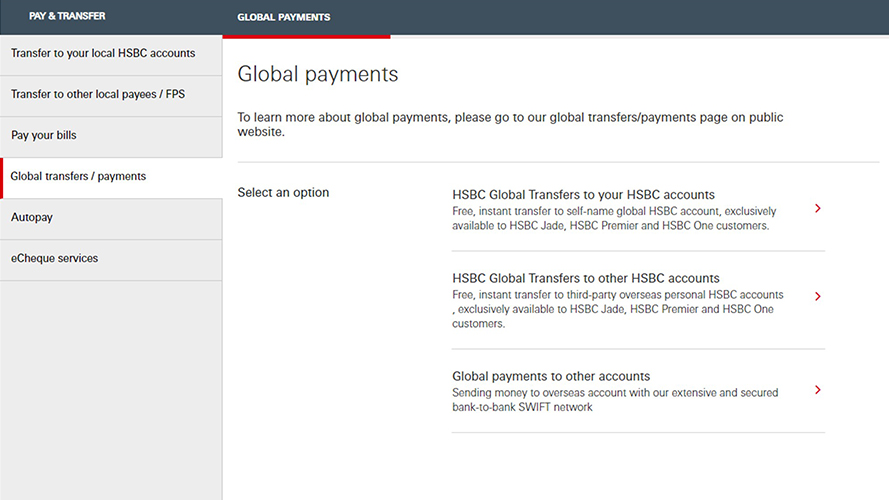

Global transfers / payments

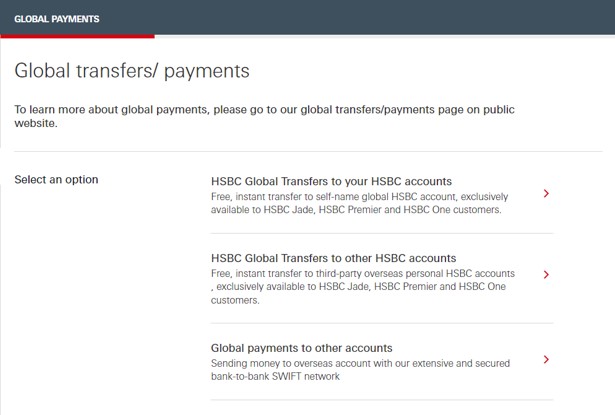

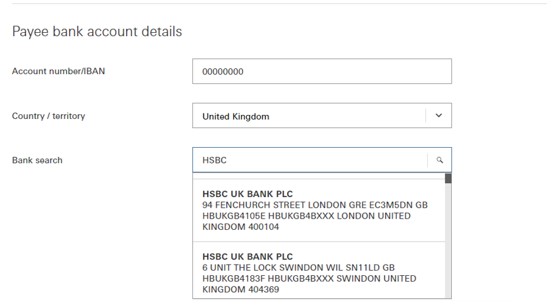

You can now make your global payments more easily with the new menu:

- choose between HSBC Global Transfers and Telegraphic Transfer by the receiving account type

- simply put in the bank code, name or address in 'Bank search' field to search for the receiving overseas bank

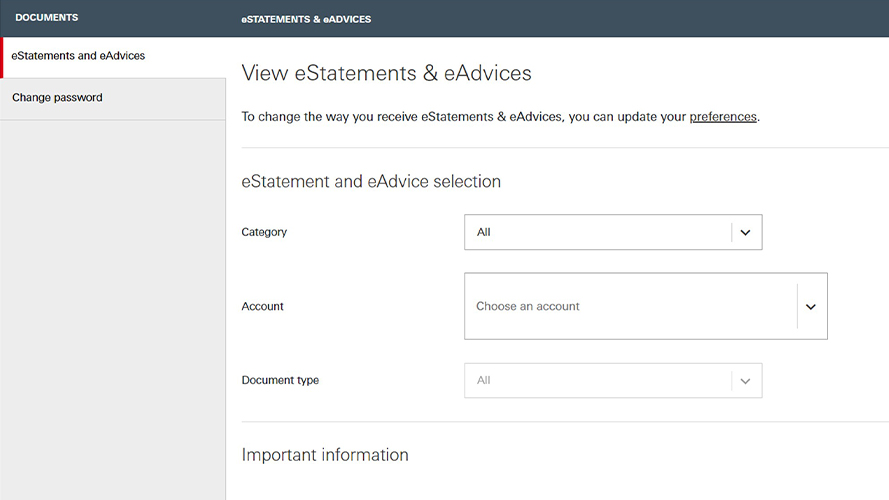

eStatements & eAdvices

- You can check all documents with the new filters, including up to 3 months of transaction advices, and eStatements from as far back as 7 years ago2

- You can quickly identify the document needed by filtering account, document type and time period

Frequently asked question

Need assistance?

Connect with us instantly via 'Chat with us'. We're here to help you, every step of the way.

Remarks:

1. The screen displays and the images of the website are for reference and illustration purposes only.

2. Your eAdvice are retained up to 3 months. Monthly HIBOR-based Mortgage Plan Repayment eAdvices are retained up to 12 months. Your eStatements for other accounts (including investment services and securities accounts) are retained up to 24 months. Your eStatements for integrated accounts, HKD current accounts and HKD savings accounts are retained up to 84 months. For more details, please visit https://www.hsbc.com.hk/accounts/estatement/

3. HSBC Premier Elite Client ID is only applicable to HSBC Premier Elite customers