Chance to win 1 of 6 iPhone 16 Pro 256GB with FlexInvest and Future Planner

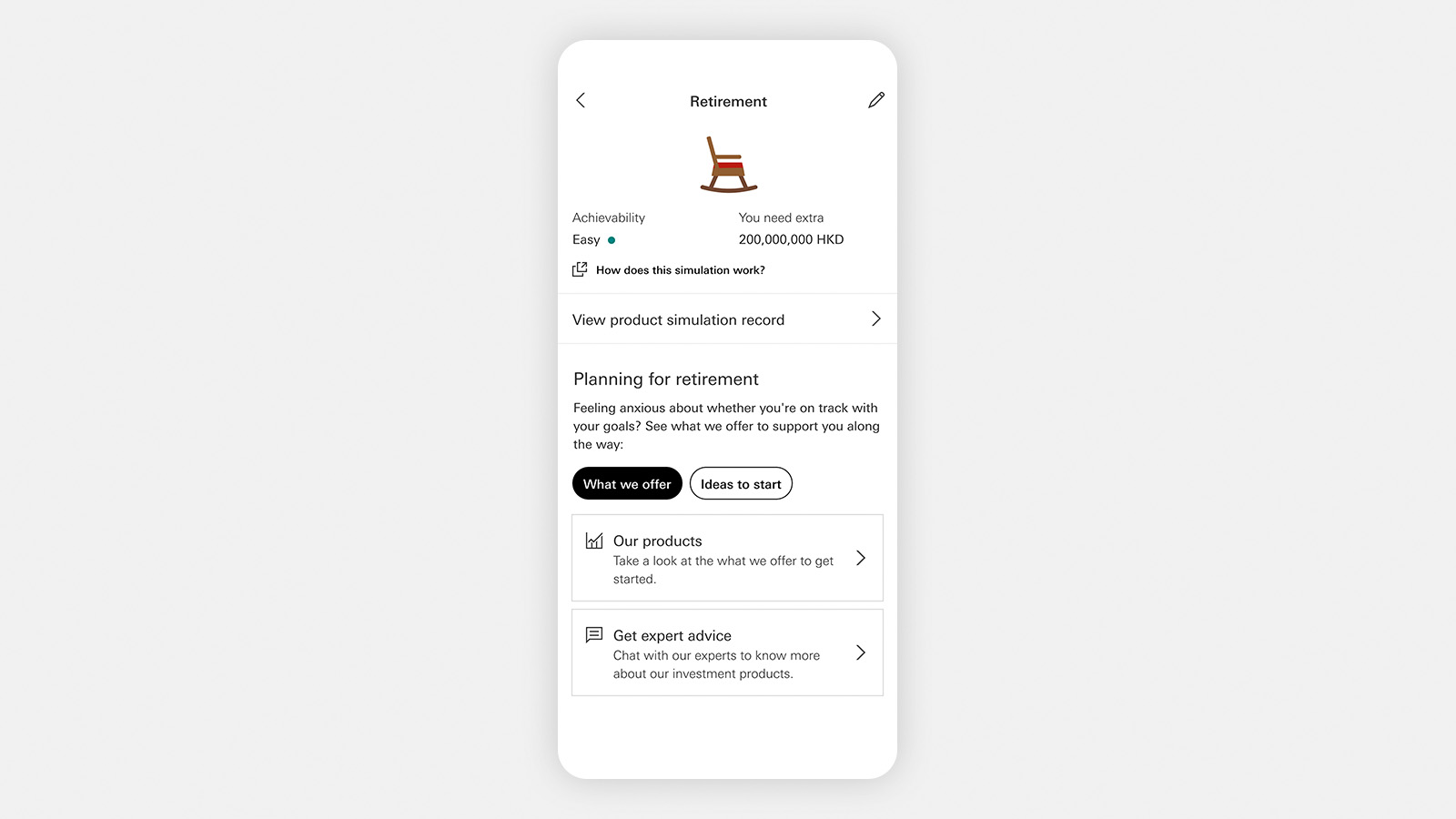

Step 1: Set a retirement goal in Future Planner

Step 2: Review and confirm your retirement lifestyle

Step 3: Invest HKD5,000 with FlexInvest

There will be 6 lucky draws over the next 6 months. You'll get a chance at each monthly lucky draw when you invest HKD5,000 or more in that same month.

You can invest across multiple funds as long as the total amount reaches HKD5,000 or more.

Exciting rewards await when you set up a monthly plan!

This offer ends on 31 December 2024. Read our terms & conditions.

Step 1

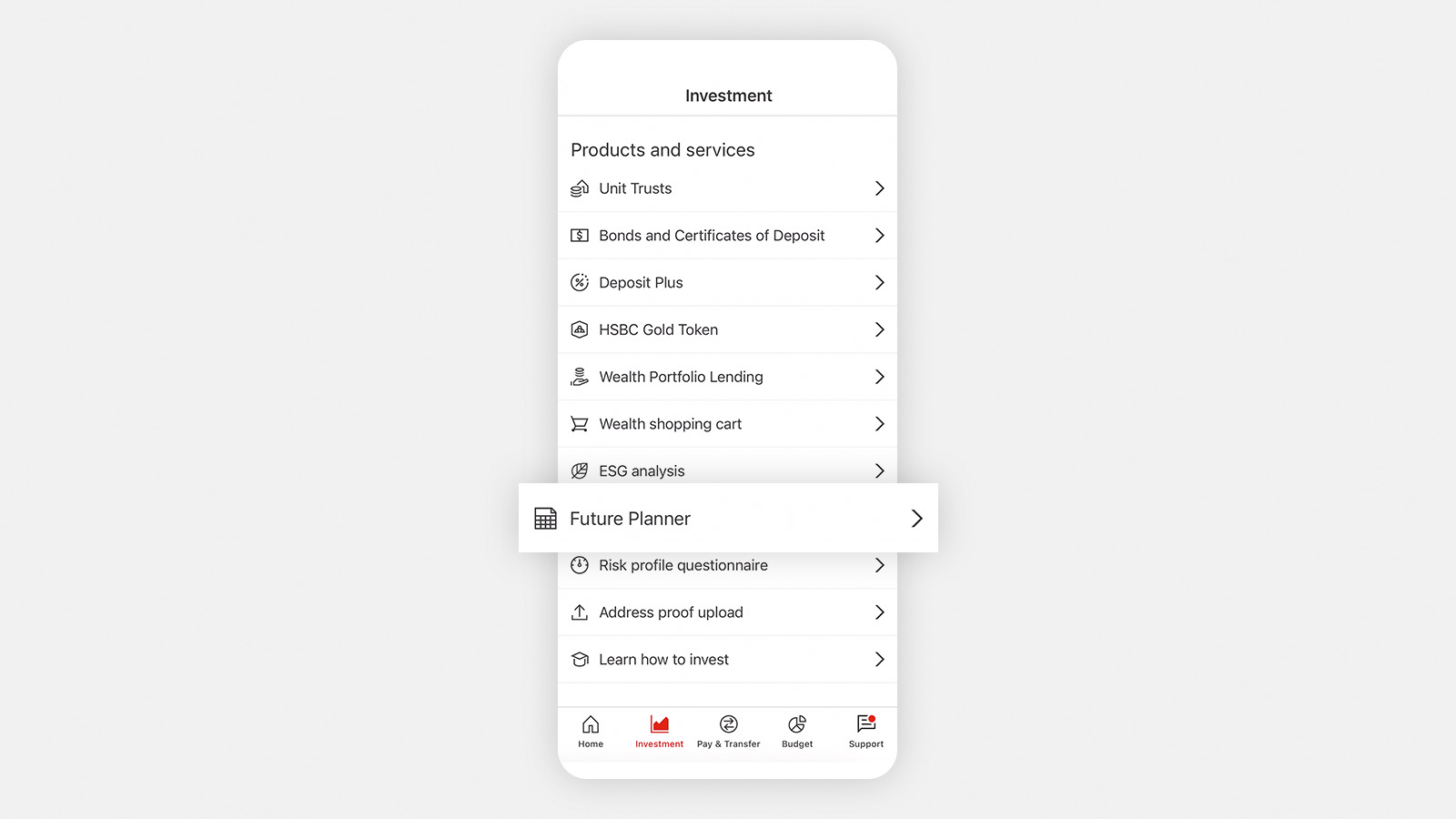

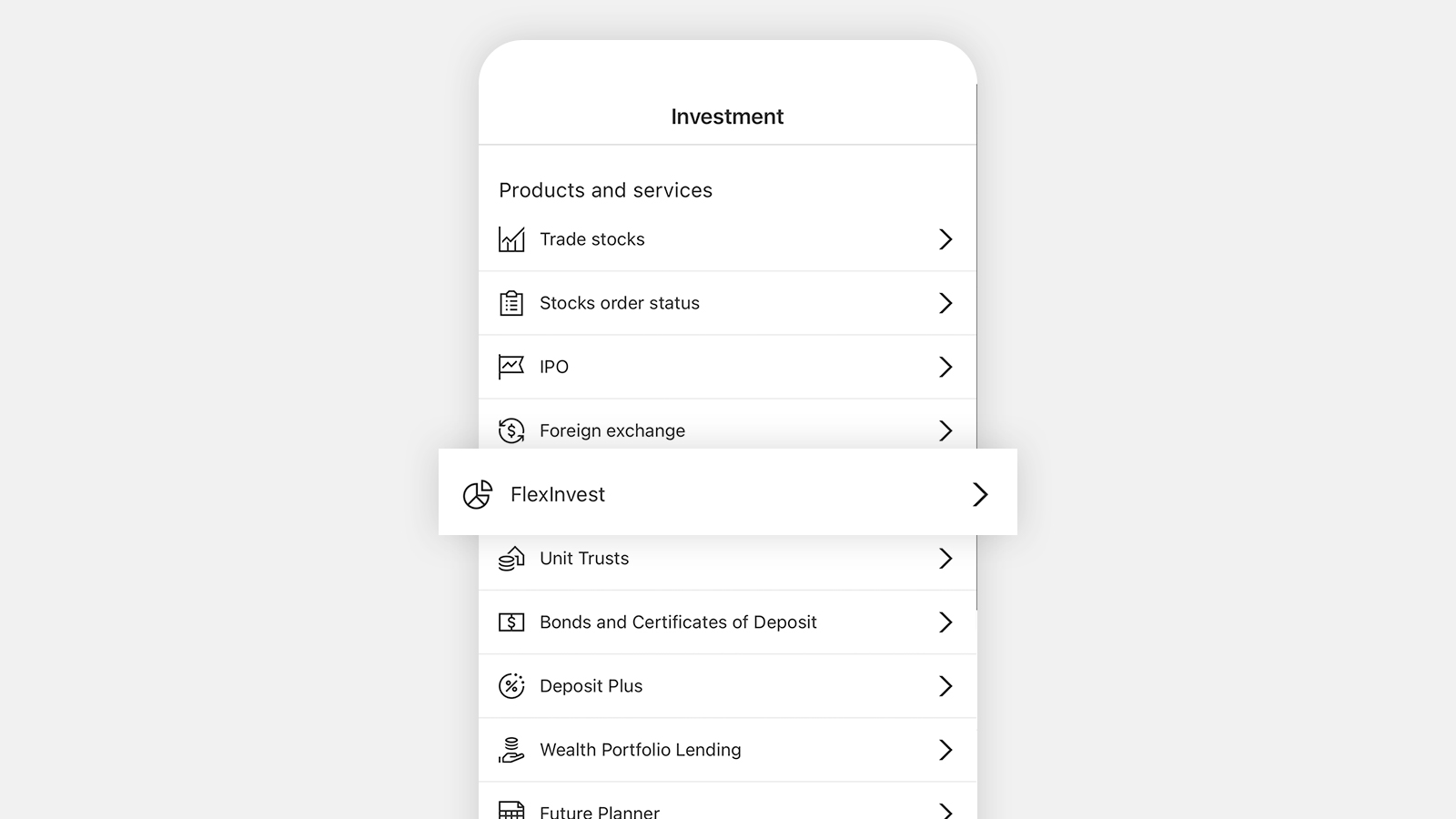

Log on to the HSBC HK Mobile Banking App > Select ‘Investment’ > Select ‘FlexInvest’.

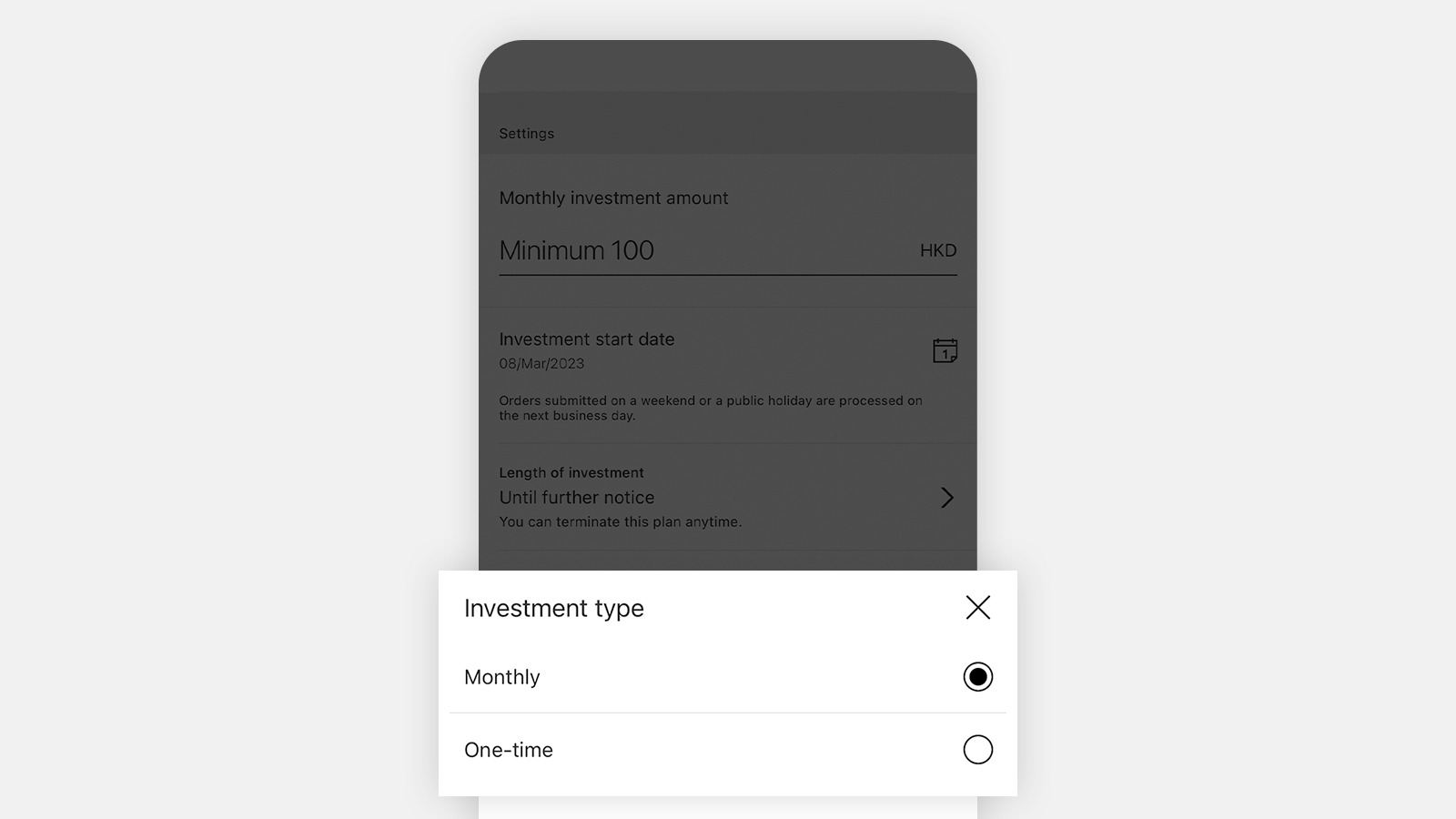

The screen displays are for reference and illustration purposes only.

Step 2

Once you’re ready to invest, make sure you select ‘monthly’ investment type before you settle your transaction.

You can invest across multiple funds, as long as the total amount reaches HKD1,000 or more.

Step 3

You will receive HKD60 cash reward after 3 months, HKD90 after 6 months and HKD150 after 12 months of continuous monthly investments.1

Why choose FlexInvest

We make it easy to diversify in all assets and markets, by covering a wide range of companies, sectors and regions, and for as little as HKD100, you can invest and buy or sell our funds starting with zero monthly fees.

The readymade options

Not sure where to start? You can buy an entire portfolio using our multi-asset funds that cover assets across the world.

There are 5 to choose from with different risk levels to match your investment style.

Prefer to pick where to invest but not be overwhelmed with choices?

We offer 10 individual funds, each aiming to replicate an entire index and its composition – for example Hang Seng Index or S&P 500. You can rebalance your mix over time by buying and selling with no charges.

Fees and charges

You'll be charged:

- a monthly platform fee, but only when your average holding balance (the daily average of the total market value of your holdings) reaches HKD10,000. See the table for how much you might need to pay.

You won't be charged:

- any fund management fees by us, as the companies who manage the funds will take them directly from the fund's performance (read the fund detail pages for details of these fees)

- for any trading activities—you can buy or sell FlexInvest funds for free, without any limits

Fees table

| Your average holding balance | Monthly platform fees |

|---|---|

| Less than HKD10,000 | Free |

| Between HKD10,000–200,000 |

HKD28 per month |

| More than HKD200,000 |

0.8% p.a. of your average holding balance |

| Your average holding balance | Less than HKD10,000 |

|---|---|

| Monthly platform fees |

Free |

| Your average holding balance |

Between HKD10,000–200,000 |

| Monthly platform fees |

HKD28 per month |

| Your average holding balance |

More than HKD200,000 |

| Monthly platform fees |

0.8% p.a. of your average holding balance |