General

Logon and Passwords

eStatements and eAdvice

Pay and transfer

e-Cheque Services

Form name Description |

Form download |

|---|---|

Self-employed Application Form Apply to participate in an HSBC MPF scheme. |

IN31 |

Self-employed Person Relevant Income Declaration Form Declare relevant income for each scheme financial year for MPF purposes. |

IN24 |

Individual Tax Residency Self-certification Form (CRS-I (HK)–MPF) To confirm your personal status under the Common Reporting Standard (CRS). |

INCI |

Personal Details Change Form (Fillable format available) Notify any change to personal details, including address, contact number, email address and preferred language for correspondence, etc.

For any changes not listed on the form, please inform us in writing. |

(fillable format) (Sample) |

Change of Member Signature Specimen To change the signature specimen. |

IN92 |

New/Change of Direct Debit Instruction Notification Form Direct Debit Authorisation Notify an addition or change to a direct debit authorisation for your MPF scheme or a particular pay centre, and authorise deduction of MPF contributions from your bank account.

Paying your contributions through direct debit saves you time in writing and checking the payee and total amount for each payment.

Please note that about 2 weeks' processing time is required to set up a direct debit authorisation for a bank account with HSBC or Hang Seng Bank, or about a month for other bank accounts. |

|

Change of Investment Instruction Form Change your investment instruction of your existing investments and/or future contributions and/or accrued benefits transferred from another Registered Scheme. This form is applicable if you want to:

|

INBP |

Remittance Statement Report relevant income and contributions. |

INB4 |

Contribution remittance advice To provide contribution remittance details (applicable for the remittance of contributions by cheque due to delays in setting up direct debit authorisation, dishonoured direct debit/cheque or insufficient funds in your last contribution) |

INCP |

Additional Voluntary Contributions Arrangement Form Set up or cancel regular voluntary contribution arrangement. |

INPS |

Scheme Member's Request for Fund Transfer Form (Fillable format available)

It is also applicable for employees who cease employment to transfer their benefits to an individual personal account. |

INPM (fillable format) (Sample) |

Scheme Member's Request for Account Consolidation Form Consolidate multiple personal accounts into one account. |

(Download from MPFA's website) |

Customer Information Form – Personal Customer Provide accurate and up-to-date information to support a more secure protection arrangement. |

INKE |

Claim Form for Payment of MPF Accrued Benefits (Benefits) on Grounds of Attaining the Retirement Age of 65 or Early Retirement [Form MPF(S) - W(R)] (Fillable format available)

Appropriate supporting documents and, where applicable, statutory declarations must be enclosed. |

INPR (fillable format) |

Change of Regular Withdrawal Instruction Form Change the monthly regular withdrawal amount, payment method or cancellation of regular withdrawal instruction. |

INRW |

Claim Form for Payment of MPF Accrued Benefits (Benefits) on Grounds of Permanent Departure from Hong Kong/Total Incapacity/Terminal Illness/Small Balance/ Death [Form MPF(S) - W(O)] (Fillable format available)

Appropriate supporting documents and, where applicable, statutory declarations must be enclosed. |

INPO (fillable format) (Sample) |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Early Retirement Supporting documentation for claiming accrued benefits on the grounds of early retirement.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(SD1) |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Permanent Departure from Hong Kong Supporting documentation for claiming accrued benefits on the grounds of permanent departure from the Hong Kong SAR.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(SD2) |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Small Balance Supporting documentation for claiming accrued benefits on the grounds of small balance.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(SD3) |

Statutory Declaration Made by the Committee of the Estate of a Scheme Member for Claims for Payment of Accrued Benefits Supporting documentation for claiming accrued benefits on the grounds of early retirement, small balance or permanent departure from Hong Kong by committee of estate on behalf of a mentally incapacitated scheme member.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(SD4) |

Certificate of a Person Having a Terminal Illness That Falls within Section 158(3) of the Mandatory Provident Fund Schemes (General) Regulation or Section 6(12G) of Schedule 2 to the Mandatory Provident Fund Schemes (Exemption) Regulation Supporting documentation for claiming accrued benefits on the grounds of terminal illness.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(T) |

Certificate of a Person's Permanent Unfitness for a Particular Kind of Work Supporting documentation for claiming accrued benefits on the grounds of total incapacity.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

MPF(S)-W(M) |

Partial Withdrawal Request Form Request a withdrawal of benefits that are not subject to MPF preservation requirements. |

IN22 |

Instructions for Treatment of Accrued Benefits after Retirement Age Notify treatment of accrued benefits after age 65. |

INAT |

Cessation of Self-employment / Transfer of Accrued Benefit Notification Form Notify your cessation of self-employment or transfer to another MPF scheme. |

IN33 |

Duplicate Remittance Statement Requisition Form Request a copy of any previous Remittance Statement from up to 7 years prior.

The handling charge is HKD50 per statement for a minimum of HKD200 per request. |

INMT |

Account Statement Requisition Form 1. (Applicable to employer or member) Request a copy of any previous employer or member statement for up to 7 years prior. |

INFT |

Form name Description |

Self-employed Application Form Apply to participate in an HSBC MPF scheme. |

|---|---|

| Form download |

IN31 |

Form name Description |

Self-employed Person Relevant Income Declaration Form Declare relevant income for each scheme financial year for MPF purposes. |

| Form download |

IN24 |

Form name Description |

Individual Tax Residency Self-certification Form (CRS-I (HK)–MPF) To confirm your personal status under the Common Reporting Standard (CRS). |

| Form download |

INCI |

Form name Description |

Personal Details Change Form (Fillable format available) Notify any change to personal details, including address, contact number, email address and preferred language for correspondence, etc.

For any changes not listed on the form, please inform us in writing. |

| Form download |

(fillable format) (Sample) |

Form name Description |

Change of Member Signature Specimen To change the signature specimen. |

| Form download |

IN92 |

Form name Description |

New/Change of Direct Debit Instruction Notification Form Direct Debit Authorisation Notify an addition or change to a direct debit authorisation for your MPF scheme or a particular pay centre, and authorise deduction of MPF contributions from your bank account.

Paying your contributions through direct debit saves you time in writing and checking the payee and total amount for each payment.

Please note that about 2 weeks' processing time is required to set up a direct debit authorisation for a bank account with HSBC or Hang Seng Bank, or about a month for other bank accounts. |

| Form download |

|

Form name Description |

Change of Investment Instruction Form Change your investment instruction of your existing investments and/or future contributions and/or accrued benefits transferred from another Registered Scheme. This form is applicable if you want to:

|

| Form download |

INBP |

Form name Description |

Remittance Statement Report relevant income and contributions. |

| Form download |

INB4 |

Form name Description |

Contribution remittance advice To provide contribution remittance details (applicable for the remittance of contributions by cheque due to delays in setting up direct debit authorisation, dishonoured direct debit/cheque or insufficient funds in your last contribution) |

| Form download |

INCP |

Form name Description |

Additional Voluntary Contributions Arrangement Form Set up or cancel regular voluntary contribution arrangement. |

| Form download |

INPS |

Form name Description |

Scheme Member's Request for Fund Transfer Form (Fillable format available)

It is also applicable for employees who cease employment to transfer their benefits to an individual personal account. |

| Form download |

INPM (fillable format) (Sample) |

Form name Description |

Scheme Member's Request for Account Consolidation Form Consolidate multiple personal accounts into one account. |

| Form download |

(Download from MPFA's website) |

Form name Description |

Customer Information Form – Personal Customer Provide accurate and up-to-date information to support a more secure protection arrangement. |

| Form download |

INKE |

Form name Description |

Claim Form for Payment of MPF Accrued Benefits (Benefits) on Grounds of Attaining the Retirement Age of 65 or Early Retirement [Form MPF(S) - W(R)] (Fillable format available)

Appropriate supporting documents and, where applicable, statutory declarations must be enclosed. |

| Form download |

INPR (fillable format) |

Form name Description |

Change of Regular Withdrawal Instruction Form Change the monthly regular withdrawal amount, payment method or cancellation of regular withdrawal instruction. |

| Form download |

INRW |

Form name Description |

Claim Form for Payment of MPF Accrued Benefits (Benefits) on Grounds of Permanent Departure from Hong Kong/Total Incapacity/Terminal Illness/Small Balance/ Death [Form MPF(S) - W(O)] (Fillable format available)

Appropriate supporting documents and, where applicable, statutory declarations must be enclosed. |

| Form download |

INPO (fillable format) (Sample) |

Form name Description |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Early Retirement Supporting documentation for claiming accrued benefits on the grounds of early retirement.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(SD1) |

Form name Description |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Permanent Departure from Hong Kong Supporting documentation for claiming accrued benefits on the grounds of permanent departure from the Hong Kong SAR.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(SD2) |

Form name Description |

Statutory Declaration for Claims for Payment of Accrued Benefits on Ground of Small Balance Supporting documentation for claiming accrued benefits on the grounds of small balance.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(SD3) |

Form name Description |

Statutory Declaration Made by the Committee of the Estate of a Scheme Member for Claims for Payment of Accrued Benefits Supporting documentation for claiming accrued benefits on the grounds of early retirement, small balance or permanent departure from Hong Kong by committee of estate on behalf of a mentally incapacitated scheme member.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(SD4) |

Form name Description |

Certificate of a Person Having a Terminal Illness That Falls within Section 158(3) of the Mandatory Provident Fund Schemes (General) Regulation or Section 6(12G) of Schedule 2 to the Mandatory Provident Fund Schemes (Exemption) Regulation Supporting documentation for claiming accrued benefits on the grounds of terminal illness.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(T) |

Form name Description |

Certificate of a Person's Permanent Unfitness for a Particular Kind of Work Supporting documentation for claiming accrued benefits on the grounds of total incapacity.

Please use the Chinese version of the declaration form if you would read the jurat in Chinese. |

| Form download |

MPF(S)-W(M) |

Form name Description |

Partial Withdrawal Request Form Request a withdrawal of benefits that are not subject to MPF preservation requirements. |

| Form download |

IN22 |

Form name Description |

Instructions for Treatment of Accrued Benefits after Retirement Age Notify treatment of accrued benefits after age 65. |

| Form download |

INAT |

Form name Description |

Cessation of Self-employment / Transfer of Accrued Benefit Notification Form Notify your cessation of self-employment or transfer to another MPF scheme. |

| Form download |

IN33 |

Form name Description |

Duplicate Remittance Statement Requisition Form Request a copy of any previous Remittance Statement from up to 7 years prior.

The handling charge is HKD50 per statement for a minimum of HKD200 per request. |

| Form download |

INMT |

Form name Description |

Account Statement Requisition Form 1. (Applicable to employer or member) Request a copy of any previous employer or member statement for up to 7 years prior. |

| Form download |

INFT |

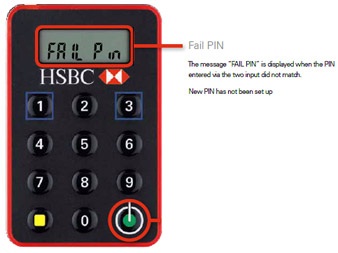

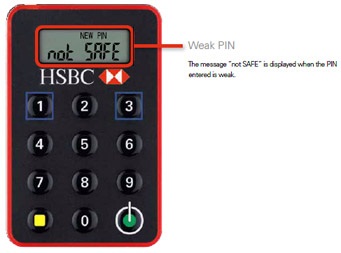

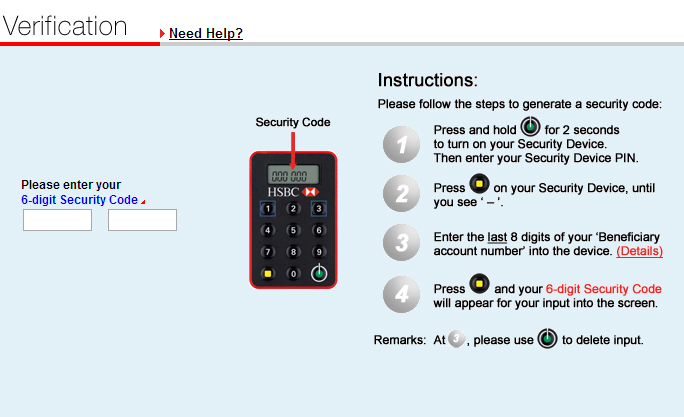

Physical Security Device

We are no longer issuing physical Security Device (except to customers with accessibility needs). If you are still using a physical Security Device, you may switch to Mobile Security Key via HSBC HK App with a few steps. Refer to our step-by-step guide.

If you are looking for information on Mobile Security Key, you may read our Mobile Banking FAQ.