$0 commission at Hong Kong's best broker1

HSBC Trade25 is designed especially for the next generation of stock traders aged 18-25. For just HKD25 a month, join and you'll get:

- $0 commission on HK, US and China A stocks

- $0 platform fees

- Free access to our Trade25 Academy to level up your stock trading knowledge

2026 Trade25 Offers and Terms & Conditions

- 2026 Extending Eligible Age of Joining HSBC Trade25 (for customers aged 26-35) (PDF)

- 2026 Trade25 HKD1,000 Apple Store Gift Card Offer (for customers aged 18-35) (PDF)

Exclusive to HSBC One+ members

- HSBC One+ Wealth Management Privileges: Access to Trade25 Offer for Customers Aged 36 or above (PDF)

- 2026 Trade25 HKD200 Apple Store Gift Card Offer for HSBC One+ (for customers aged 18-35) (PDF)

For full details of HSBC One+ membership and benefits, please visit HSBC One+ promotional page.

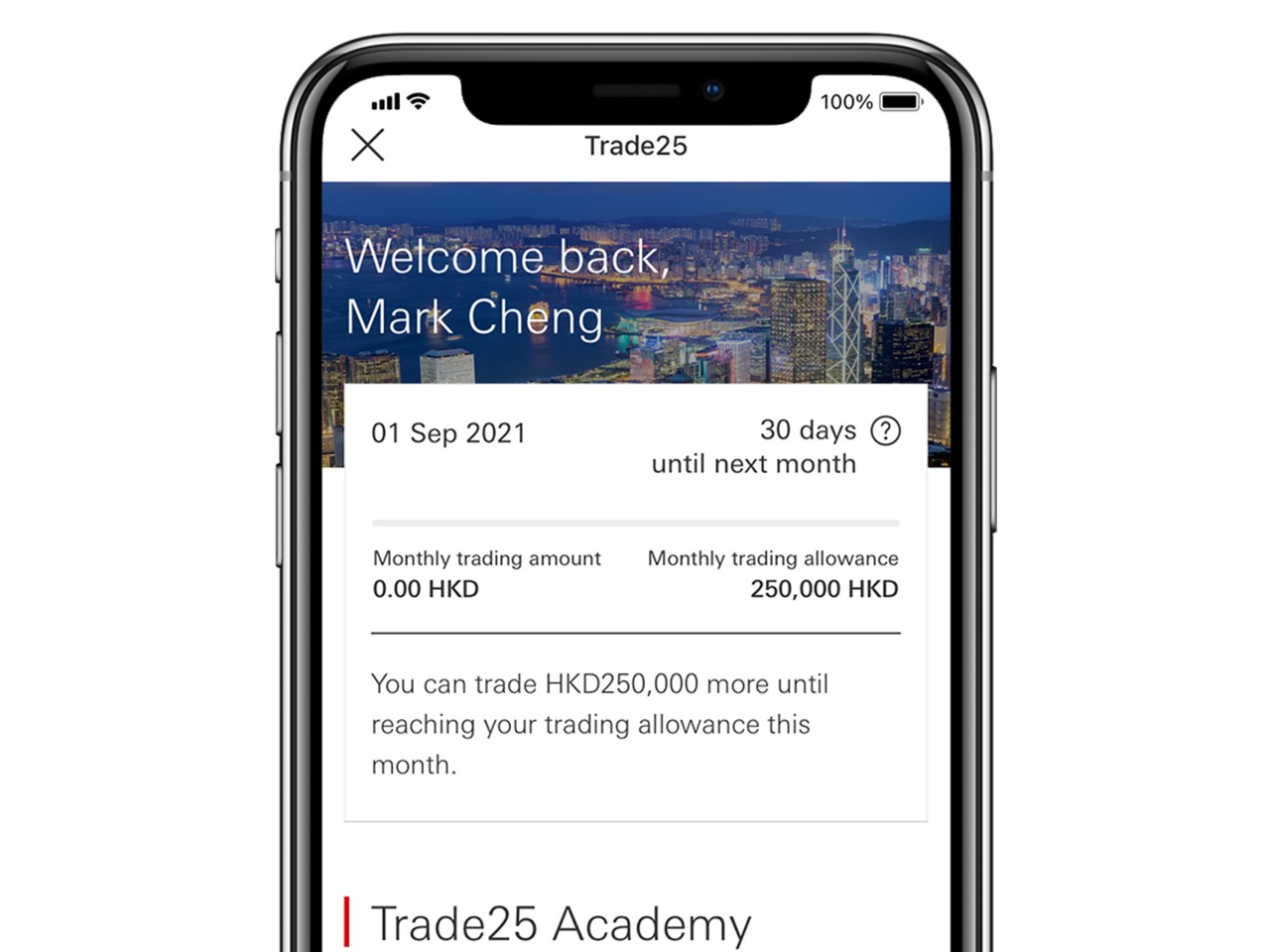

Join HSBC Trade25 on your HSBC HK Easy Invest app.

Just the price of one bubble tea, that's all you need

HKD25 per month

You will only be charged this monthly fee when you trade or hold stocks with us.

$0 commission

Trade stocks commission-free on up to HKD250,000 monthly trading turnover. No hidden platform fees.

Trade25 Academy

Explore our exclusive Trade25 Academy and get to know your way around stock trading.

| Monthly trading turnover |

Monthly fee2 |

Commission fees for HK stocks |

Commission fees for US stocks |

Commission fees for China A shares |

|---|---|---|---|---|

| HKD250,000 or below | HKD25 |

HKD0 |

USD0 |

RMB0 |

| Above HKD250,000 | HKD25 |

0.25% brokerage fee min HKD100 |

USD18 for first 1,000 share USD18 + USD0.015 per share (above 1,000 shares) |

0.25% brokerage fee min RMB100 |

| Monthly trading turnover |

HKD250,000 or below |

|---|---|

| Monthly fee2 |

HKD25 |

| Commission fees for HK stocks |

HKD0 |

| Commission fees for US stocks |

USD0 |

| Commission fees for China A shares |

RMB0 |

| Monthly trading turnover |

Above HKD250,000 |

| Monthly fee2 |

HKD25 |

| Commission fees for HK stocks |

0.25% brokerage fee min HKD100 |

| Commission fees for US stocks |

USD18 for first 1,000 share USD18 + USD0.015 per share (above 1,000 shares) |

| Commission fees for China A shares |

0.25% brokerage fee min RMB100 |

You won't be charged HKD25 if you do not trade or hold stocks with us in the respective month.

Brokerage fees are applied based on the latest monthly trading amount at the time of execution. Please refer to the product factsheets and the HSBC Trade25 conditions for more details of fees and charges.

Lower trading costs than other Hong Kong brokers

Trade25 offers $0 commission stock trading, with none of the hidden fees that many other brokers charge. Even if you make multiple trades within the month, all you pay is HKD25 as long as your monthly trading turnover does not exceed HKD250,000. However, please note other regulatory fees apply2 as well.

Breaking it down

| HSBC Trade25 | Broker 1 | Broker 2 |

|---|---|---|

|

|

|

| HSBC Trade25 |

|

|---|---|

| Broker 1 |

|

| Broker 2 |

|

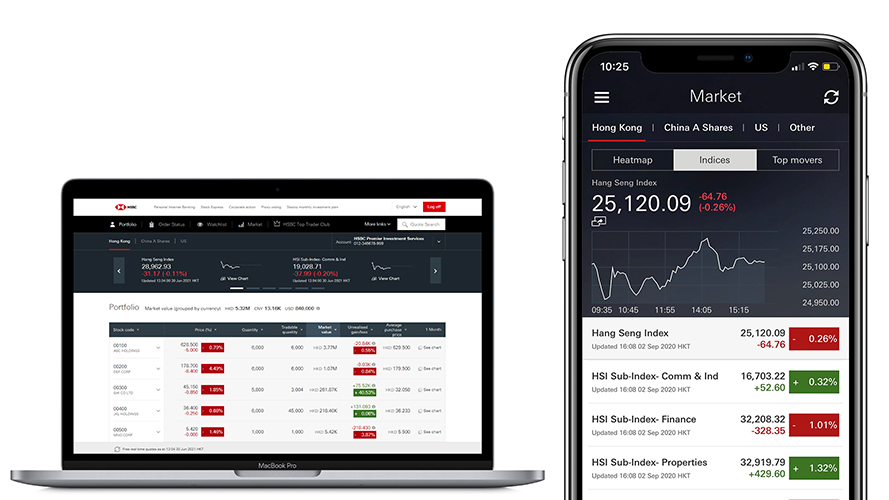

Trade anywhere you go with our dynamic stock trading platform

- Place an order directly from the bid/ask queue or interactive chart

- Receive push notifications when important events happen in the market or to stocks in your portfolio

- Read trend-spotting indicators such as Moving Average Convergence / Divergence (MACD), Relative Strength Index (RSI) and KDJ indicator

- Subscribe to an IPO with $0 handling fee

Start trading with $0 commission fees in just 3 simple steps

If you're 18 to 25 years old and already have an HSBC investment account, you can sign up for HSBC Trade25 in a matter of minutes:

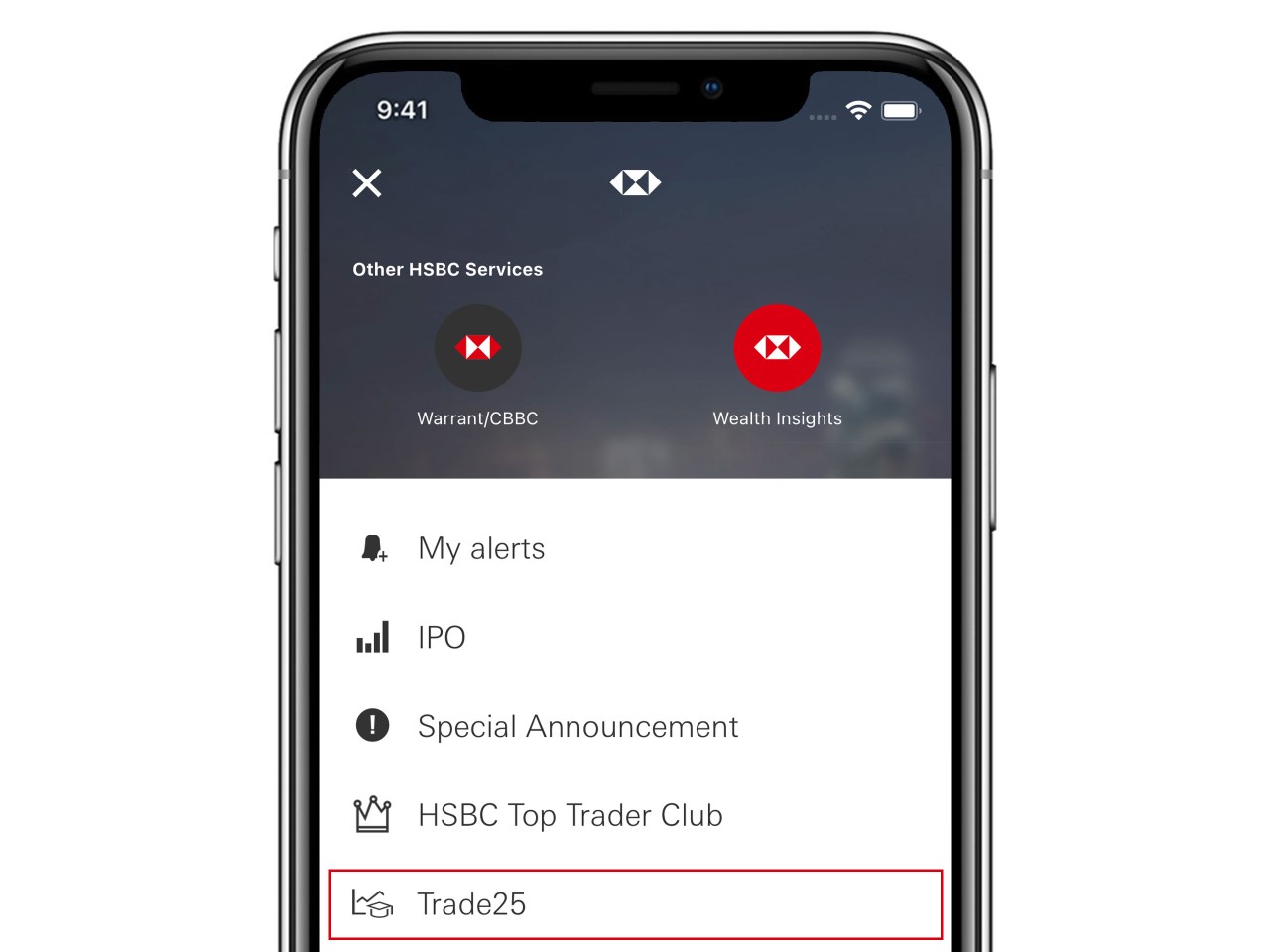

- Download the HSBC HK Easy Invest app

- Open the app, select 'Menu' and then tap on 'Trade25' to apply

- That's it! Start trading right away, commission free

Got a question about HSBC Trade25? Read our FAQs for more details

You might also be interested in

HSBC Top Trader Club

Our HSBC Top Trader Club gets you exclusive access to brokerage fees as low as 0.01% and HKD time deposit rates as high as 5% p.a.

HSBC HK Easy Invest

Leverage all the tools and features available on our app to trade across 3 major stock markets

IPO services

Enjoy zero handling fees when you subscribe to stock IPOs using online or mobile banking

Additional information

1 Finance Asia awarded HSBC as "HK Best Broker" in 2019

- HSBC won top prize for Securities Company of the Year at the Bloomberg Businessweek - Financial Institution Awards 2020.

- HSBC won top prize for Brokerage Service at the Bloomberg Businessweek - Financial Institution Awards from 2020 to 2023 for four consecutive years

2 There are also other regulatory fees collected by the regulators when you trade. Learn more in the HSBC Trade25 conditions and our product factsheets for HK stocks, US stocks and China A shares.