Take me straight to

- Introduction

- Scenario 1: Autocall condition is satisfied

- Scenario 2: Closing price is equal to or above the exercise price

- Scenario 3 : Closing price is lower than the exercise price with knock-in (airbag) triggered

- Scenario 4 : Closing price is lower than the exercise price with knock-in (airbag) triggered

- Worst-case scenario

Introduction

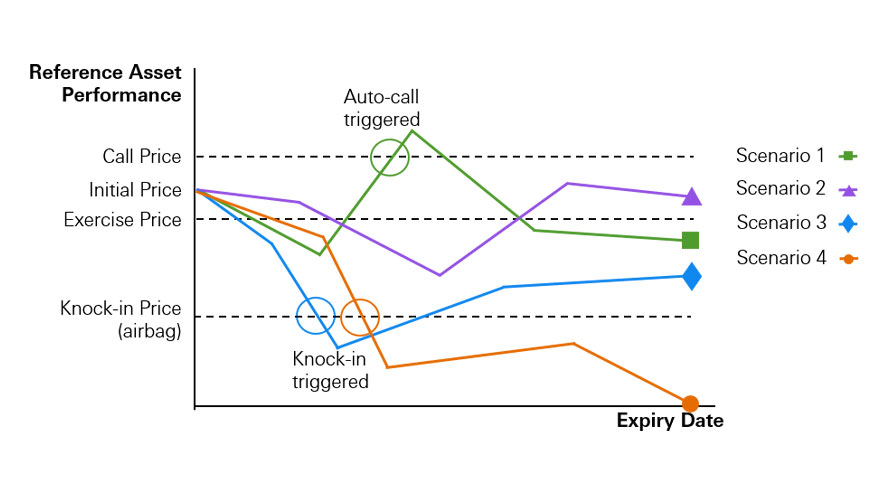

Scenarios you may encounter when investing in ELIs

An equity-linked investment (ELI) is a type of structured product. Its investment return is directly linked to the performance of a single underlying equity or a basket of up to 4 underlying equities.

An ELI is typically a short to medium-term investment product that may provide potential yield enhancement. On top of this potential interest, investors could either receive 100% of their initial principal investment or stock delivery of the worst-performing stock at a discounted price lower than the initial spot price upon maturity.

But in the worst-case scenario, the stock price can drop to 0 which means that the stock investors receive can be worth nothing.

ELIs can seem complex but these examples will help you understand what scenarios you may run into when you invest in an ELI and what it will mean for your investment.

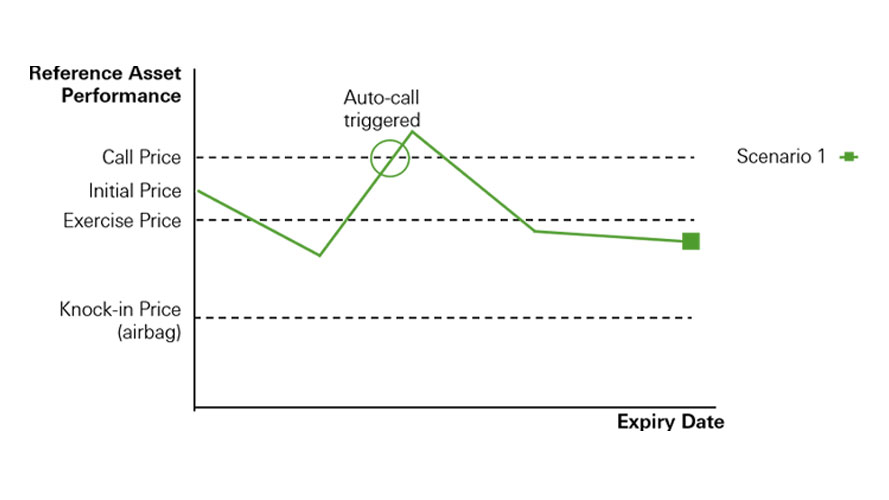

Scenario 1

Autocall condition is satisfied

If the worst-performing reference asset price is at or above the call price on the call date, then the ELI will be terminated early. You will receive:

- a full redemption of the invested amount

- the potential cash dividend amount up to the call date

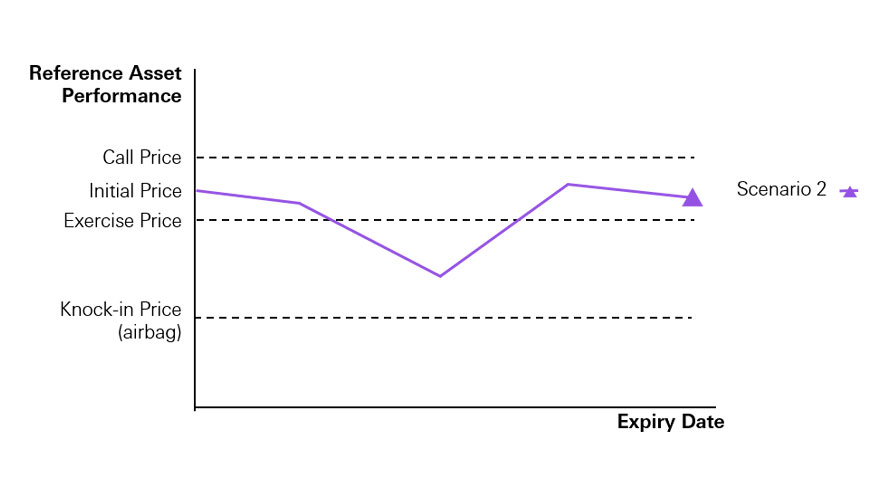

Scenario 2

Closing price is equal to or above the exercise price

If the closing price is equal to or above the exercise price on expiry date, you will receive:

- a full redemption of the invested amount

- the potential cash dividend amount

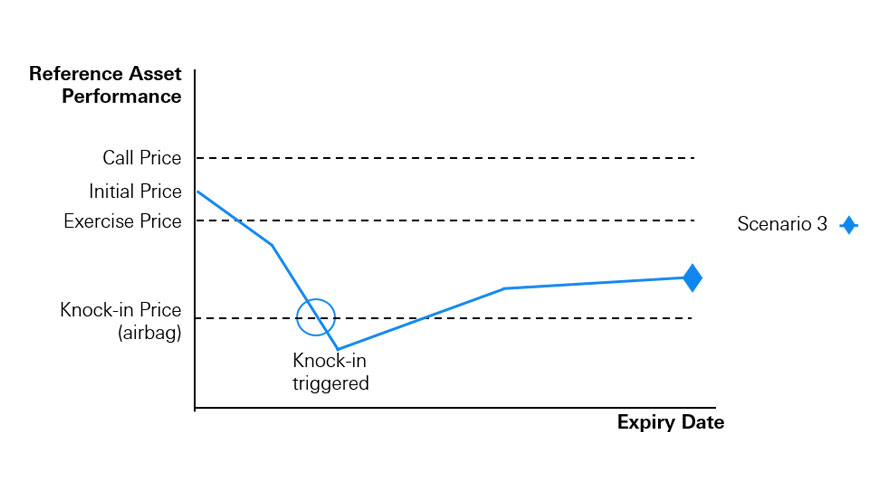

Scenario 3

Closing price is lower than the exercise price with knock-in (airbag) triggered (for product with daily knock in observation)

If the closing price is lower than the exercise price on the expiry date and the knock-in is triggered, you will receive either a physical or cash settlement.

(a) Physical settlement

- Delivery of the worst-performing reference asset (fractional share may result in delivery of cash in addition to the share)

- Potential cash dividend amount

or

(b) Cash settlement

- Cash equivalent of the physical settlement amount

- Potential cash dividend amount

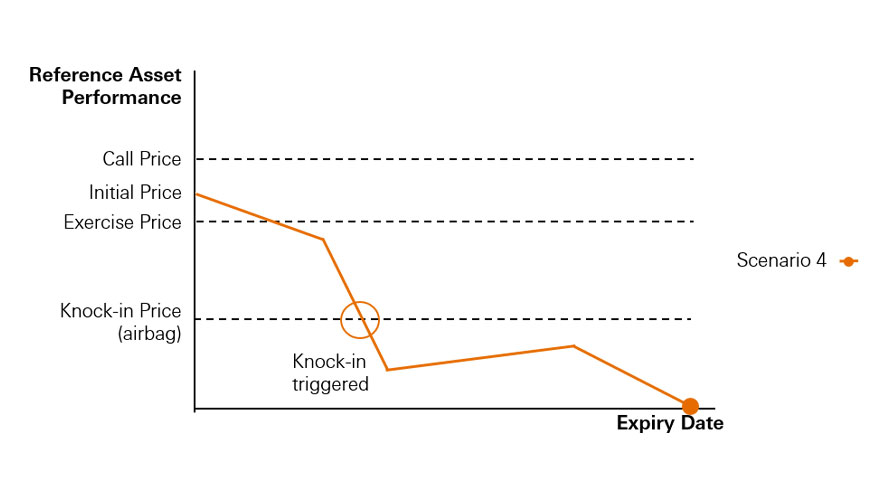

Scenario 4

Closing price is lower than the exercise price with knock-in (airbag) triggered (for product with daily knock in observation)

If the closing price is lower than the exercise price on the expiry date and the knock-in is triggered, you will receive either a physical or cash settlement.

(a) Physical settlement

- Delivery of the worst-performing reference asset (fractional share may result in delivery of cash in addition to the share)

- Potential cash dividend amount

or

(b) Cash settlement

- Cash equivalent of the physical settlement amount

- Potential cash dividend amount

Worst-case scenario

Closing price of a settlement stock drops to zero

In the worst-case scenario, the physical settlement amount or the cash equivalent of the physical settlement amount could be worth nothing (ie if the closing price of a settlement stock drops to zero you could lose 100% of your initial investment amount).

If HSBC as issuer becomes insolvent or defaults on its obligations under the ELIs, investor may get nothing back, including the nominal amount, any accrued potential cash dividend amounts, the physical settlement amount or the cash equivalent of the physical settlement amount regardless of the price performance of the reference assets. The potential maximum loss could then be 100% of the initial investment amount.

Ready to explore ELIs?

HSBC investment account holders

Log on to HSBC Online Banking to see the full product list.

Don't have an HSBC investment account?

You can open an investment account on the HSBC HK Mobile Banking app and start trading with us in minutes.

You may also be interested in

Equity-linked investments

Tap into the potential of Hong Kong and US equity market movements and earn higher potential income even when the market is range-bound

How does Deposit Plus work?

See how a Deposit Plus may work for you depending on the appreciation or depreciation of the linked currency.

How does Capital Protected Investment – Currency Linked III (CPI III) work?

See how a Capital Protected Investment – Currency Linked III (CPI III) may work for you and what payouts you may receive