HSBC One - the digital wealth banking suite to help you achieve financial freedom

Spend and save in 12 major currencies with your HSBC One account. Enjoy exclusive benefits such as auto-payroll setup and saving rates offers. You can invest or make time deposits and more, all without having to maintain a minimum total relationship balance with us. Open an account on your mobile in just 5 minutes[@accounts-hsbc-one-5-min].

Elevate your lifestyle with our exclusive benefits

Join HSBC One+ and earn rewards worth up to HKD9,600[@accounts-hsbc-one-plus-total-rewards]

HSBC One+ offers exclusive savings, wealth management, foreign exchange, and lifestyle privileges, which help you earn your first bucket of gold and achieve new life goals. Get cash rewards of up to HKD3,500 for bringing in new funds[@accounts-hsbc-one-plus-new-funds-etb],[@accounts-hsbc-one-plus-new-funds-ntb] and enjoy other exclusive offers. Discover more privileges now!

Join HSBC One to experience low threshold and value for money banking!

Open an HSBC One account and enjoy the following as welcome offers:

- Complimentary HSBC HealthPass Standard Annual Plan membership (worth HKD456)[@accounts-hsbc-one-healthpass-sap-promo]: Enjoy 20% off on consultation fees at 2,000+ medical service providers including dentistry[@accounts-hsbc-one-healthpass-medical-network], plus one free medical video consultation with medicine delivery

- HSBC Trade25 limited-time offer: Enjoy a lifetime $0 commission stock trading, and earn up to HKD1,000 Apple Gift Card[@accounts-t25-eligible-stock-transaction] by completing 10 eligible transactions[@accounts-t25commission]

- Foreign exchange & time deposit offer: Exchange designated currencies and set up a 1-week time deposit via HSBC HK App to enjoy up to 12.5% p.a. time deposit rate[@accounts-fx-td-offer-2025q4]

- New-to-investment and multi-product-holding offer: Earn up to HKD450 in cash rewards for accumulating an investment amount of HKD50,000 or above (excluding fees and charges)[@accounts-one-new-to-invest-25q4]

Investment and currency exchange involve risks. Terms and conditions apply.

Key features

Discover how we help you get the most out of life

Earn extra interest income

Set up a foreign currency time deposit to earn more interest than in a savings account, with as little as the equivalent of USD2,000.

- Choice of multiple currencies – Australian dollar, Canadian dollar, euro, Japanese yen, New Zealand dollar, pound sterling, Singapore dollar, Swiss franc, Thai baht and United States dollar

- Receive interest half-yearly (for deposit periods of 18 months or more) or at maturity

- Choose a deposit period between 1 week and 36 months

- Enjoy a preferential interest rate based on your deposit amount, deposit period and Total Relationship Balance (TRB)

Invest and insure without any worries

Enjoy more investment and insurance perks with HSBC One 2.0!

- HSBC One 2.0 'Investment Start Up': Level up in your investment game with our AI Avatar

- Join HSBC Trade25 and start trading in HK, US and China A stock markets with a lifetime $0 commission and $0 platform fee[@accounts-t25commission]. HKD25 per month is only required if you trade or hold stocks with us in the respective month

- Explore HSBC TradeTrack on HSBC HK Easy Invest app for the top 10 Hong Kong stocks other HSBC Investors are actively trading in to get insights for your next trade

- Build your own diversified investment portfolio with FlexInvest, starting from just HKD100

- View your insurance policy details and coverage on the HSBC HK App, any time – full disclosure, zero pressure

HSBC One+

If you've maintained an Total Relationship Balance of HKD500,000 or above with us in the past 3 months, you can now become an HSBC One+ member[@accounts-hsbc-one-plus-membership-req] and enjoy exclusive savings, wealth management, foreign exchange, and lifestyle privileges for one year.

Earn rewards as you spend or borrow

Discover the hottest year-round offers with HSBC credit cards and HSBC Mastercard® Debit Card.

- Earn up to 8% RewardCash at designated merchants and up to 4% RewardCash when you shop online[@accounts-red-card-rc] with the HSBC Red Credit Card

- Do more with your exchanged currencies abroad with HSBC Mastercard® Debit Card. Shop, spend, or withdraw cash from HSBC ATMs worldwide, all while enjoying zero annual fees or handling fees

- HSBC credit cards and debit cards bring you the hottest year-round offers at over 10,000 dining and shopping and entertainment outlets

- Redeem rewards the way you want! Use HSBC Reward+ to convert your RewardCash instantly to miles, gifts, merchant partner loyalty points or settle your credit card bills – in just a few taps

Manage your everyday banking on the go

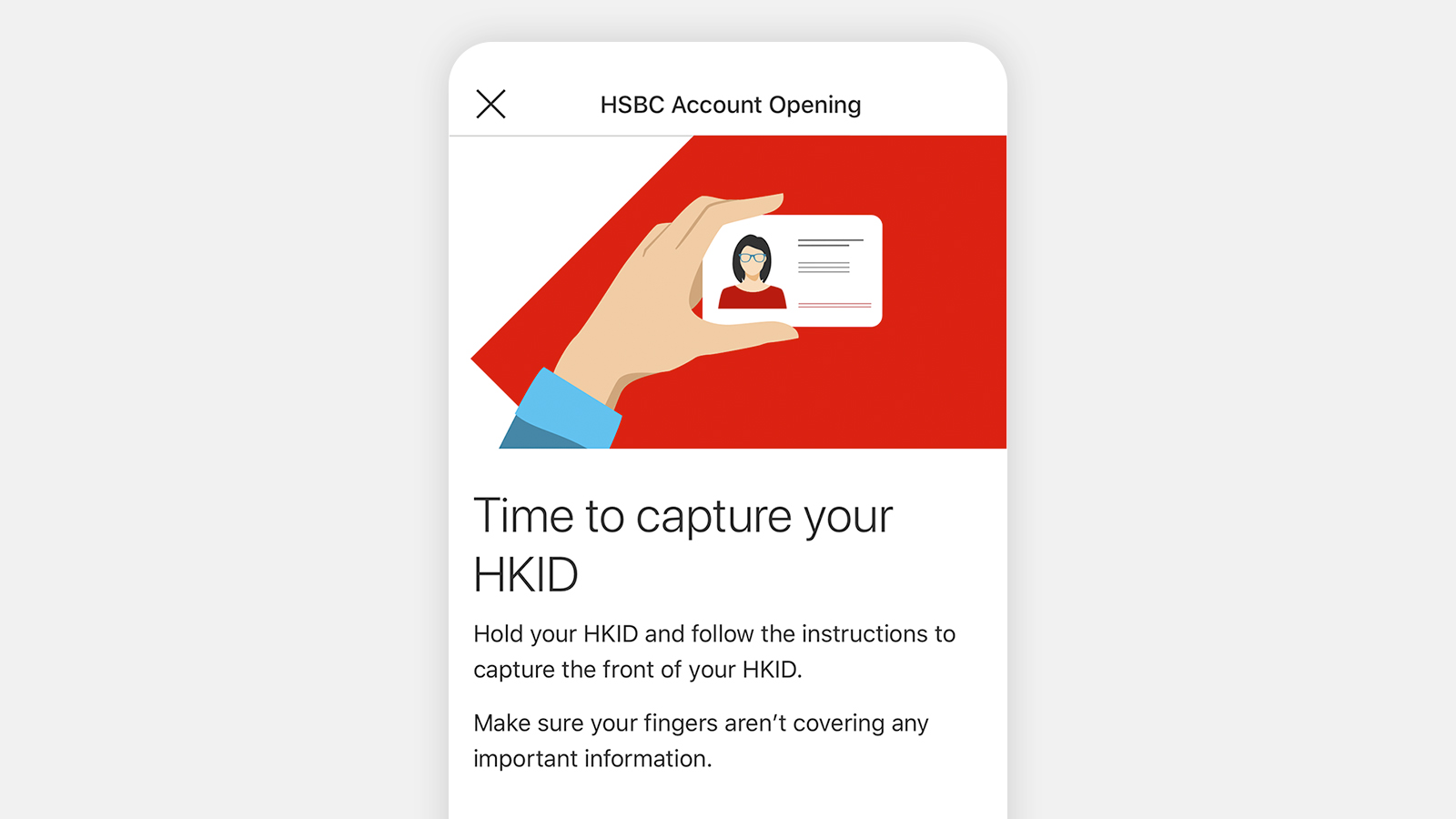

Open an HSBC One account via HSBC HK App in just 5 minutes[@accounts-hsbc-one-5-min], and banking smarter with these features.

- Make 24/7 exchanges for up to 12 major currencies[@accounts-hsbc-one-fx-currency] on the HSBC HK App, or set up FX Order Watch or rate alerts to save you the hassle of watching the market

- Track expenses from all your HSBC bank accounts and credit cards using the 'Budget' feature. Find out where you spend the most, and set monthly budgets to monitor your expenses. We'll also remind you when you overspend.

- Use Future Planner to project your finances for every stage of your life. We'll run real-time simulations and show you how likely you are to achieve your personal goals.

- Speak to our representative via 'Chat with us' for any wealth management and investment queries

Stay in shape with our special health privileges

Health is the key to winning it all. As HSBC One customers, you and your family can enjoy:

- up to 64% discount on select health check programmes at private hospitals

- up to 22% discount on health check, Weight Management & Speech Therapist package for Child, along with discount on Men/Women programmes at Hong Kong Adventist Hospital - Stubbs Road

- over 100 healthcare offers (including Health Check, Vaccination, Lasik and Eye Care, Chinese Medicine and Others) if you hold an HSBC credit card

Get more from life with rewards exclusive to HSBC One

Live your best life with financial freedom. Make the most of our offers across savings, investment and insurance, health and more.

Open an HSBC One account

Apply on HSBC HK App

For non-HKID holders who open an HSBC One account on or after 1 January 2026, the Below Balance Fee (BBF) of HKD100 per month will be waived if an average Total Relationship Balance (TRB) of HKD10,000 is maintained for three consecutive months.

Non-HKID holder customers opened their HSBC One accounts before 1 January 2026 or customers who open their accounts using an HKID will not be subject to any minimum TRB or BBF. See Frequently Asked Questions (PDF).

Already banking with us?

But not an integrated account holder? Not a problem. You can open an HSBC One account via mobile banking in minutes.

If you're on a desktop, scan the QR code with a mobile device to apply on the app, no matter you're a new customer or already banking with us.