What is a bond / CD?

It's important to have some cash savings for emergencies. But adding bonds and certificates of deposit (CDs) to your portfolio can give you a better return than if you left all your cash in a savings account. Here's what we have to offer:

- Bonds, issued by governments including China, the US and Hong Kong, local quasi-government bodies, supranationals and well-known corporations around the world.

- CDs, issued by different high credit quality financial institutions like banks.

- Initial Public Offerings (IPOs) for various bonds and CDs.

For more information, access IFEC's The Chin Family website.

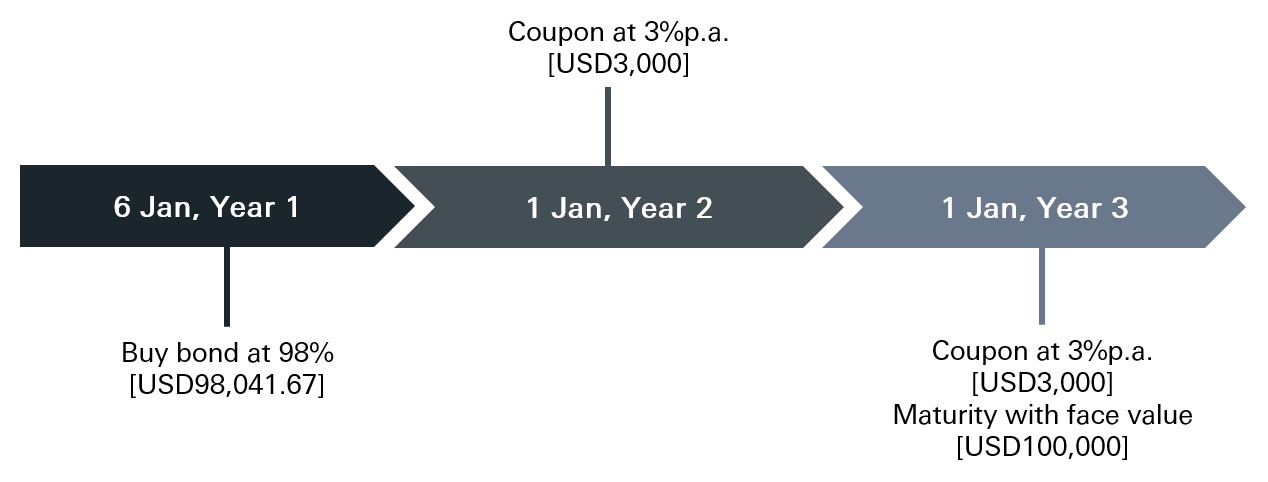

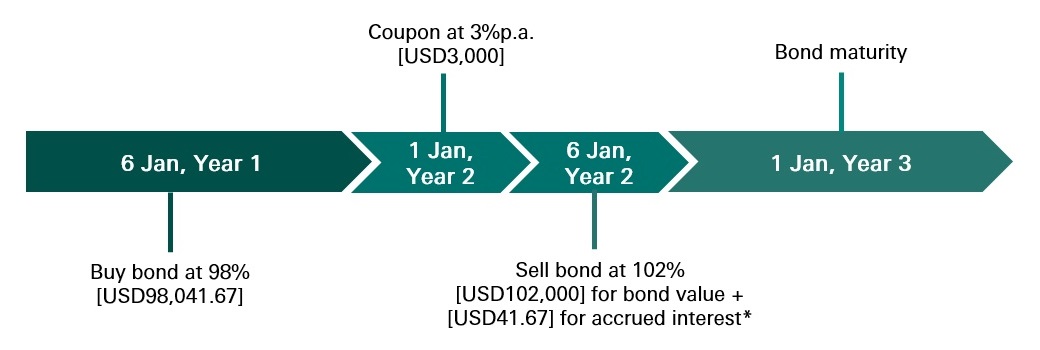

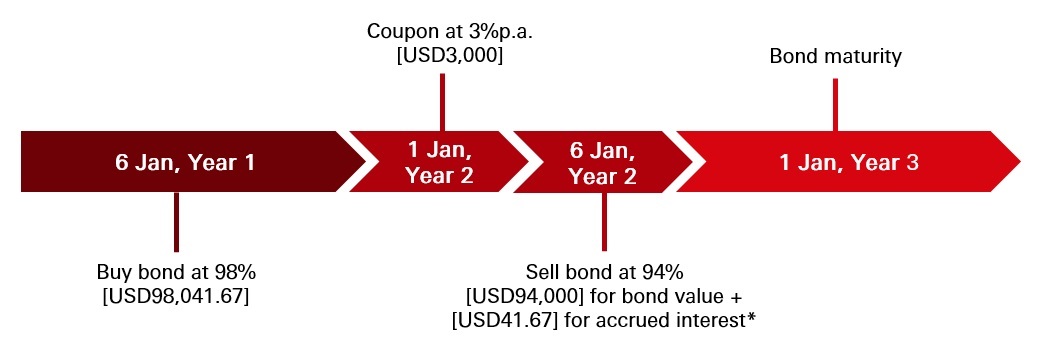

How do bonds/CDs work? – illustrative examples

| Face value | Offer price | Coupon rate | Coupon frequency | Maturity date | Initial payment |

|---|---|---|---|---|---|

| USD100,000 | 98% | 3% | Annually | 1 Jan, Year 3 | purchase amount USD98,000 + accrued interest* USD41.67 = USD98,041.67 |

| Face value | USD100,000 |

|---|---|

| Offer price | 98% |

| Coupon rate | 3% |

| Coupon frequency | Annually |

| Maturity date | 1 Jan, Year 3 |

| Initial payment | purchase amount USD98,000 + accrued interest* USD41.67 = USD98,041.67 |

*Accrued interest : USD100,000 x 3% x 5 days/360 days = USD41.67 for receiving/releasing the bond holding 5 days after last interest payment date