The Well+ programme ("Programme") is co-branded by HSBC Life (International) Limited, incorporated in Bermuda with limited liability ("HSBC Life") and The Hongkong and Shanghai Banking Corporation Limited ("the Bank"), incorporated in the Hong Kong Special Administrative Region ("Hong Kong SAR") with limited liability ("HSBC"), and is provided in Hong Kong SAR only.

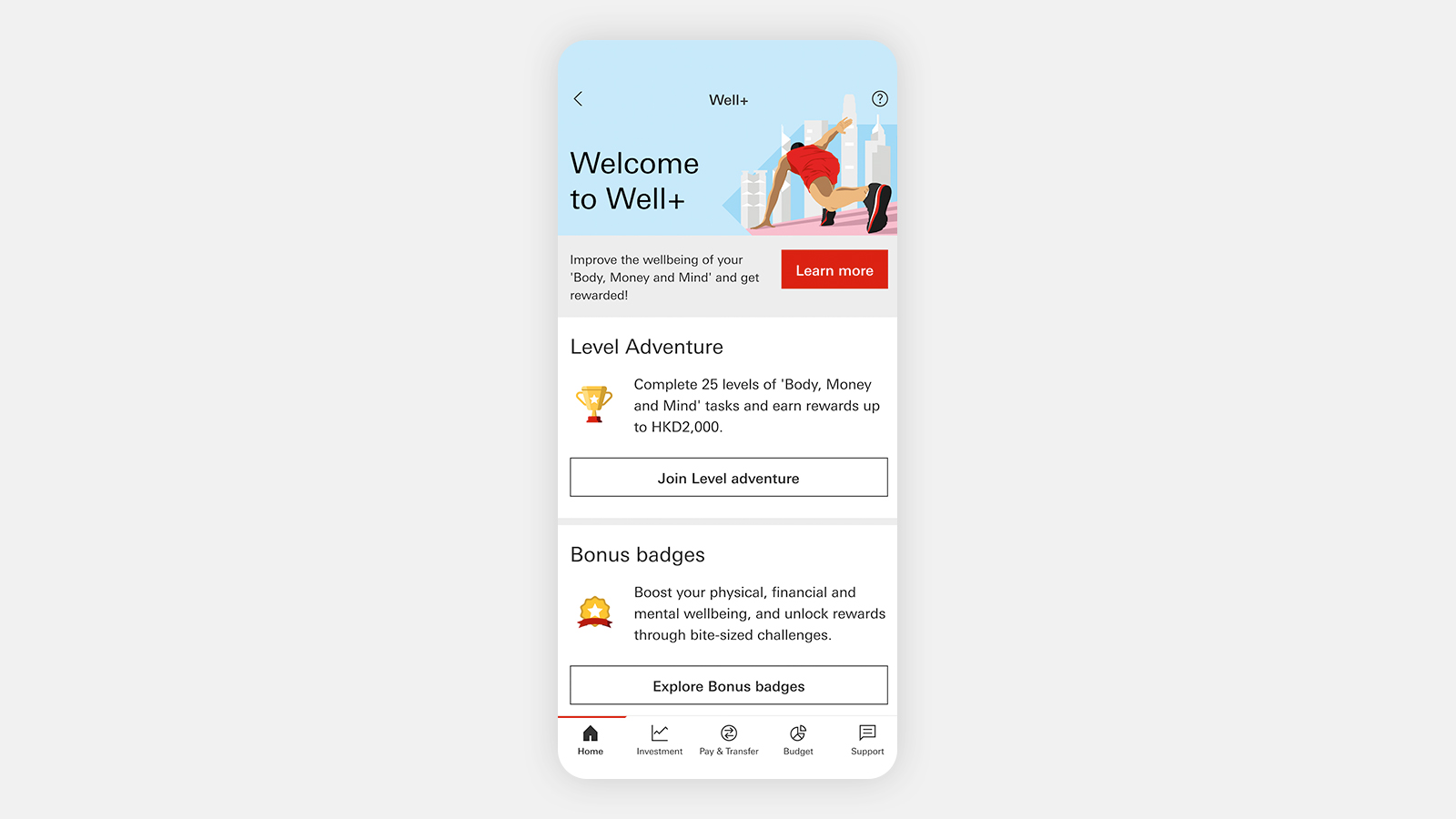

To be eligible to join the Programme, you are required to maintain your status as a valid "HSBC HK Mobile Banking" app user throughout the duration of the Programme; and your Well+ membership has not been cancelled or been terminated previously. App user is applicable to Hong Kong Residents only, not including MPF or Pension only customers .

Terms and conditions apply on the Programme. You should not read information shown on this webpage alone but should always refer to the full and most up-to-date version of these terms and conditions, which are available on this Well+ webpage and on the "HSBC HK Mobile Banking" app. You should periodically check these terms and conditions and any other applicable documents relevant to the Programme.

HSBC and HSBC Life reserve the right to cancel or terminate the Well+ membership if customer cannot fulfill the eligibility requirements as set out in the terms and conditions.

Life insurance plans are underwritten by HSBC Life which are authorised and regulated by the Insurance Authority (IA) of the Hong Kong SAR, and are intended only for sale in the Hong Kong SAR. HSBC is registered in accordance with the Insurance Ordinance (Cap. 41 of the Laws of Hong Kong) as an agency of HSBC Life for the distribution of life insurance products in the HKSAR. Policyholders will be subject to the credit risk of HSBC Life and your premiums paid will form part of HSBC Life's assets. You do not have any rights or ownership over any of these assets. Your recourse is against HSBC Life only.

In respect of an eligible dispute (as defined in the Terms of Reference for the Financial Dispute Resolution Centre in relation to the Financial Dispute Resolution Scheme) arising between HSBC and you out of the selling process or processing of the related transaction, HSBC is required to enter into a Financial Dispute Resolution Scheme process with you; however, any dispute over the contractual terms of the above insurance product should be resolved between HSBC Life and you directly. Please refer to the respective product brochure for detailed features and the policy provisions for the detailed terms and conditions.

The information shown in this website is neither a recommendation, an offer, nor a solicitation for any investment product or service. Investment involves risk. You should carefully consider whether any investment product or service is appropriate for you in view of your personal circumstances. Past performance is no guide to future performance. Investors should refer to the individual product explanatory memorandum or offering document for further details and risks involved. The price of investment products may move up or down. Losses may be incurred as well as profits made as a result of buying and selling investment products.

The information contained on this website is intended for Hong Kong residents only and should not be construed as a distribution, an offer to sell, or a solicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction, in particular the United States of America.