Diversify your investments with unit trusts

Unit trusts help you diversify your investments into different markets and investment instruments. Whether you're making your first investment, or adding to your portfolio, you can choose from a range of funds that match your risk appetite and investment goals.

Key benefits

Unit Trusts offers

- HSBC Premier Elite and HSBC Premier customers who did not have any Unit Trusts holdings and transactions in the past 12 months can enjoy initial subscription charge of 0.9% on all Unit Trust orders (unlimited transaction amount). Offer valid till 31 March 2026. T&Cs apply. Learn more

- HSBC Premier Elite and HSBC Premier customers may receive HKD1,000 cash rebate for every accumulated amount of HKD250,000 transfer-in of Unit Trust, no cash rebate limit. Offer valid till 31 March 2026. T&Cs apply, Investment involves risks. Learn more

- Enjoy first 6 months initial charge waiver for Unit Trusts Monthly Investment Plan. Offer valid till 31 December 2026. T&Cs apply, Investment involves risks. Learn more

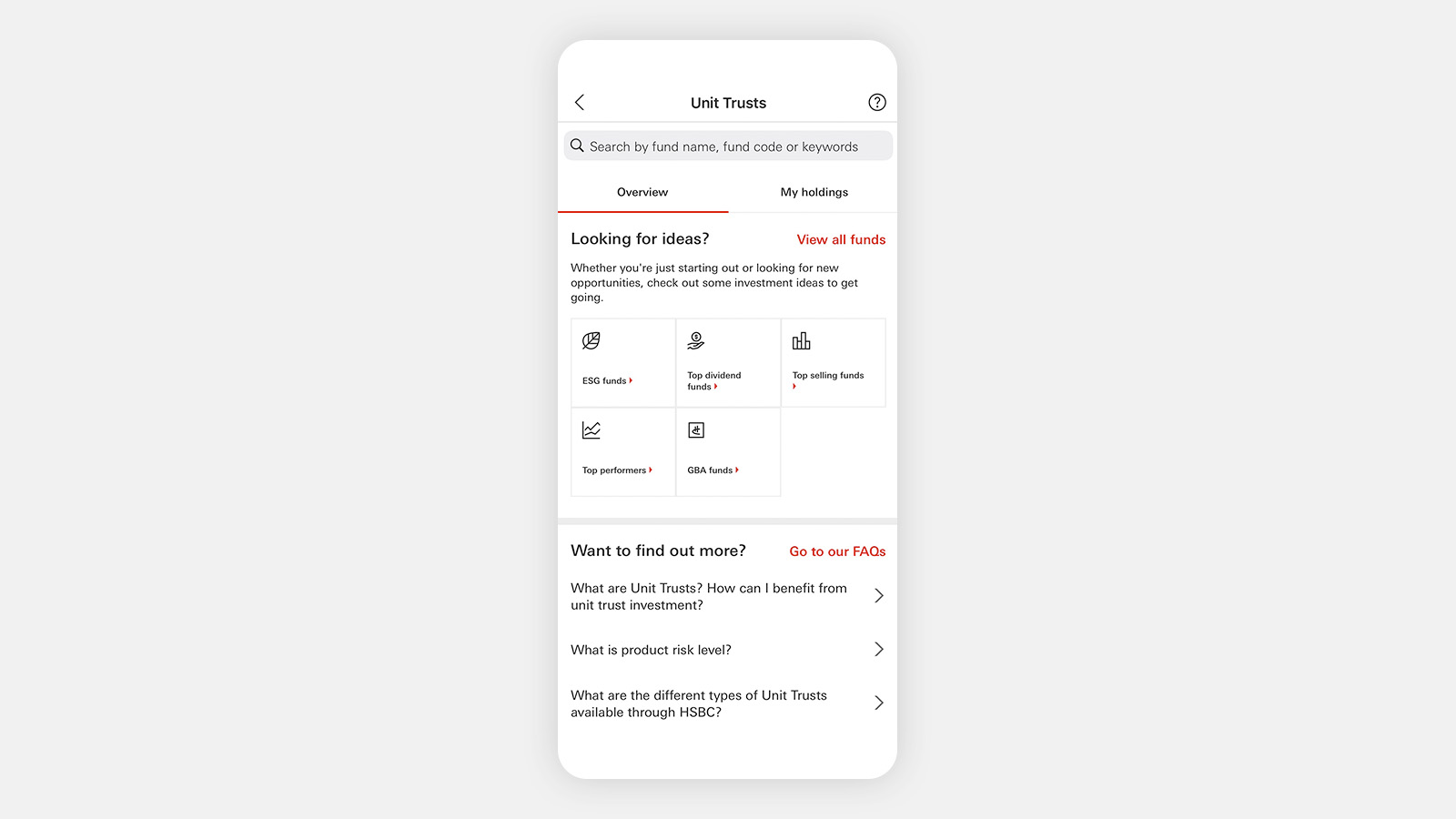

Looking for ideas?

Fees and charges

All open-end funds (except bond funds)

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type | HSBC Premier |

HSBC One or Personal Integrated Account |

Other investment accounts |

|---|---|---|---|

| Below HKD1,000,000 | 2.50% | 3.00% |

3.00% |

| HKD1,000,000 or above |

2.00% |

2.50% |

3.00% |

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type | Below HKD1,000,000 |

|---|---|

| HSBC Premier |

2.50% |

| HSBC One or Personal Integrated Account |

3.00% |

| Other investment accounts | 3.00% |

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type |

HKD1,000,000 or above |

| HSBC Premier |

2.00% |

| HSBC One or Personal Integrated Account |

2.50% |

| Other investment accounts | 3.00% |

Bond funds

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type | HSBC Premier |

HSBC One or Personal Integrated Account |

Other investment accounts |

|---|---|---|---|

| Below HKD1,000,000 | 2.00% | 2.00% |

2.00% |

| HKD1,000,000 or above |

1.50% |

2.00% |

2.00% |

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type | Below HKD1,000,000 |

|---|---|

| HSBC Premier |

2.00% |

| HSBC One or Personal Integrated Account |

2.00% |

| Other investment accounts | 2.00% |

| Subscription[@investments-ut-initial-charge], [@investments-ut-initial-charge-actual] amount / fund type |

HKD1,000,000 or above |

| HSBC Premier |

1.50% |

| HSBC One or Personal Integrated Account |

2.00% |

| Other investment accounts | 2.00% |

Other services

| Services | Charges |

|---|---|

| Redemption / management / other fees | Please refer to the respective prospectus of the fund |

| Switching fee [@investments-ut-switch-fund] |

Up to 1% of the switching amount |

| Investment order confirmation eAlerts | Free of charge |

| Transfer-out[@investments-ut-transfer] | Administration fee of HKD100 per fund transferred |

| Services | Redemption / management / other fees |

|---|---|

| Charges |

Please refer to the respective prospectus of the fund |

| Services |

Switching fee [@investments-ut-switch-fund] |

| Charges |

Up to 1% of the switching amount |

| Services | Investment order confirmation eAlerts |

| Charges |

Free of charge |

| Services | Transfer-out[@investments-ut-transfer] |

| Charges |

Administration fee of HKD100 per fund transferred |

Ways to invest in unit trusts

Unit trusts enable investors to diversify their investments into different markets and investment instruments such as equities, bonds, securities, currencies and warrants/derivatives.

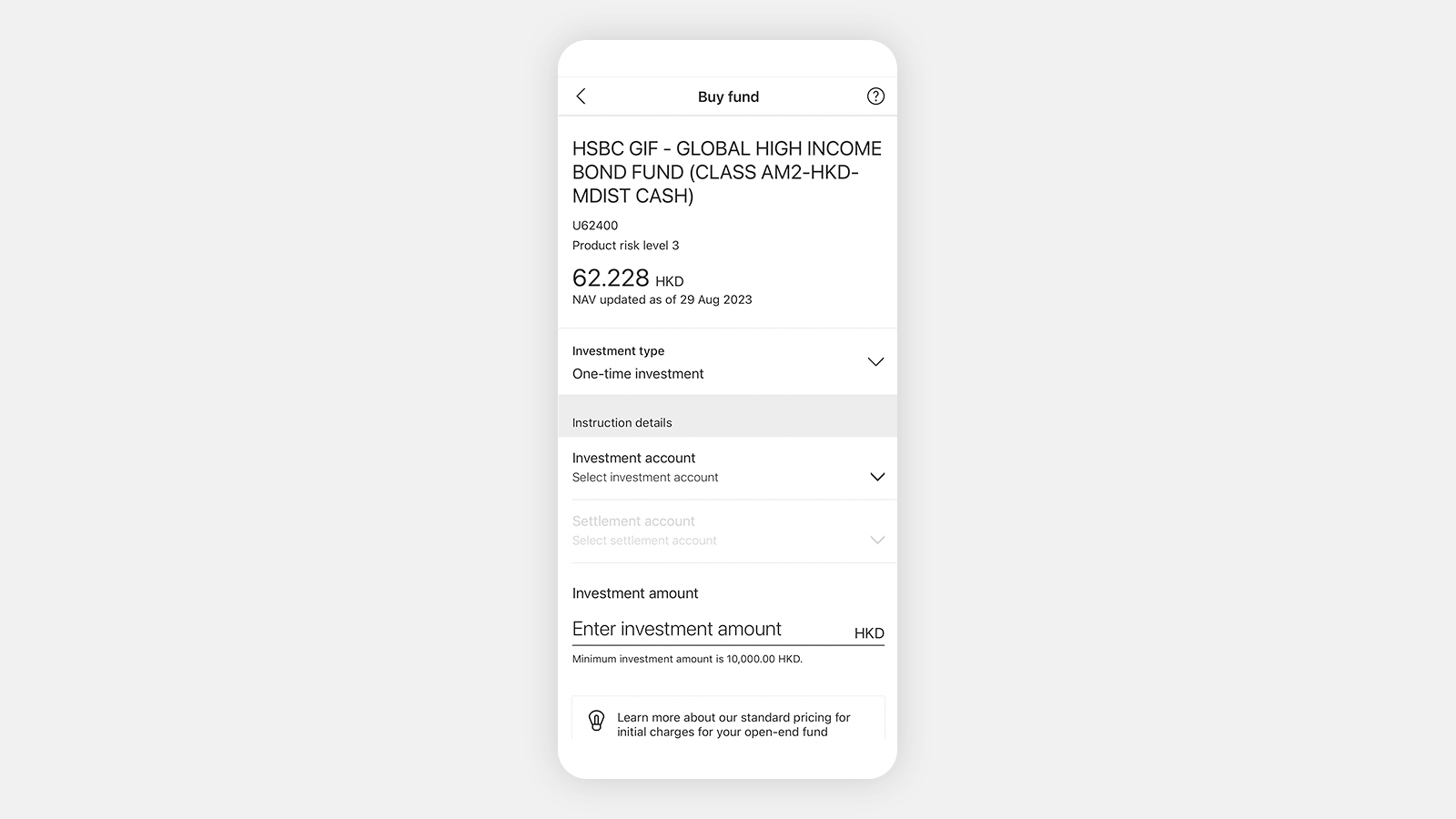

If you would like to enjoy the benefits of diversification through unit trust investments, you can invest a lump sum amount or set up a monthly investment plan.

Lump sum investment

Diversify your portfolio with unit trust investment with as little as USD1,000/HKD10,000 in a lump sum.

Minimum investment: From USD1,000/HKD10,000

Make monthly investments and achieve your wealth goals without having to tie up your savings

Minimum investment: No initial lump sum is required. Minimum monthly contribution per fund[@investments-ut-irregular] from HKD1,000

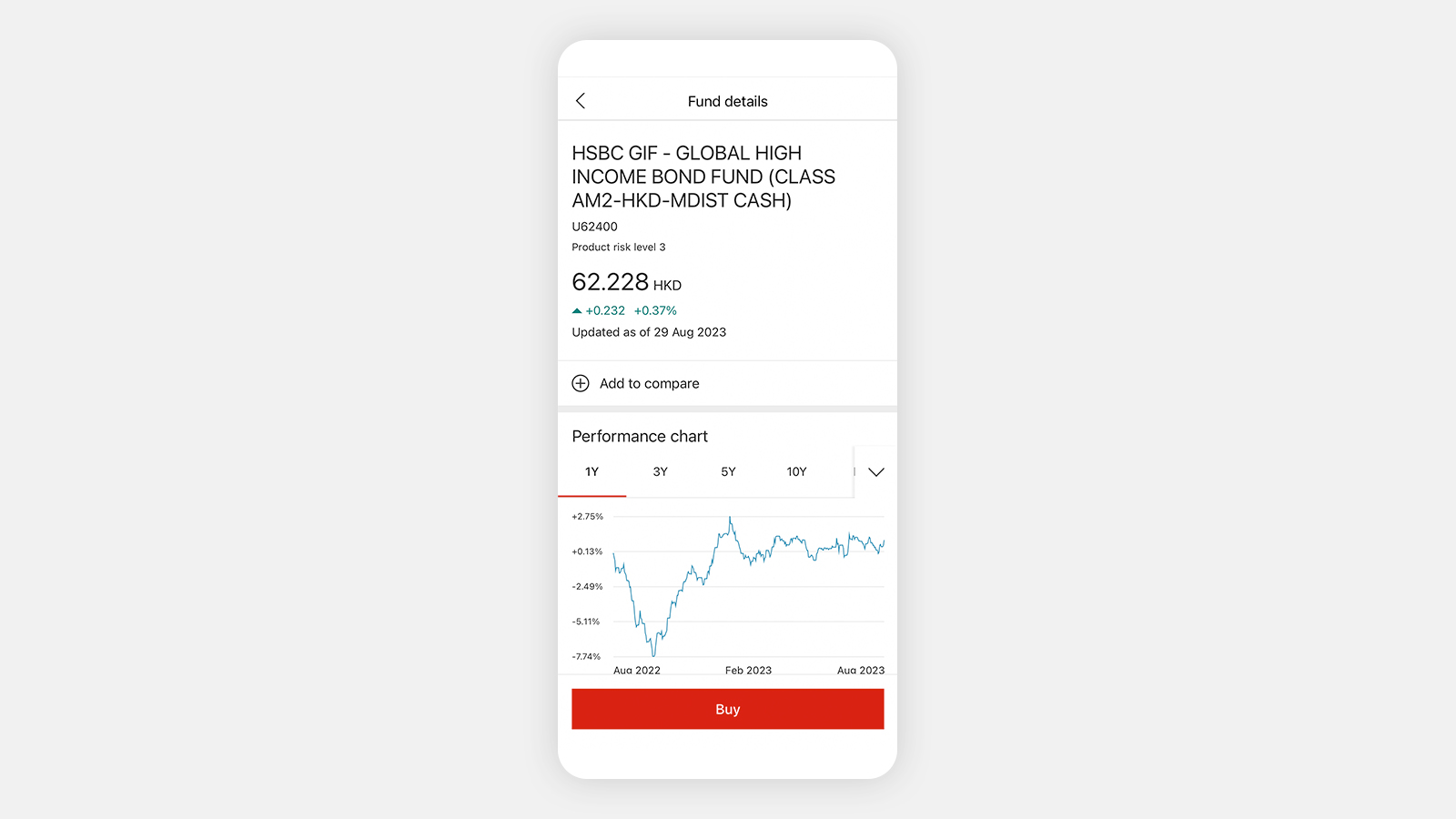

Trade via the HSBC HK Mobile Banking app

Step 1

Step 2

Step 3

Things you should know

Need help?

Talk with us

You can reach us via LiveChat.

Don't have an HSBC investment account?

You can open an investment account on the HSBC HK Mobile Banking app and start trading with us in minutes.

Award-winning products and platform

Excellence Performance in Digital Trading Platform

HSBC has been awarded the "Excellence Award" for "Digital Trading Platform" at Bloomberg Businessweek Financial Institution Awards in 2023

Download HSBC HK App

One touch and you're in

With the HSBC HK Mobile Banking app (HSBC HK App), you can manage your everyday banking needs anytime, anywhere. Discover a wide range of features and services on the app, and experience an ease of use like never before.