Why choose eStatements and eAdvice?

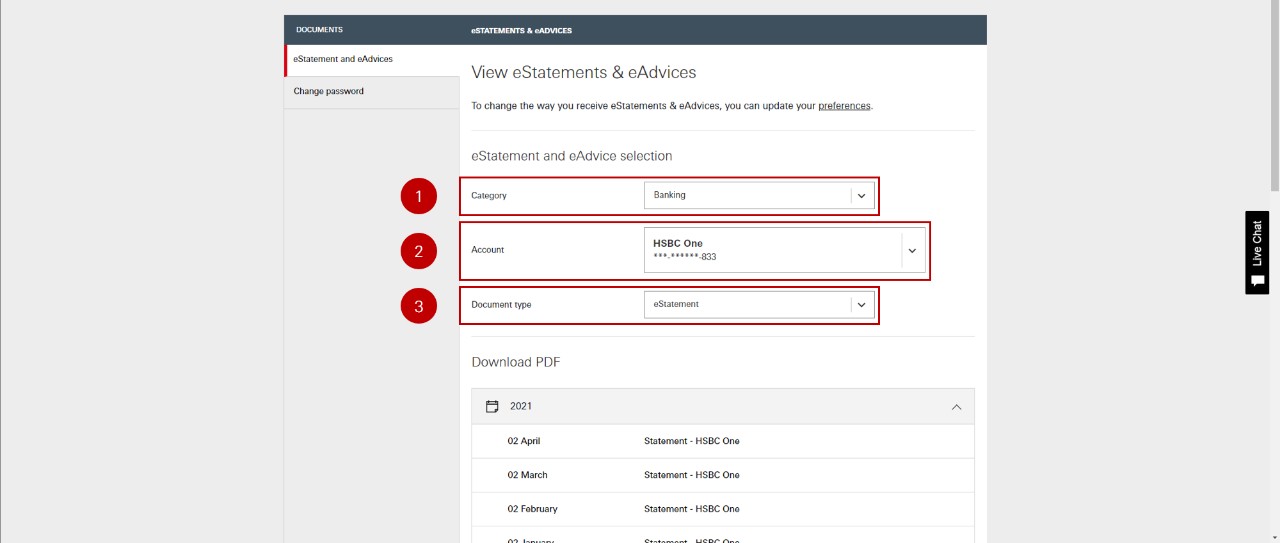

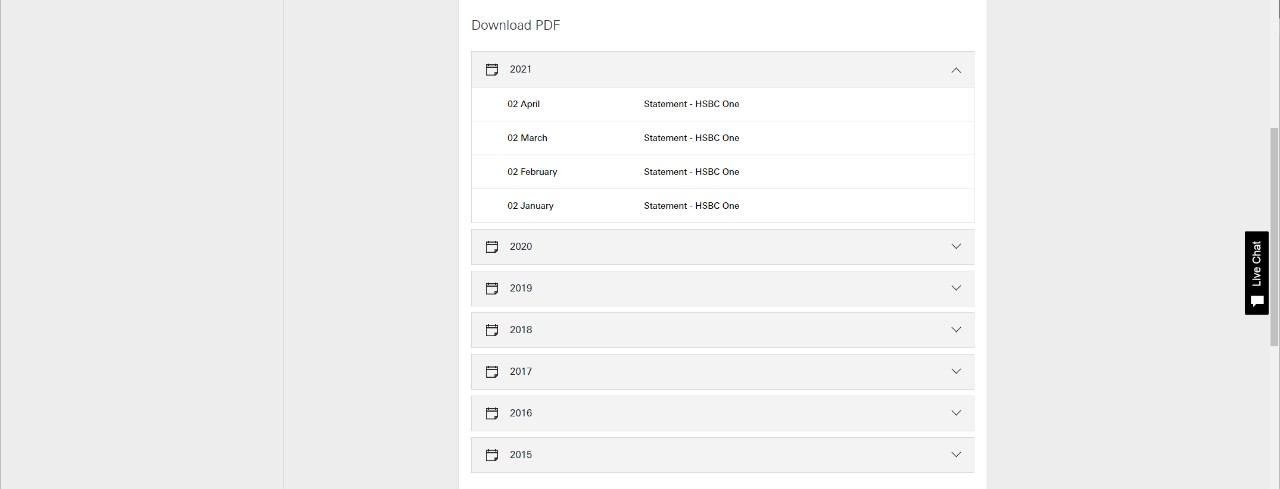

You can view up to 3 months1 transaction advice, as well as eStatements2,3 from as far back as seven years ago by using online banking or the HSBC HK Mobile Banking app (HSBC HK App). You can even download your old statements via online banking or the HSBC HK Mobile Banking app (HSBC HK App). No more waiting for the post.

- Save moneyWhen you opt for eStatements and eAdvices service, you won't have to pay the HKD60 annual fee4 for paper statements.

- Eco-friendlyFewer printouts puts less strain on our local recycling facilities, and ensures less paper ends up in landfills.

- ConvenientNo more digging through drawers and filing cabinets for that bank information from way back when. You’ll always have your financial records at your fingertips.

- Up to the minuteGet SMS or email notifications when your eStatement or eAdvice are ready, and receive push notifications5 for new statements of banking accounts on the HSBC HK App when you activate your Mobile Security Key.

Save money. Save time tracking your finances. Save space in your closet. Do it all when you switch to eStatements and eAdvice service.

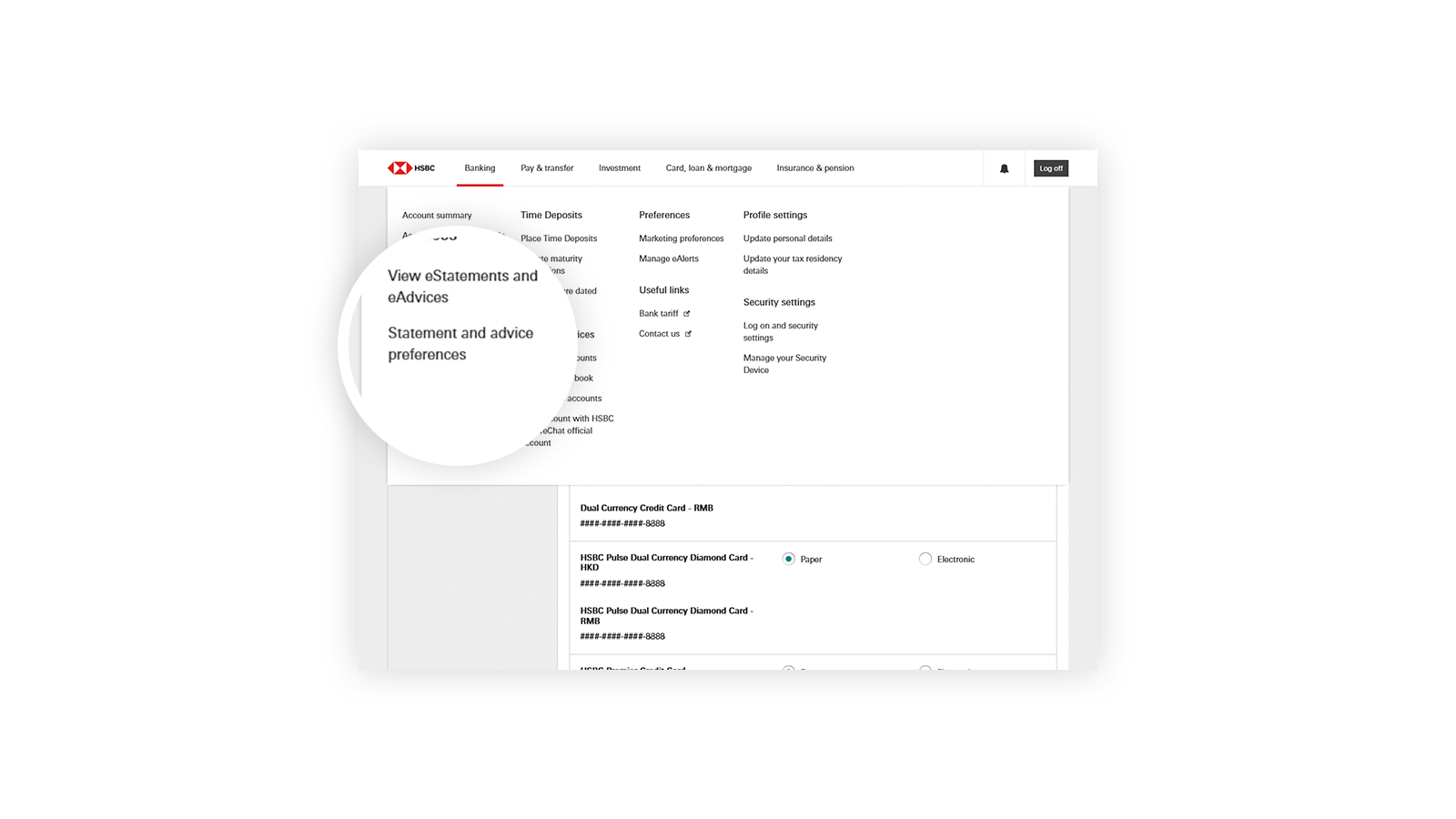

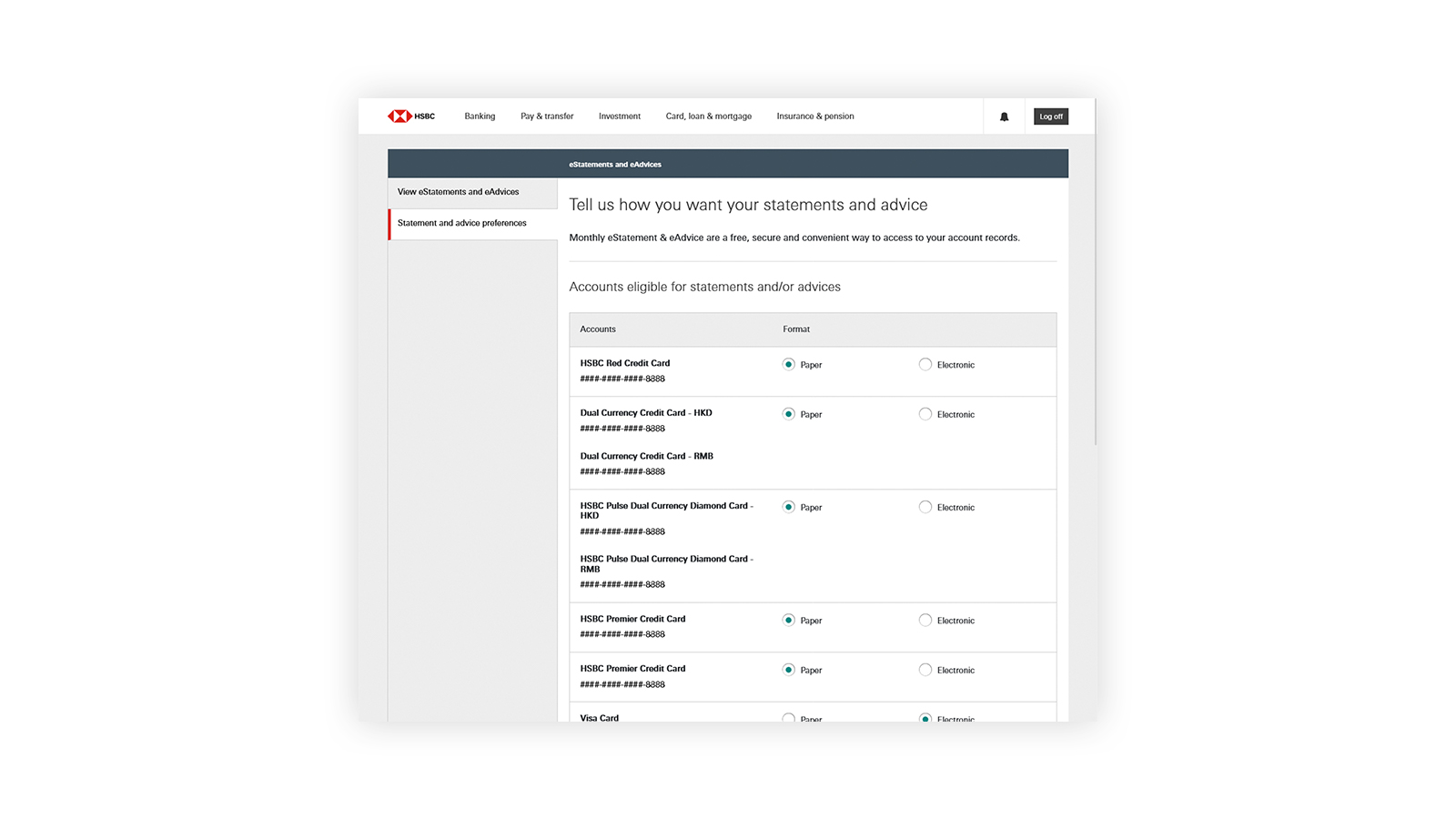

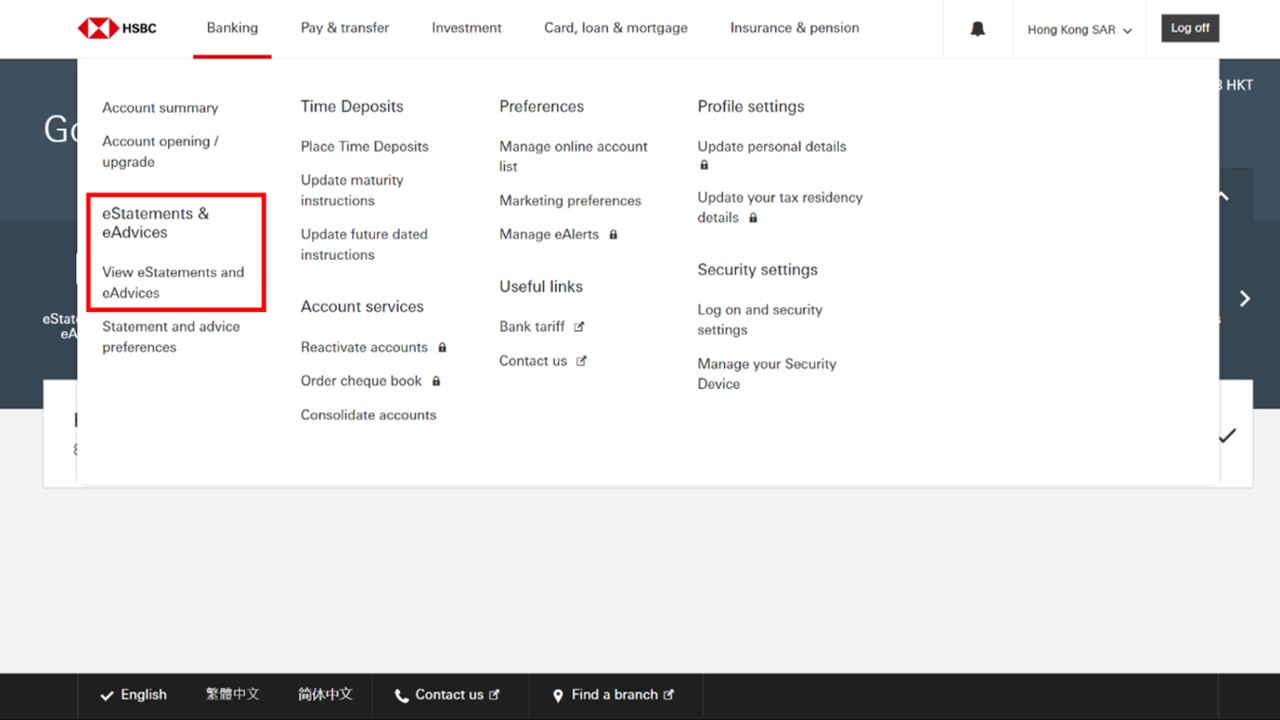

Here's how to switch to eStatements and eAdvices

How to view and download your eStatements / eAdvices

Frequently asked questions

Next steps

- Your eAdvice are retained up to 3 months. Monthly HIBOR-based Mortgage Plan Repayment eAdvice are retained up to 12 months.

- Your eStatements for other accounts (including investment services and securities accounts) are retained up to 24 months.

Your eStatements for integrated accounts, HKD current accounts and HKD savings accounts are retained up to 84 months.

We will accumulate your eStatements for credit card accounts up to 84 months. If an eStatement within the past 84 months is not displayed, you can request a paper statement and the fee will be waived. - Once you've registered for Personal Internet Banking, you'll be able to view your eStatements in the HSBC HK App or Online Banking.If you're a green cardholder with a Personal Internet Banking profile, you can view your eStatements using the app or Online Banking. They'll also be sent to your designated email address, protected by a password.

- From 1 January 2013 to 31 December 2022, a Paper Statement Service Annual Fee of HKD20 will be charged to each account if you request more than two paper statements per year for your Personal Banking Hong Kong Dollar Current, SuperEase, HSBC Premier, HSBC One, Personal Integrated Account, University Student, Cash Card, Renminbi Savings, Hong Kong Dollar Statement Savings, CombiNations Statement Savings or Foreign Currency Current accounts. This fee is waived for recipients of the Comprehensive Social Security Allowance and Disability Allowance, customers with physical or visual impairment and customers aged under 18 or over 65.

Effective 1 January 2023, if account holders choose to receive any paper statement in a full calendar year, account holders will be subject to a Paper Statement Service Annual Fee of HKD60. This standard charge applies to Personal Banking HK Dollar Current, SuperEase, HSBC Premier Elite, HSBC Premier, HSBC One, Personal Integrated Account, University Student Account, Cash Card, Renminbi Savings, HK Dollar Statement Savings, CombiNations Statement Savings, Foreign Currency Current or any Credit Card accounts. The following group of customers will be exempt from the annual fee: aged below 18 or aged 65 and above, recipients of Government's Comprehensive Social Security Allowance, recipients of Government’s Disability Allowance and the physically disabled or visually impaired. - You should ensure that your mobile phone and other telecommunications equipment and related services are capable of receiving Push Notification Alerts through push notifications.

Push notification runs on the service provided by Apple Inc. ("Apple") or Google LLC ("Google"), as applicable. Any delay or failure in delivering push notification messages due to Apple's or Google's service is beyond our control.

- Apple, the Apple logo, iPhone, iPad, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc.

- Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- The screen displays are for reference and illustration purposes only.