Get guaranteed returns of up to 4.40% p.a.[@insurance-swiftsave-annualisedrateofreturn] in USD

Pay for over 2 years and receive guaranteed returns after 3 or 5 years. The plan is available in HKD, USD or GBP.

Get exclusive rates with the promo code 'NY2026'.

Log on to HSBC Online Banking or HSBC HK App to get started.

Quota for this plan is limited subject to underlying asset return corresponding to market conditions.

[New Year exclusive] Up to 4.40% p.a.[@insurance-swiftsave-annualisedrateofreturn] guaranteed USD returns

Apply today with the promo code ‘NY2026’ and get guaranteed returns of up to 4.40% p.a.[@insurance-swiftsave-annualisedrateofreturn] to grow your wealth! T&Cs apply.

Key benefits

Guaranteed annualised return[@insurance-swiftsave-guaranteedannualreturn]

| Currency | In 3 years | In 5 years |

|---|---|---|

| HKD | 3.10% p.a. | 3.60% p.a. |

| USD | 3.90% p.a. | 4.40% p.a. |

| GBP | 3.70% p.a. | N/A |

| Currency | HKD |

|---|---|

| In 3 years | 3.10% p.a. |

| In 5 years | 3.60% p.a. |

| Currency | USD |

| In 3 years | 3.90% p.a. |

| In 5 years | 4.40% p.a. |

| Currency | GBP |

| In 3 years | 3.70% p.a. |

| In 5 years | N/A |

Please note: The quota for each currency in this plan is limited, subject to limitations bound by underlying asset returns corresponding to market conditions.

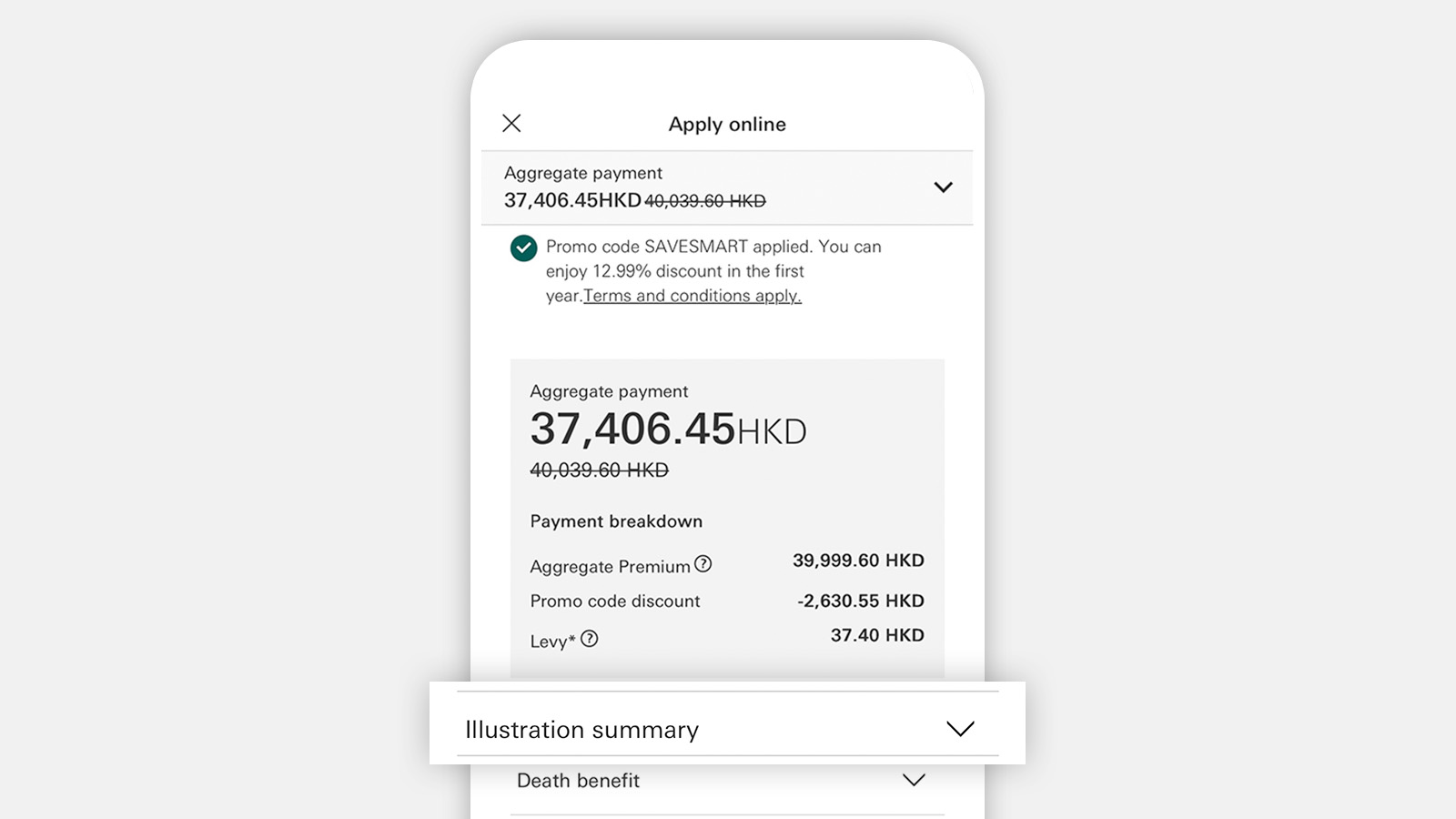

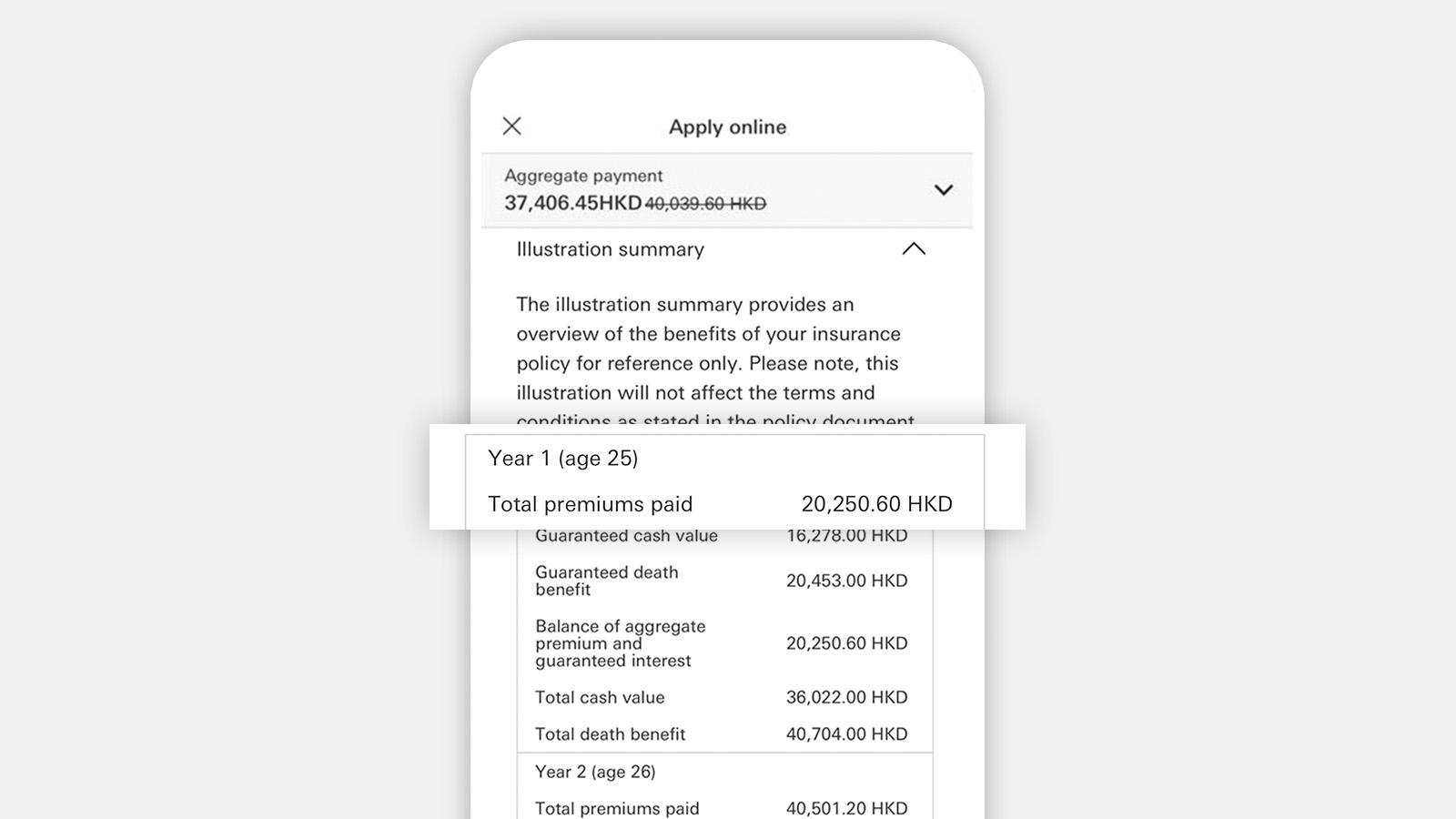

How to apply

Eligibility

To apply for HSBC Swift Save Insurance Plan, you'll need to meet all of these requirements:

- be aged[@insurance-jwip-age] between 19 and 75

- hold an existing HSBC integrated bank account

- meet our criteria for nationality (country/region/territory), address and residency— which are subject to change from time to time

- be registered for online banking

HSBC Swift Save Insurance is a life insurance plan with a savings element underwritten by HSBC Life (International) Limited ("HSBC Life"). It is not equivalent or similar to bank deposit. Policyholders are subject to HSBC Life's credit risk and early surrender loss.

Apply now

Apply online now

Limited quota available—so log on and apply now!

If you have any questions, you can talk to us via Live Chat. We're available from 10:30am to 10:00pm, Mondays to Fridays (except public holidays).

Or apply on mobile

Alternatively, you can apply for an HSBC Swift Save Insurance Plan on the HSBC HK Mobile Banking app.

Find out more

You may also be interested in

Income Goal Insurance Plan II

An annuity plan that gives you a steady income stream after just 10 years

HSBC Wealth Goal Insurance Plan III

Life insurance that helps you build towards your long-term savings goals

Life protection

Safeguard your family's financial security and pass on your wealth with our range of life insurance plans