Greater financial flexibility is just a few steps away

Borrow up to HKD3 million or 23 times your monthly salary, whichever is lower, and pay it back in instalments over a period of up to 60 months. Get approved and withdraw cash within just 1 minute[@loans-withdrawin1min].

- You can set a flexible repayment period of up to 60 months and pay your loan back in fixed monthly payments

- Redraw the amount you repaid again when you need to, without having to apply again[@loans-minimumredraw]

- You won't be charged any handling fees for the loan

APR

As low as

1.99%[@loans-lowannualisedrateoffer]

Rebates

Up to

$16,000[@loans-hkd4500-rebate-offer]

Limited-time offer

Successfully apply for an HSBC Personal Instalment Loan and enjoy rebates up to $16,000 for payroll customers, or up to $8,000 for other customers. Offer valid until 5 August 2025. T&Cs apply.

dpws-tools-calculator-creator

- The monthly repayment amount, Annualised Percentage Rate (APR) and total interest amount shown in the calculator are for indication only and not meant to be final.

- The rates for individual customers may vary. Please call our hotline, or log on to HSBC Online Banking or HSBC HK Mobile Banking app to enquire about your eligible rates including APR and repayment information.

- The illustration does not reflect the actual allocation of principal and interest. Please also note that the actual monthly repayment amount may differ, customers should refer to the loan confirmation letter for the actual related information.

- The monthly repayment amount and the APR is calculated based on a 6, 12, 18, 24, 30, 36, 42, 48, 54 or 60-month repayment period and loan amount of every HKD10,000. The monthly repayment amount is rounded up to one decimal place.

- The APR is calculated using method specified in relevant guidelines issued by The Hong Kong Association of Banks, and is rounded up or down to the nearest two decimal places. An APR is a reference rate, which includes all applicable interest rates, fees and charges of the product, expressed as an annualised rate.

- View Key Facts Statements.

- Terms and conditions apply.

Apply now

Via HSBC HK App

Complete your application in the HSBC HK App if you've already set up mobile banking.

Scan the QR code to open the HSBC HK App

Via online banking

If you've already registered for HSBC Online Banking, simply log on to get started. We've pre-filled some details for you to make your application process easier.

Apply by phone

Call us on our 24/7 application hotline to get started. (852) 2748 8080

Suggested articles

Starting your own business successfully

See what you need to consider and plan for in order to start up a successful business

Sending your child to study abroad

Planning to send your child to study abroad? Explore benefits of studying abroad and student education loan.

Factors to consider before applying for a personal loan

Know more about how to apply for a bank loan, loan rates, and documents needed for personal loans.

How to calculate APR and why it's important

Look at what APR means, why it’s important, and how it's calculated for loans.

A loan is just a few steps away

You can apply for a loan quickly and easily on the HSBC HK Mobile Banking app.

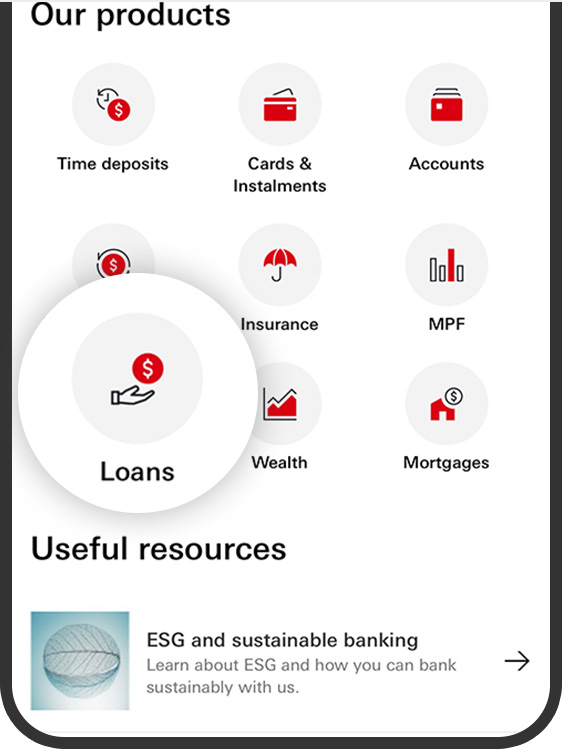

- Log on to HSBC HK Mobile Banking app.

- Go to 'Home', scroll down and select 'Loans'.

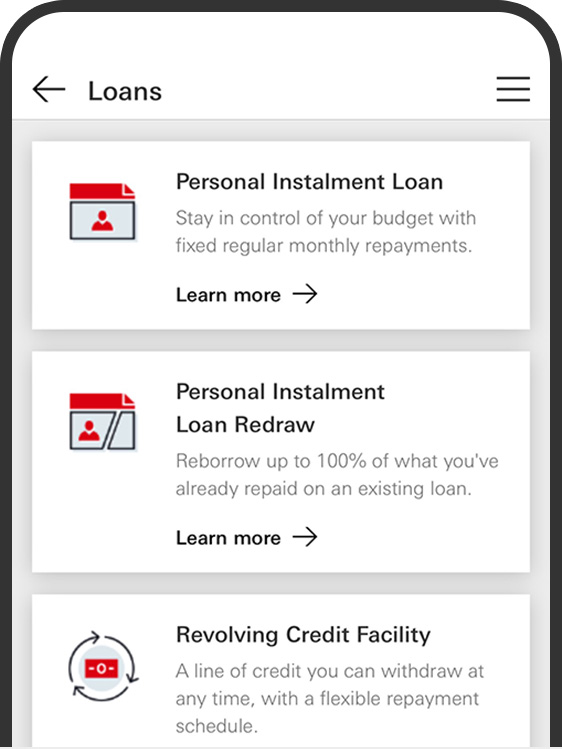

- Select 'Personal Instalment Loan' and follow the instructions to complete your application.

Things you should know

Eligibility

To be eligible for HSBC Personal Instalment Loan, you must:

- be a Hong Kong resident

- be at least 18 years old

- have a monthly income of at least HKD5,000

Find out more

Related products

Personal Instalment Loan Redraw

Borrow a part of or up to all of the principal from what you’ve repaid on your existing loan, without having to reapply

HSBC Revolving Credit Facility

Apply successfully to enjoy HKD100 cash rebate. Get an introductory APR of 2.92%[@loans-introrate] for the first 3 months, plus 50% rebate on 1st month's interest.

HSBC Personal Instalment Loan Balance Consolidation Program

Consolidate your other loans and credit card balances into a high loan amount of up to 23 times your monthly salary or HKD3 million (whichever is lower) without any handling fees