What's HSBC Money Safe?

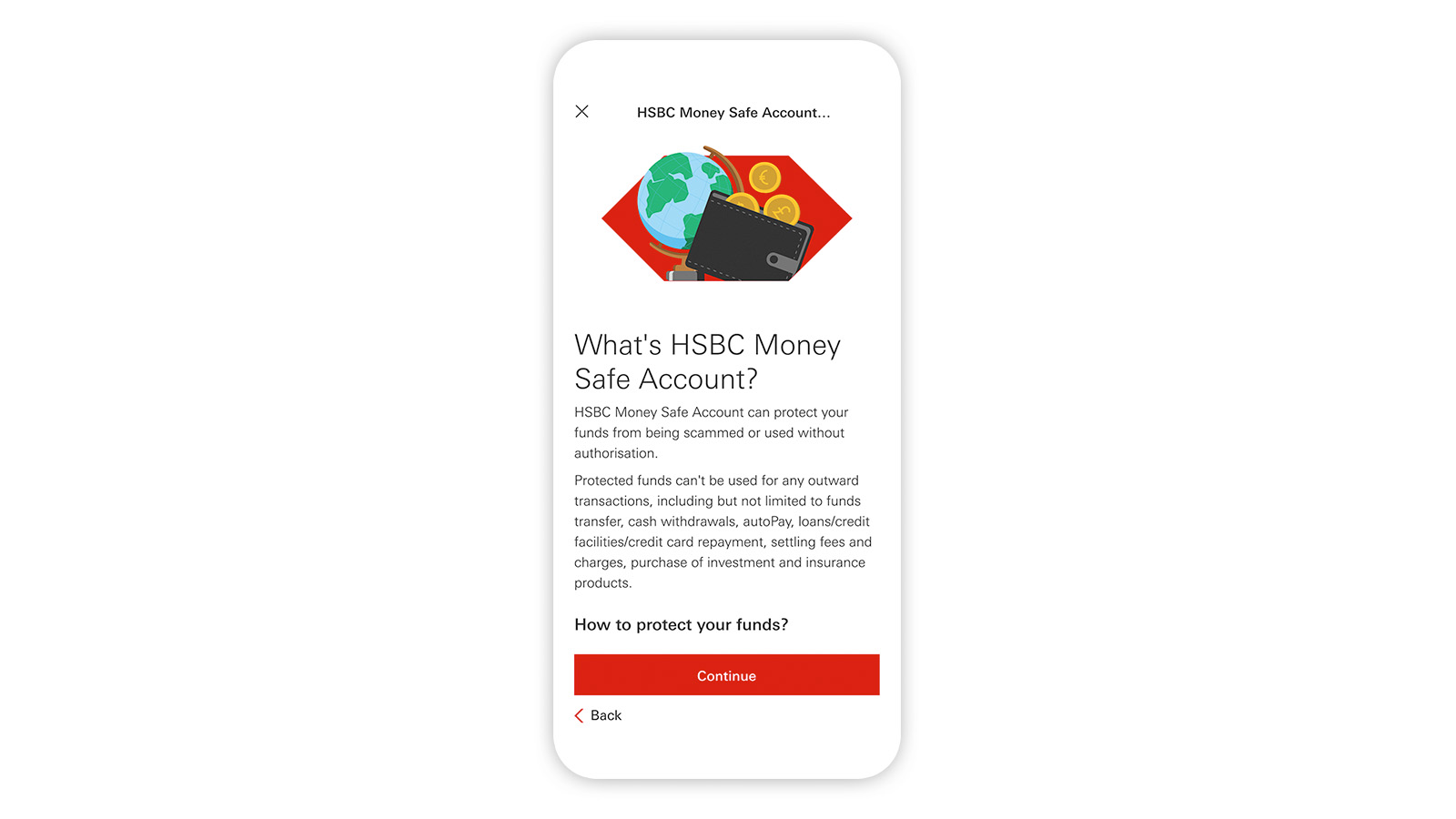

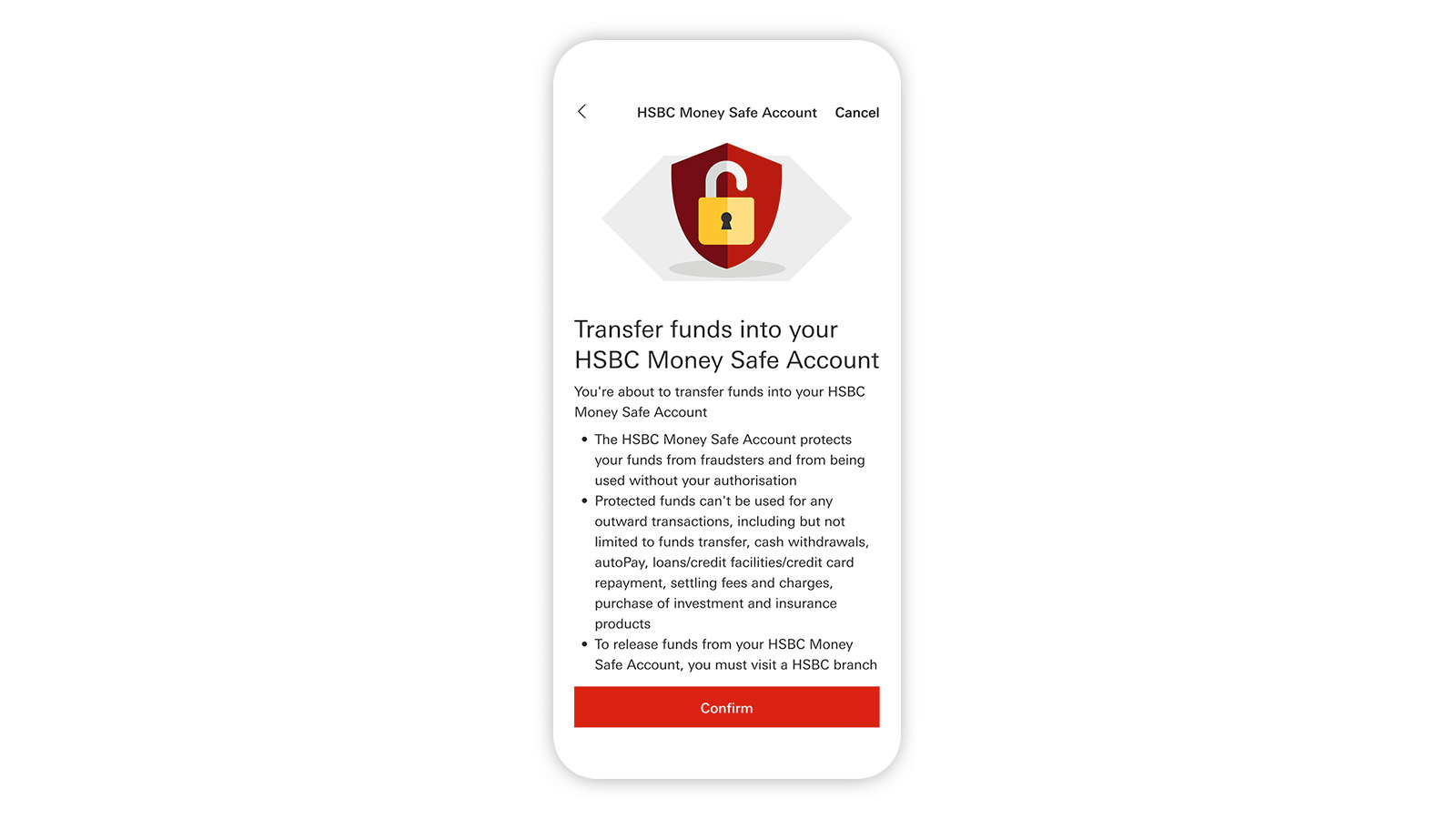

HSBC Money Safe is a service that safeguards your funds from scams or unauthorised use. Once locked, your funds will be blocked from all outward transactions, including but not limited to fund transfers, cash withdrawals, autoPay, loan / credit facility / credit card repayments, settling fees and charges and purchasing investment and insurance products.

Key features

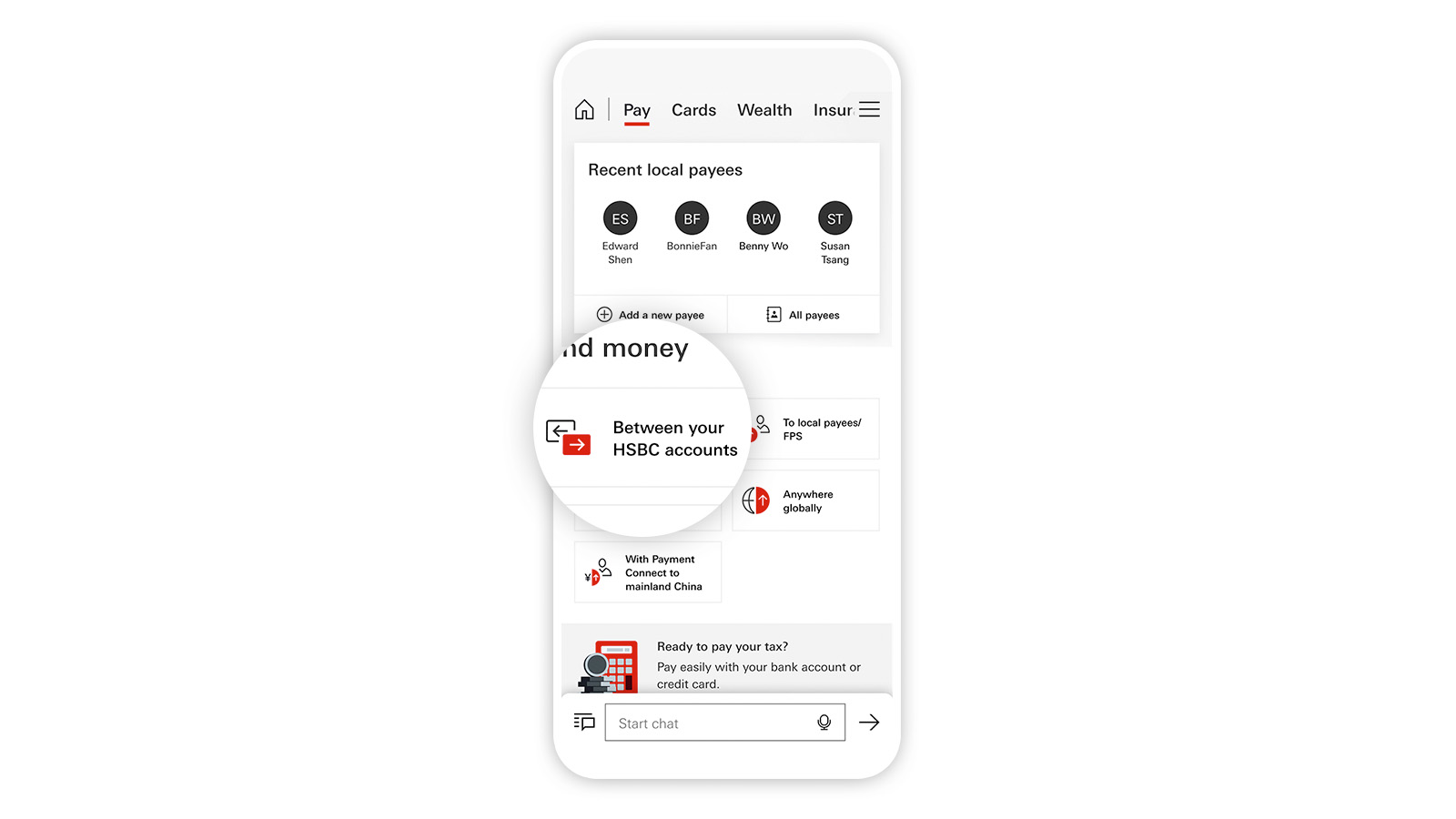

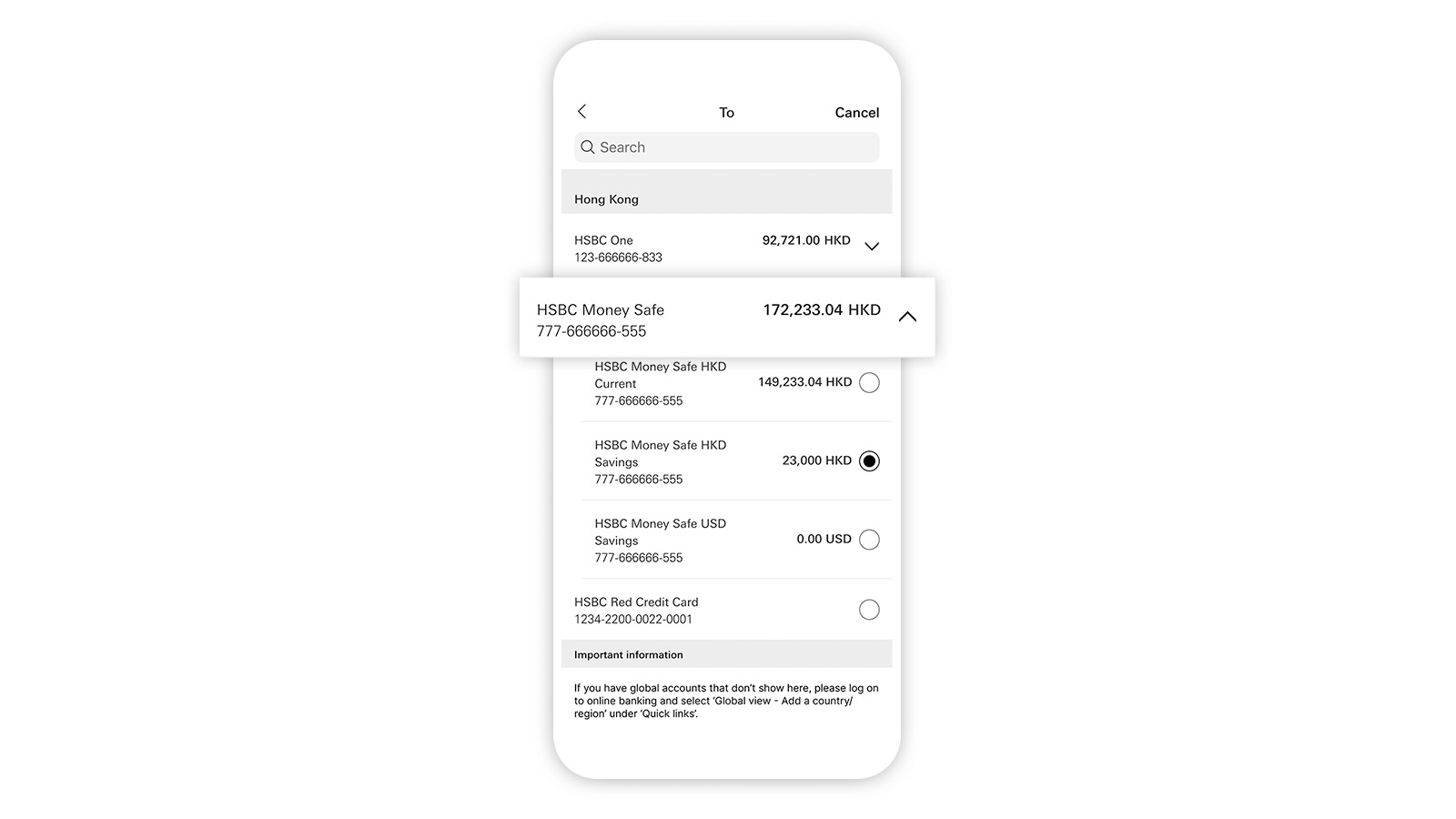

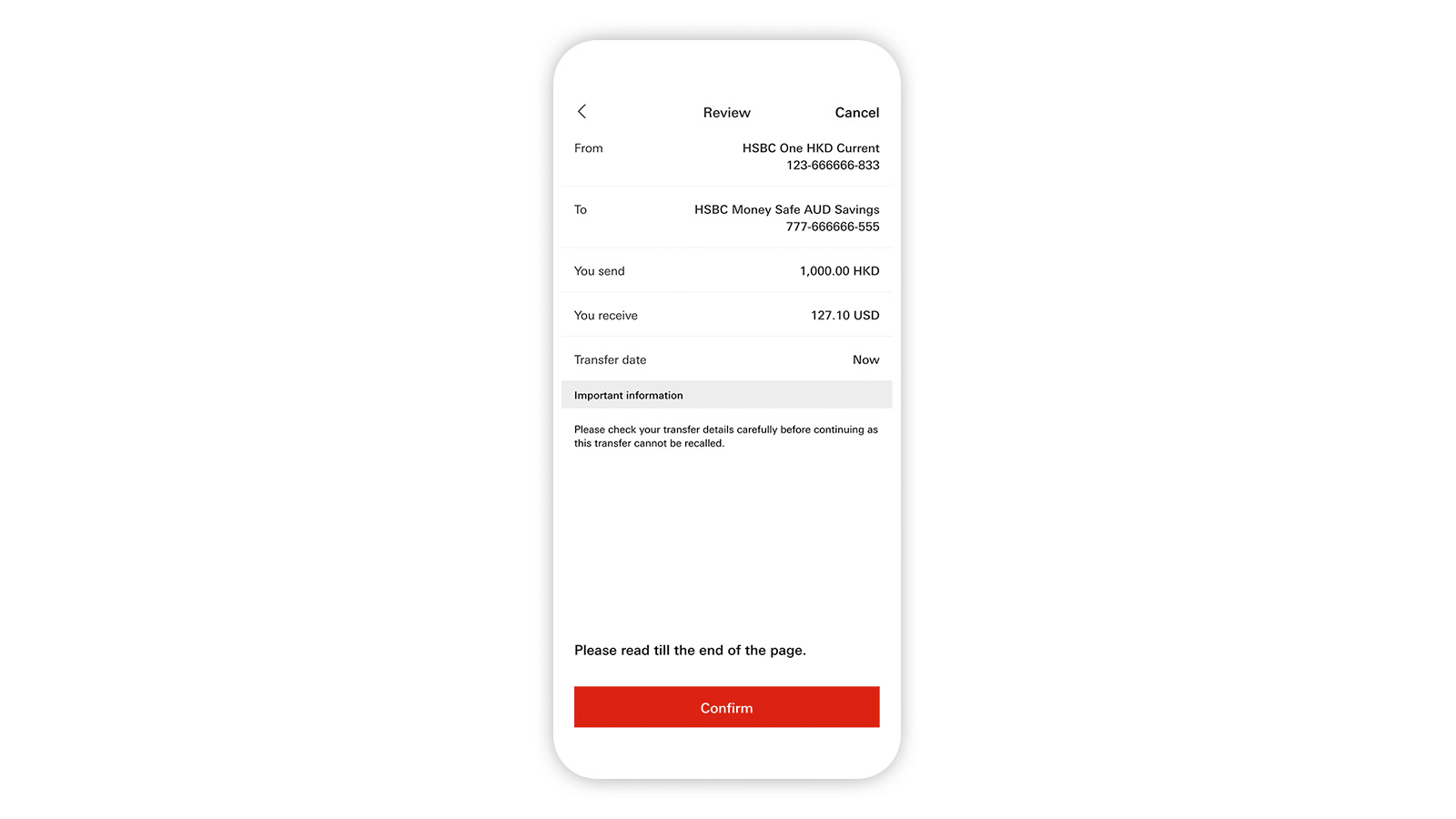

How to use HSBC Money Safe

What you need to know

By opening an HSBC Money Safe Account, you'll be able to:

- lock and protect your funds by transferring them into the account

- ensure locked funds are protected from scams and unauthorised use – as all outward transactions are blocked

- release locked funds by visiting a Hong Kong branch in person

Before locking your funds, please note that locked funds can't be used for any outward transactions, including but not limited to:

- recurring payments

- fund transfers

- cash withdrawals

- settling autoPay instructions

- repayments for loans, credit facilities and credit cards

- settling fees and charges

- purchasing investment and investment products

No ATM or debit cards or cheque books will be issued for this account.

Apply now

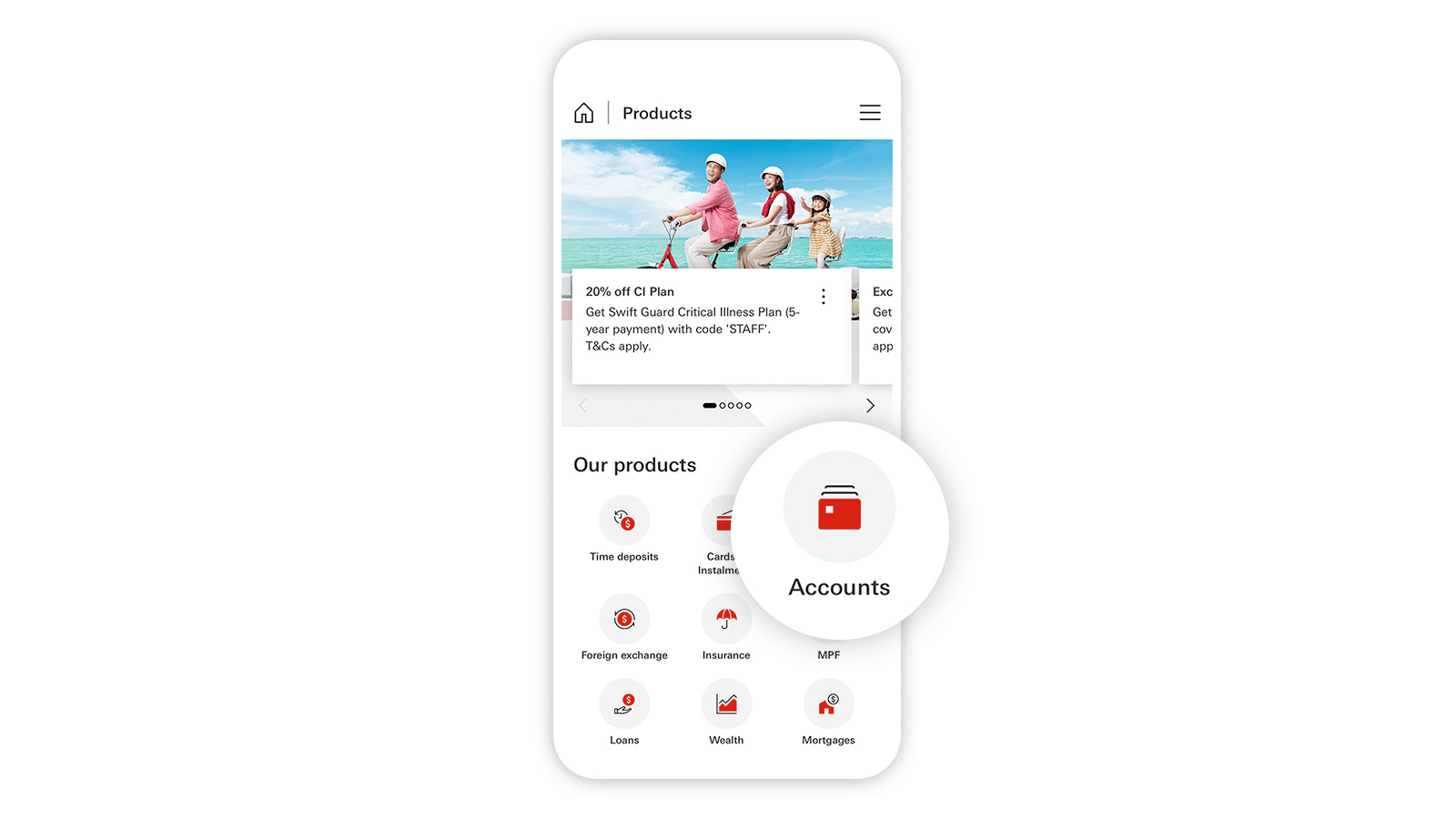

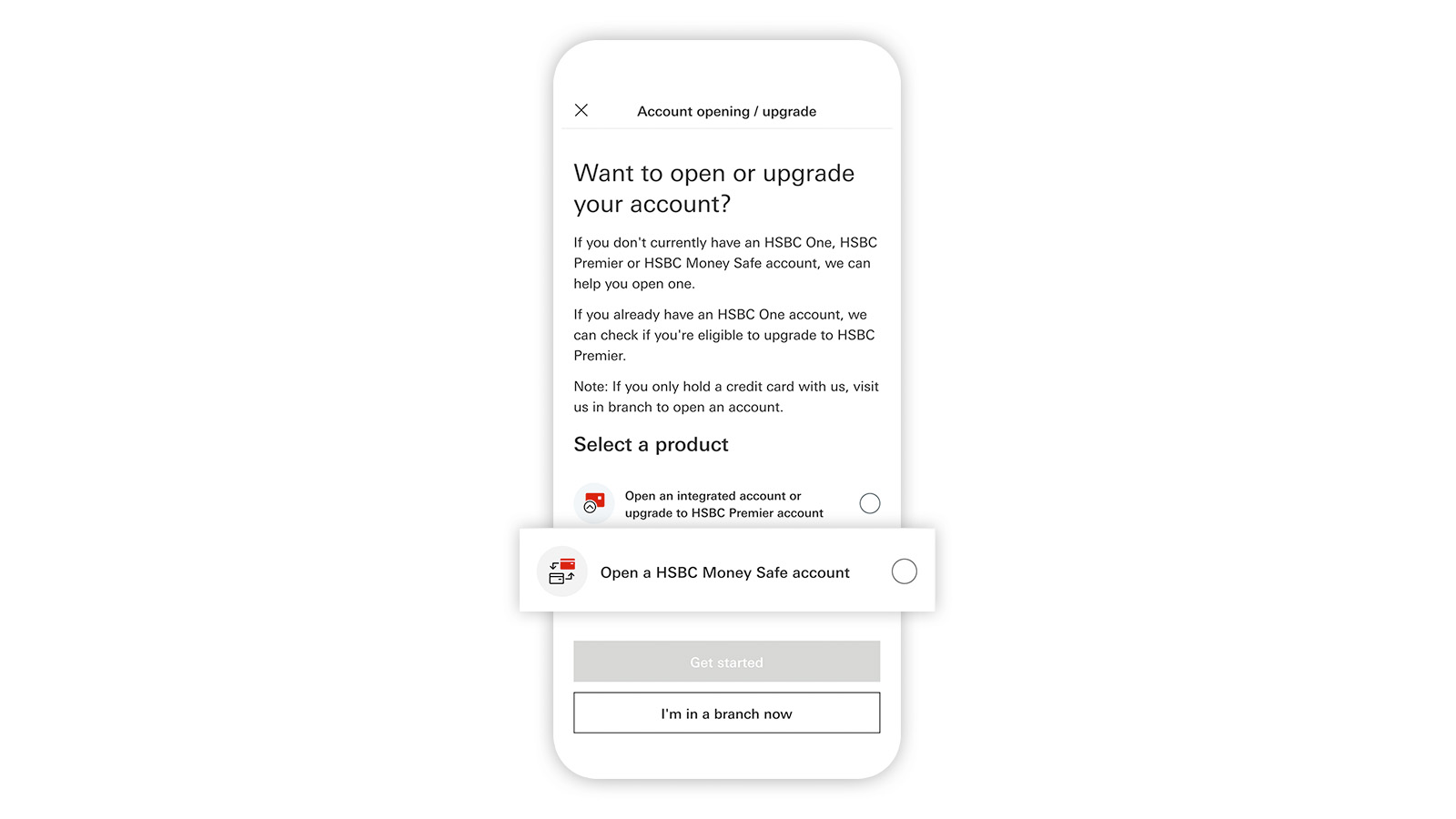

Apply via HSBC HK App

Complete your application in the HSBC HK App if you've already set up mobile banking.

Scan this QR code and download the app

Apply via HSBC Online Banking

If you've already registered for HSBC Online Banking, simply log on to get started. We've pre-filled some details for you to make your application process easier.