More cash, more financial flexibility with Cash Instalment Plan

Convert your available credit limit into cash, or transfer outstanding balance from other credit cards onto your HSBC credit card. Some of the benefits you'll enjoy with our Cash Instalment Plan include:

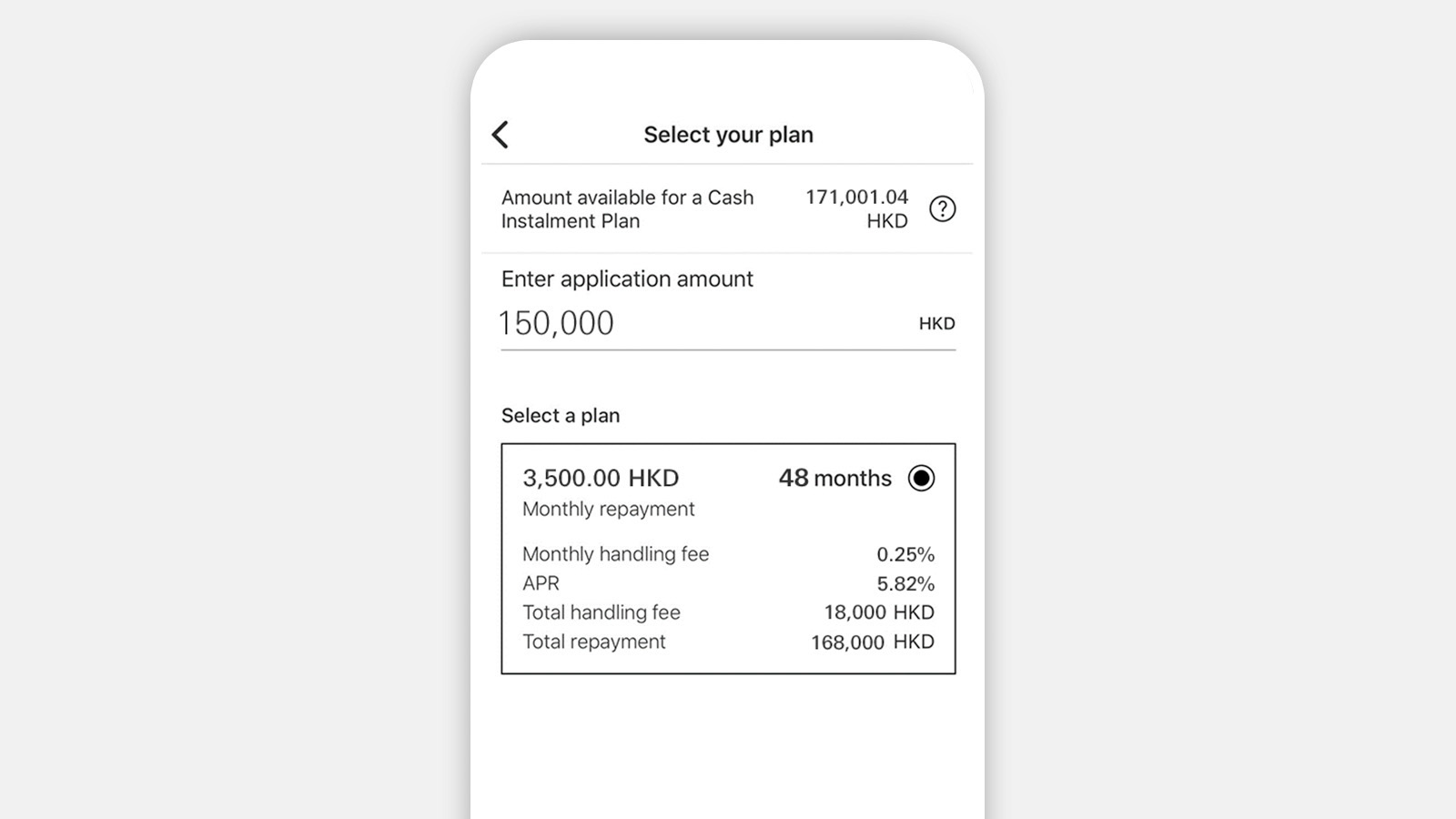

- Make repayments flexibly over 6 to 60 months

- Manage your debt easily with fixed monthly repayment amounts over a fixed repayment period

- Get cash credited directly into your selected account

- Receive cash in your account the same day your loan gets approved[@cards-same-day-disbursement] (within opening hours[@cards-sip-instant-approval])

Monthly handling fee

as low as

0.19%[@cards-cashinstalmonthlyhandlingfee]

You can also submit your supporting documents via HSBC HK Mobile Banking App.

Cash out your card limit with HSBC Cash Instalment

Limited-time offer – up to HKD6,888 spending credit

From 5 February to 9 March 2026, apply for a Cash Instalment Plan and get approved with a designated withdrawal amount and repayment period to get:

Up to HKD6,888 spending credit for new-to-lending customers

Withdraw a designated amount and select a repayment period of:

- 6 or 12 months – up to HKD1,500 spending credit

- 18 to 42 months – up to HKD3,000 spending credit

- 48 to 54 months – up to HKD4,200 spending credit

- 60 months – up to HKD6,888 spending credit

Up to $5,000 spending credit for other customers

Withdraw a designated amount and select a repayment period of:

- 18 to 42 months – up to HKD2,500 spending credit

- 48 to 54 months – up to HKD3,600 spending credit

- 60 months – up to HKD5,000 spending credit

Get an extra HKD100 spending credit when you submit all required supporting documents and get an approved withdrawal amount of HK30,000 or above.Footnote link 5

Extra $200 RewardCash

Until 28 February 2027, new HSBC credit card holder can enjoy an extra $200 RewardCash for a successful application for Cash instalment plan. T&Cs apply.

dpws-tools-calculator-creator

Things you should know

Apply now

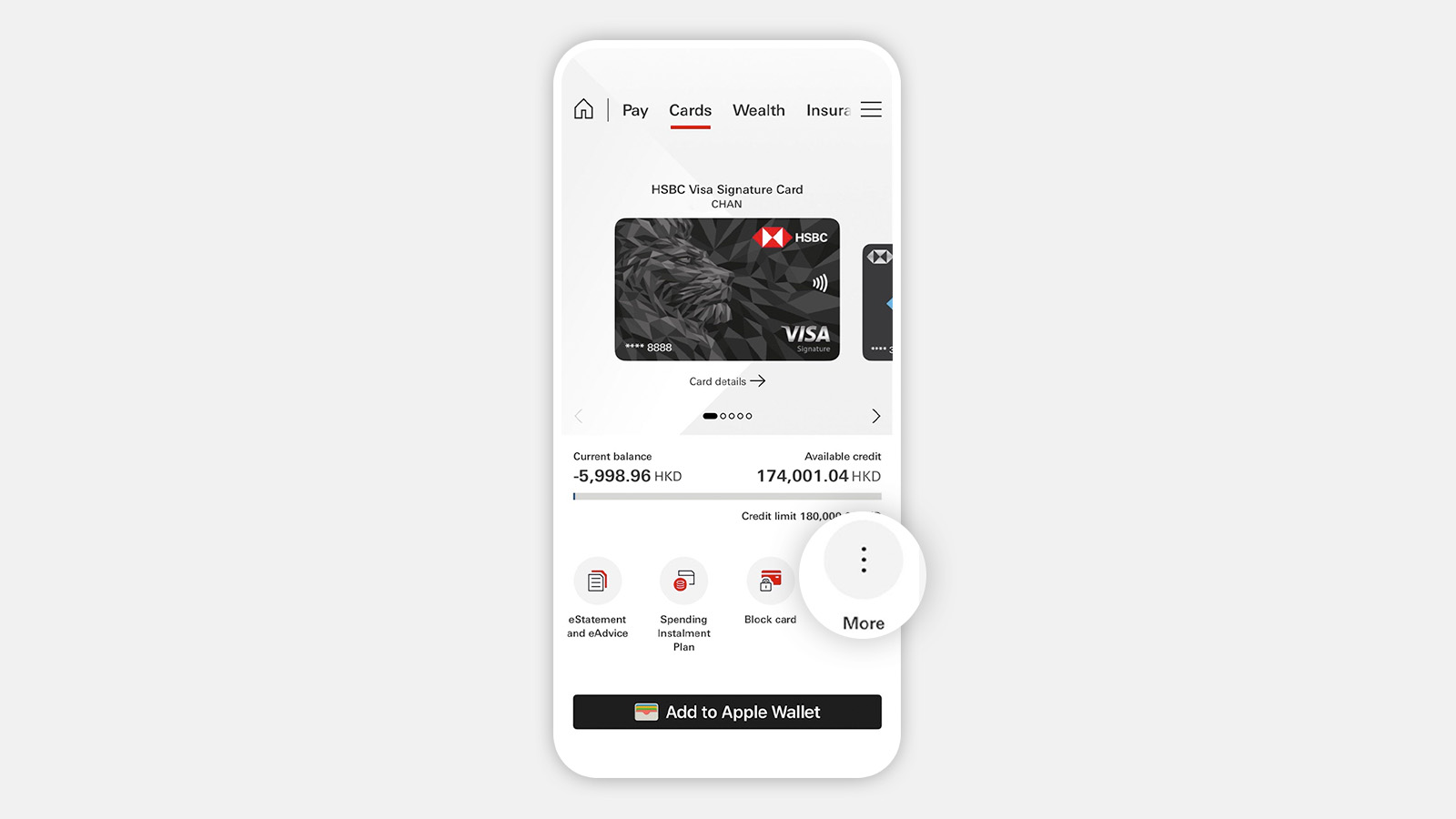

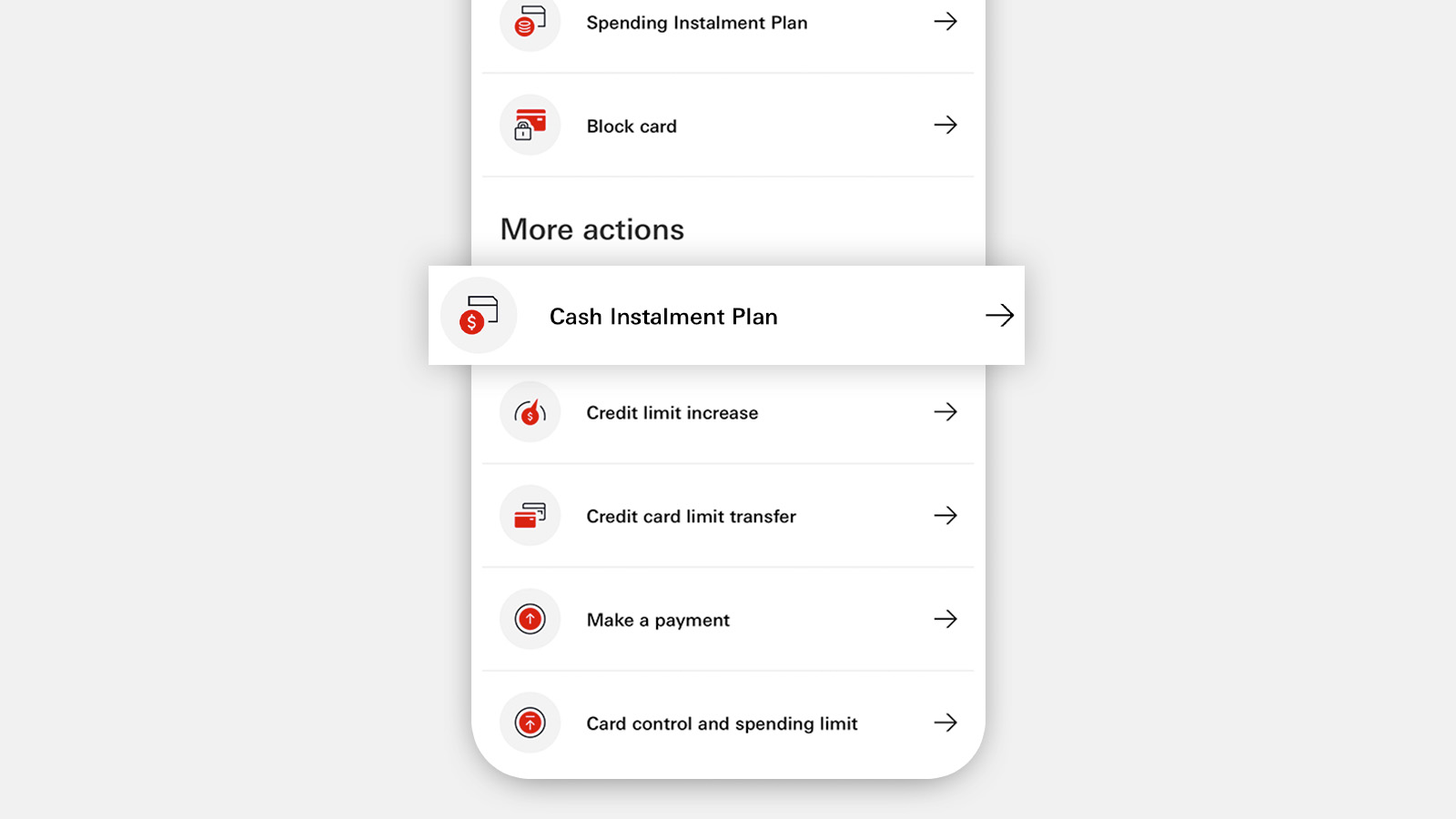

Via HSBC HK App

Complete your application in the HSBC HK App if you've already set up mobile banking.

Scan the QR code to open the HSBC HK App

By phone

Call us on our 24/7 application hotline to get started. (852) 2233 3051

Check your application status in just a few taps

Step 1

Step 2

Step 3

Find out more

You may also be interested in

Important information

You can cancel your Cash Instalment Plan by calling us at (852) 2233 3033 (HSBC Global Private Banking and HSBC Premier Elite customers), (852) 2233 3322 (HSBC Premier customers) or (852) 2233 3000 (Other personal banking customers) within 7 calendar days following the day of fund disbursement (cooling-off period). For more details, please refer to the product terms and conditions.