Simpler design for your everyday banking needs

With HSBC Online Banking, you can securely bank anywhere with an internet connection, on any device.

- Holistic banking experienceSee all your transactions and in-depth account details summarised on one dashboard.

- Comprehensive investment portfolioManage your investments with ease on our user-friendly interface.

- Enhanced banking servicesEnjoy greater control of your own banking preferences such as setting transfer limits and auto-payments.

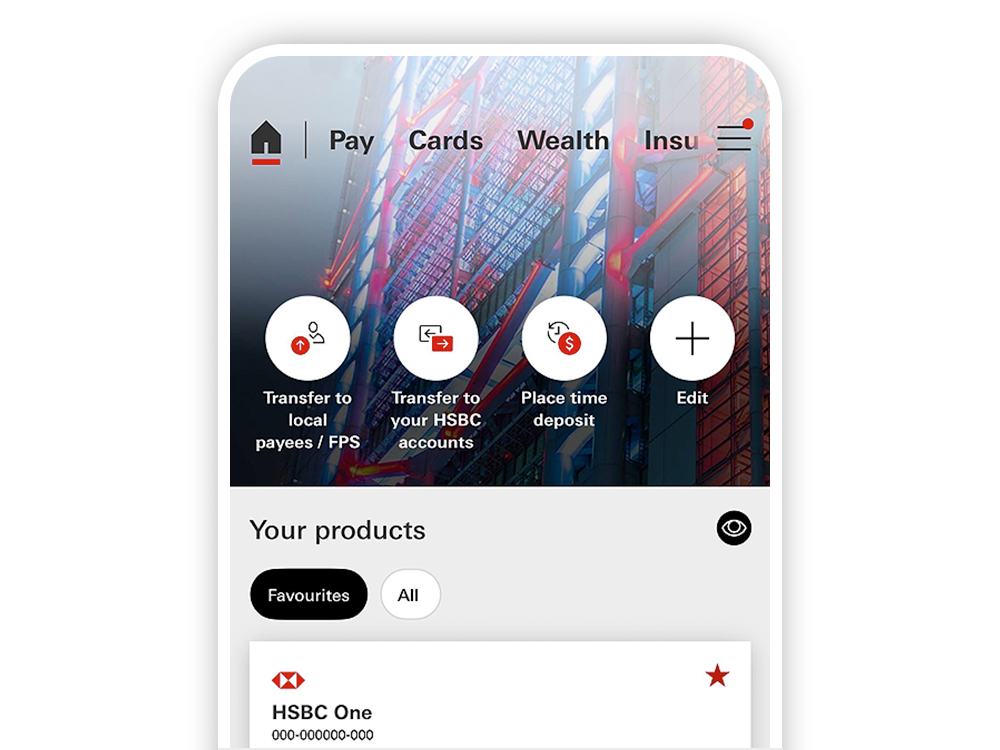

HSBC HK App: One touch and you're in

With HSBC HK App, you can:

- manage your everyday banking needs anytime, anywhere

- log on seamlessly across Online and Mobile Banking, Easy Invest and Reward+

- get live help via 'Chat with us', 24/7

- tailor quick actions, account list and app mode to your liking, and hide your balance to protect your privacy

Key features

Access your statements and advices anytime, anywhere

We keep your eStatements for up to 7 years (84 months), and your eAdvices for up to 3 months.

Invest with ease

Manage your full investment portfolio using our wealth dashboard.

Send money and make payments online

Send money 24/7 with free instant transfers using Faster Payment System (FPS)1or HSBC Global Transfers2. You can also set up auto-pay to pay bills to a list of merchants.

Stay flexible with time deposits

Make your savings work for you with 24-hour access to our time deposit accounts.

Get help right away

Talk to us directly from our website using 'Chat with us'. We're here to help you instantly answer any questions about our online banking services.

Bank smartly and securely online

Online and banking security

Learn how to keep your accounts secure through regular log ons, checking transactions and keeping anti-virus software up to date.

Mobile Security Key

Mobile Security Key is a feature within the HSBC HK Mobile Banking app and is used to generate a unique, one-time use security code in order to access to full range of Personal Internet Banking services.

Remarks

- There is no charge from us if you pay money to, or receive money from accounts from other banks via FPS, but other banks may have different charging policies.

- HSBC Global Transfers is an instant transfer to self-named or third-party overseas HSBC accounts exclusively available to HSBC Global Private Banking, HSBC Premier Elite, HSBC Premier and HSBC One customers. It is free of charge to HSBC Global Private Banking, HSBC Premier Elite and HSBC Premier customers exclusively. Please refer here for the list of supported countries.

3. The services of changing credit limit and applying for Octopus Automatic Add-Value Service are applicable to credit card only.