The refreshed HSBC HK App is here

Mobile banking just got easier. A more intuitive experience is available on the HSBC HK App now!

Download the HSBC HK App

APK app version: Version 3.66.2 (Last updated: 3 Feb 2026)

What's new?

In the new year, we've been busy making the HSBC HK App even better to get you ready for the Year of the Horse. Wishing you a fantastic and prosperous year ahead!

- Send up to 10 FPS Laisee in one-go with the same custom greeting

- Verify your identity using HSBC HK App instead of entering your phone banking PIN

- Open an HSBC Money Safe account and lock your money away from fraudsters

If you need any help, chat with us 24/7 in the app.

If you don't have Google Play on your Android device, please install the HSBC HK App with the APK file. Learn more about the APK file.

New safety measure in the Android version of the HSBC HK App

Learn more on how we protect you from malware with our new safety measure in the Android version of the HSBC HK App.

Set up the HSBC HK App

Key features

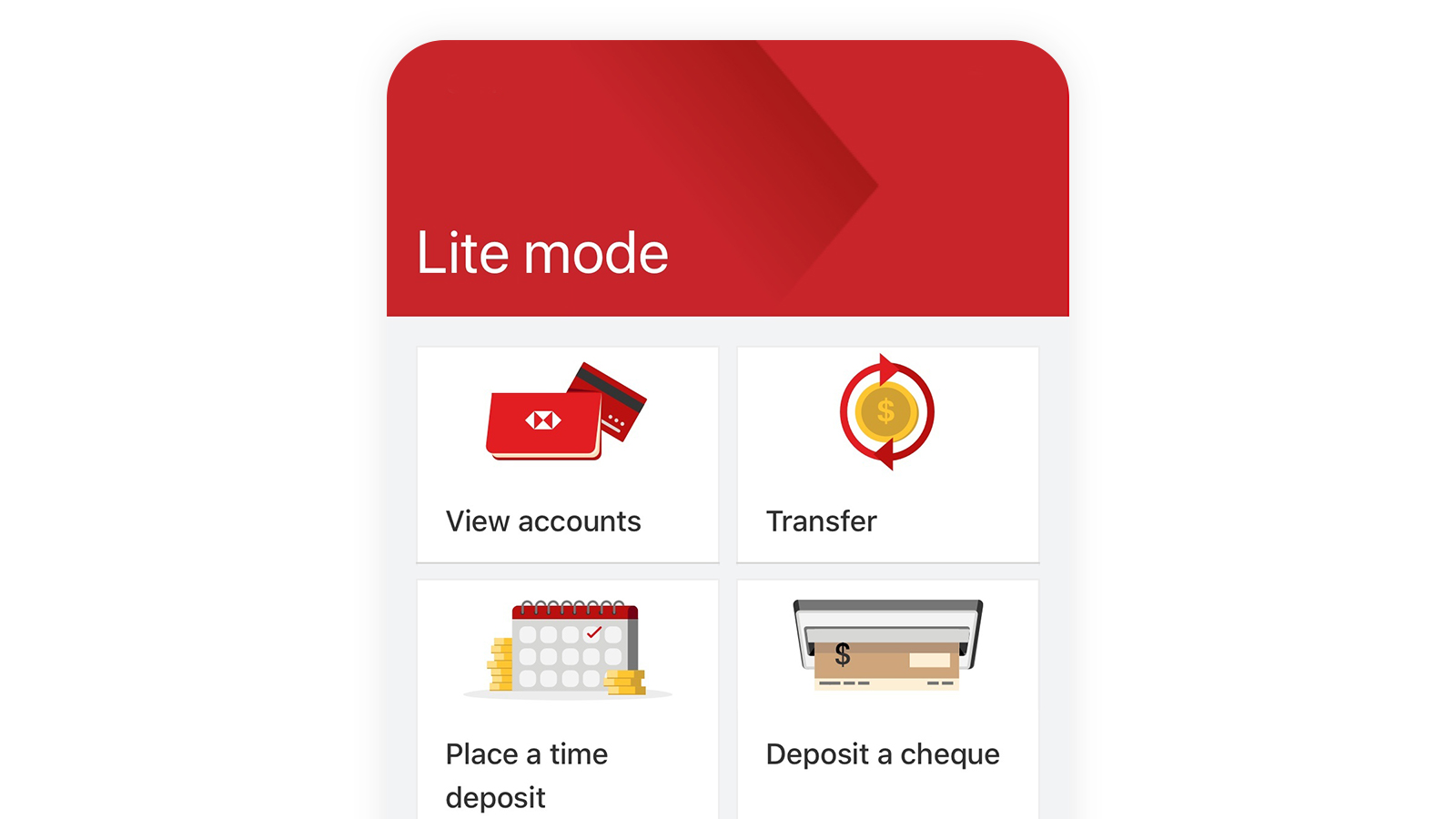

Lite Mode

Simple grid view, essential functions, better chat and call support for your day-to-day banking needs

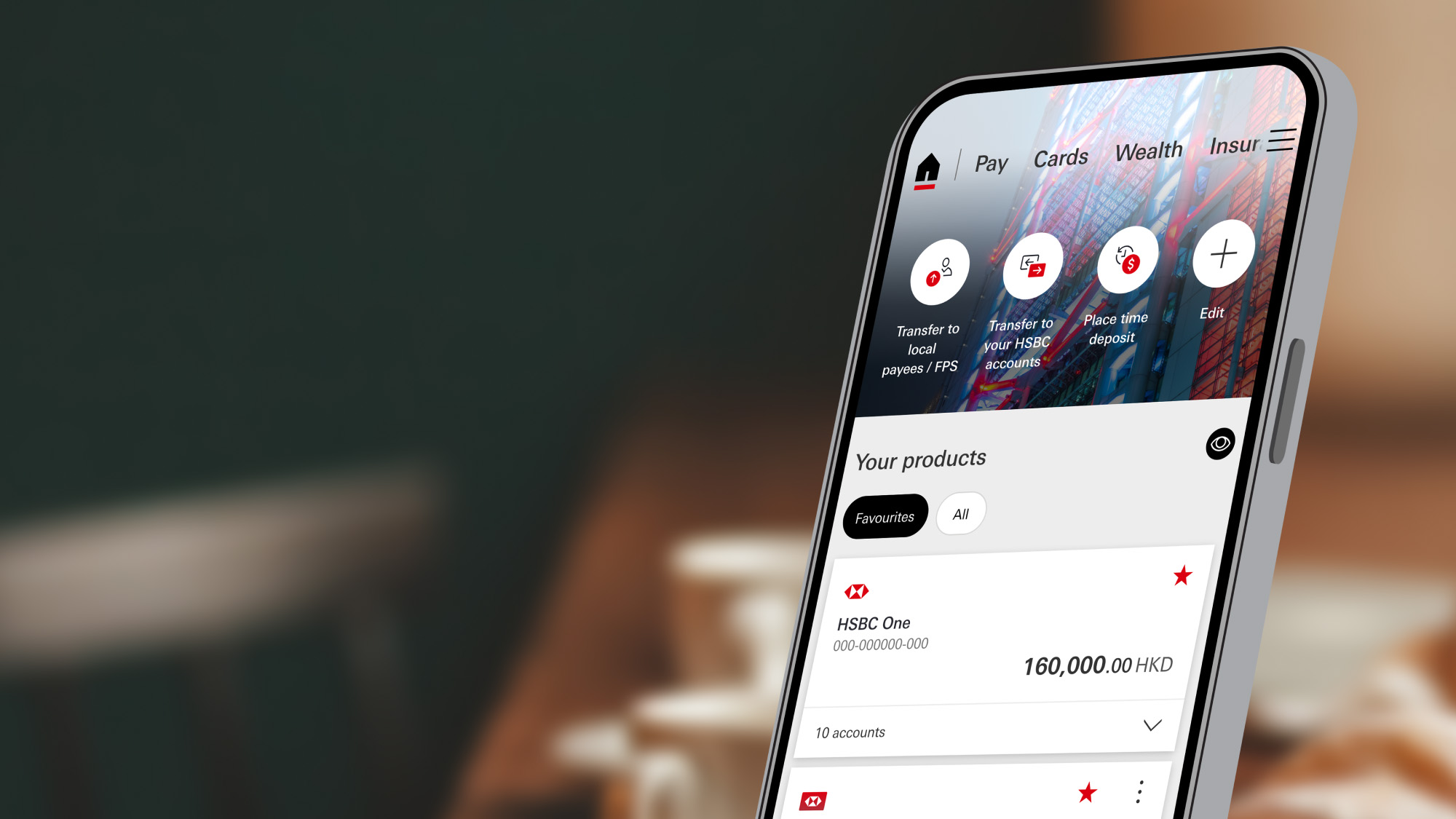

Personalised mobile experience

Quick access to customisable quick actions and account list based on your own preference, and hide your balance to protect your privacy.

Mobile Security Key

Push notifications

Don't miss out! Turn on the push notifications3 you want to receive and get instant updates on personalised offers, your account activity, payment reminders and more.

Explore more

Open an account instantly

New and existing customers2 can now use the HSBC HK App to open a bank account in less than 5 minutes.

Budgeting made easy

Automatically track expenses from your HSBC accounts and HSBC credit cards with ease. Plan your finances and develop saving habits effortlessly.

Well+

Improving your wellness can be fun and rewarding. In just a few steps, join Well+ for free and enjoy simple fun Body, Money and Mind activities to earn fabulous rewards.

Investing with us

In just a few taps, you can get a holistic view of your investment portfolio, explore our suite of investment products and update your Risk Profiling Questionnaire.

Chat with us

Manage your credit and debit cards

Do more than just track your credit card expenses with pending transactions and eStatements. Easily add your cards to digital wallets and set spending limits on your debit cards. And if you ever misplace or lose a card, you can easily and immediately place a temporary block.

Faster Payment System (FPS)

Manage your security in one place

Need help?

Chat with us

Get instant help with 'Chat with us' on our app (Support > Chat with us).

Digital Academy

Learn how to use the HSBC HK App with our Digital Ambassadors.

FAQs

You may also visit the FAQs for our app.