How to build your wealth over time

Many people know how to build wealth simply by accumulating savings. Research shows that Hong Kong people have the strongest tendency to save within the region. 67% of Hong Kong interviewees would increase their rate of savings in the next six months. It takes careful and considered planning to build wealth and overcome the effects of inflation.

Manage and build up your wealth

- Most people understand that investing their capital can lead to potentially greater wealth.

- However, if you simply invest your money in equities and expect to double your earnings in a short time, the risk is much higher.

- It may take higher risk in order to maintain growth momentum in a long run.

- An effective savings plan needs a longer period of time for the power of compound interest to work to your advantage.

- Be reminded not to let your savings adjust to your spending needs. Let your spending adjust to your savings needs.

For example:

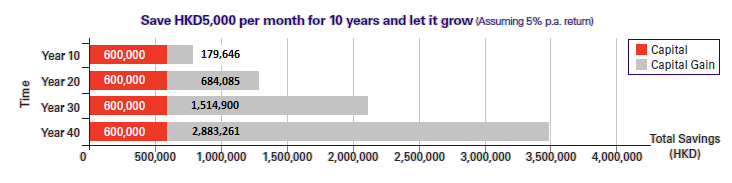

- Saving HKD5,000 a month for 10 years.

- Total amount accumulated is HKD600,000.

- Assuming 5% interest each year on your savings. After 10 years, the accumulated amount will grow up to HKD779,646 (almost HKD180,000 more).

- By the 40th year, the sum will reach HKD3,483,261.

That is the power of compound interest, assuming the same target and return, the earlier you start your saving plan, the less the contribution per month and the more the total capital gain.

Note: The above diagram is for illustration only and is not an indication of the actual performance of any insurance plans or investment products.

Invest regularly to benefit from fluctuations

Dollar-cost averaging is a common technique used in long-term investments, aiming to lower the average cost of each fund unit. By investing a fixed amount regularly, you will buy more units when the fund price drops and less when it rises.

Good asset allocation helps grow your wealth steadily

Asset allocation is a practice to diversify risk among different assets within your investment portfolio. It aims to create a more balanced portfolio that adapts to all market conditions.

Get started

Future Planner

Want to review your future planning and see if you're on track to achieving your goals? Get started with Future Planner to gain insights into your planning and see what areas may need more attention.

Risk Profiling Questionnaire

Want to understand your investment needs and risk appetite? Please log on to HSBC Personal Internet Banking or the latest version of HSBC HK Mobile Banking app, and it will take you just a few minutes to complete the Risk Profiling Questionnaire.