The bank account for independent teens

Looking to open your first bank account? It is never too early to start – take your first steps towards financial independence by banking with us.

To apply, you will need to be under the age of 18. No fees or minimum balance needed.

If you are interested, please talk to your parents/guardian and ask them to book an appointment with us via the button below. To open an account, your parent or guardian needs to be present.

What you get with your HSBC account

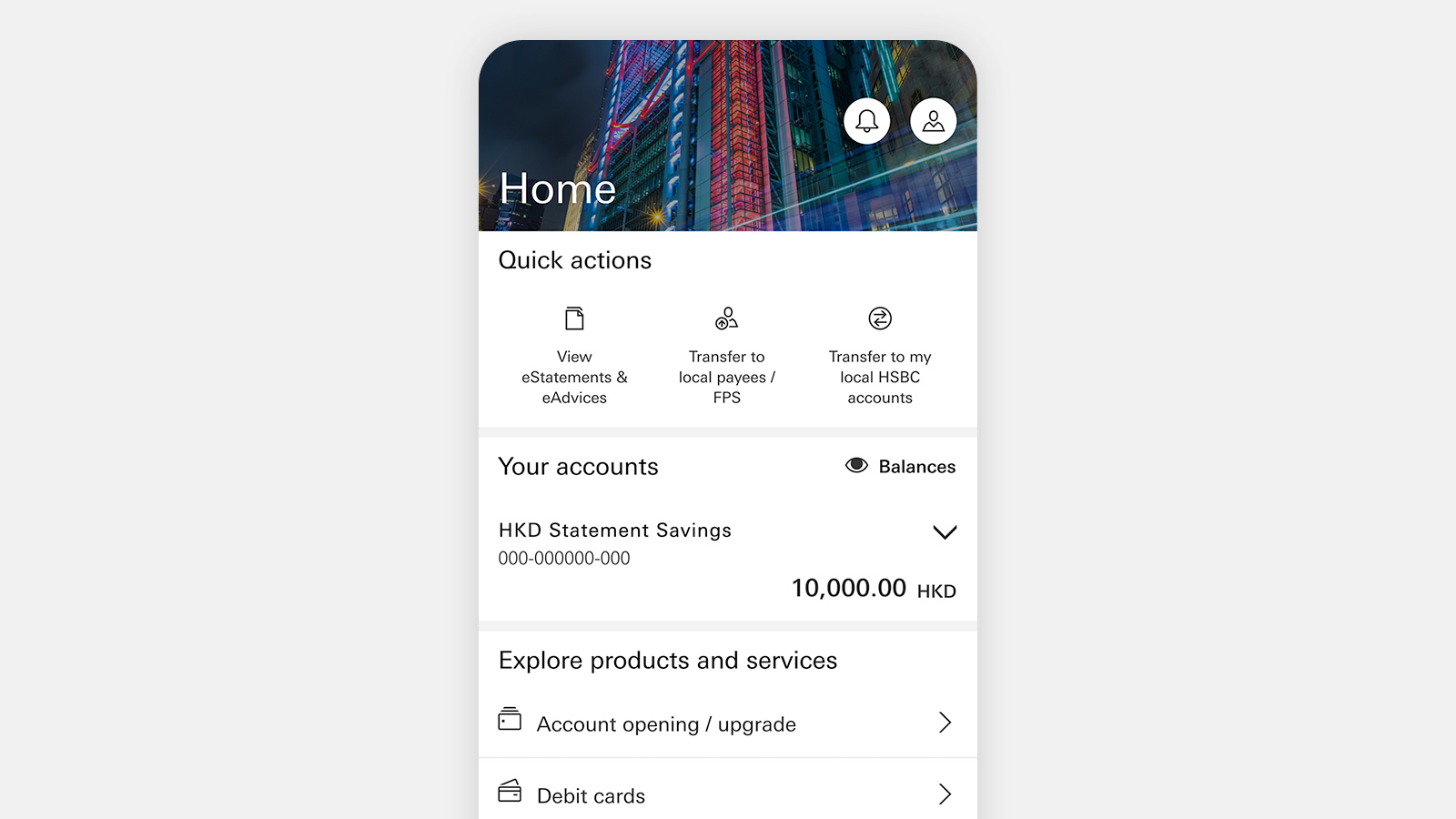

Independent money management

Whether you're saving up for your next adventure or looking for a way to withdraw cash – our HSBC HK App has got you covered.

- Check your account balanceIn just a few taps, see how much money you've spent or saved. You can also turn on push notifications[@accounts-childrens-savings-notification] to get updates on your account activities and more

- Withdraw cash at any local HSBC and Hang Seng ATM using the HSBC HK App – it is that simple!

- Simple to use, easy to learn! Switch from to Full Mode to Lite Mode in the app to get a stress-free start to banking on-the-go

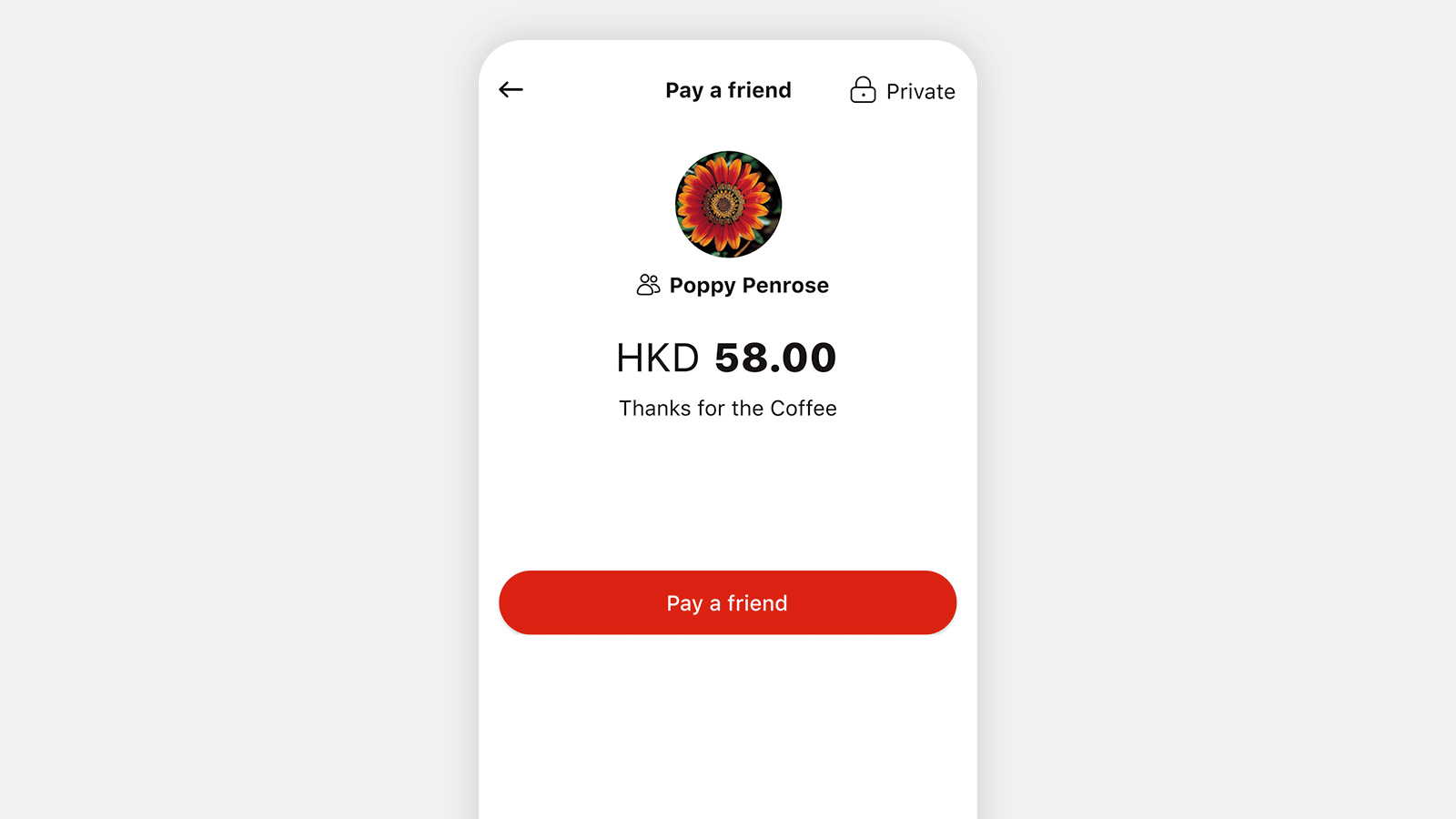

Receive and pay, your way

Receiving money or paying friends just got a whole lot easier.

- PayMeBy downloading PayMe and simply registering with your HKID and personal details, you can pay your family and friends, split the bill for lunch and grab flash vouchers to spend at your favourite businesses

- FPSSend and receive money easily with Faster Payment System (FPS) via HSBC HK App. Simply use mobile number, email address, FPS identifier or scan a QR code to make transfers instantly and free of charge[@accounts-fps]!

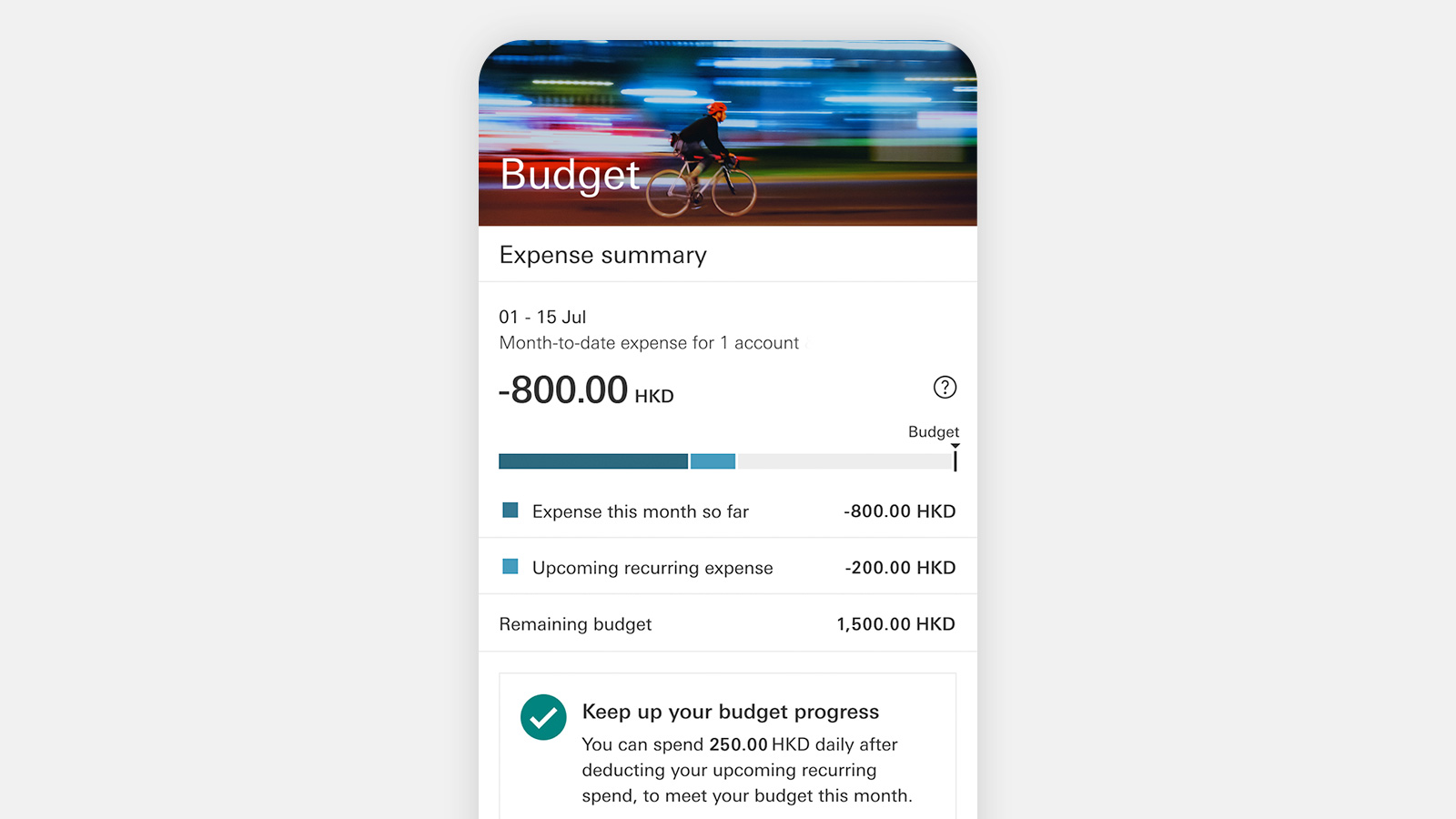

Level up your savings

With 'Budget' on the HSBC HK App, you can start keeping tabs on your spending!

- Your personal financial buddy'Budget' helps you keep track of all your money and transactions, so you know how much you've spent across different categories.

- Personalised insightsKnow where you're overspending so you can make smarter spending choices. This will keep you on track to saving up for the next big thing!

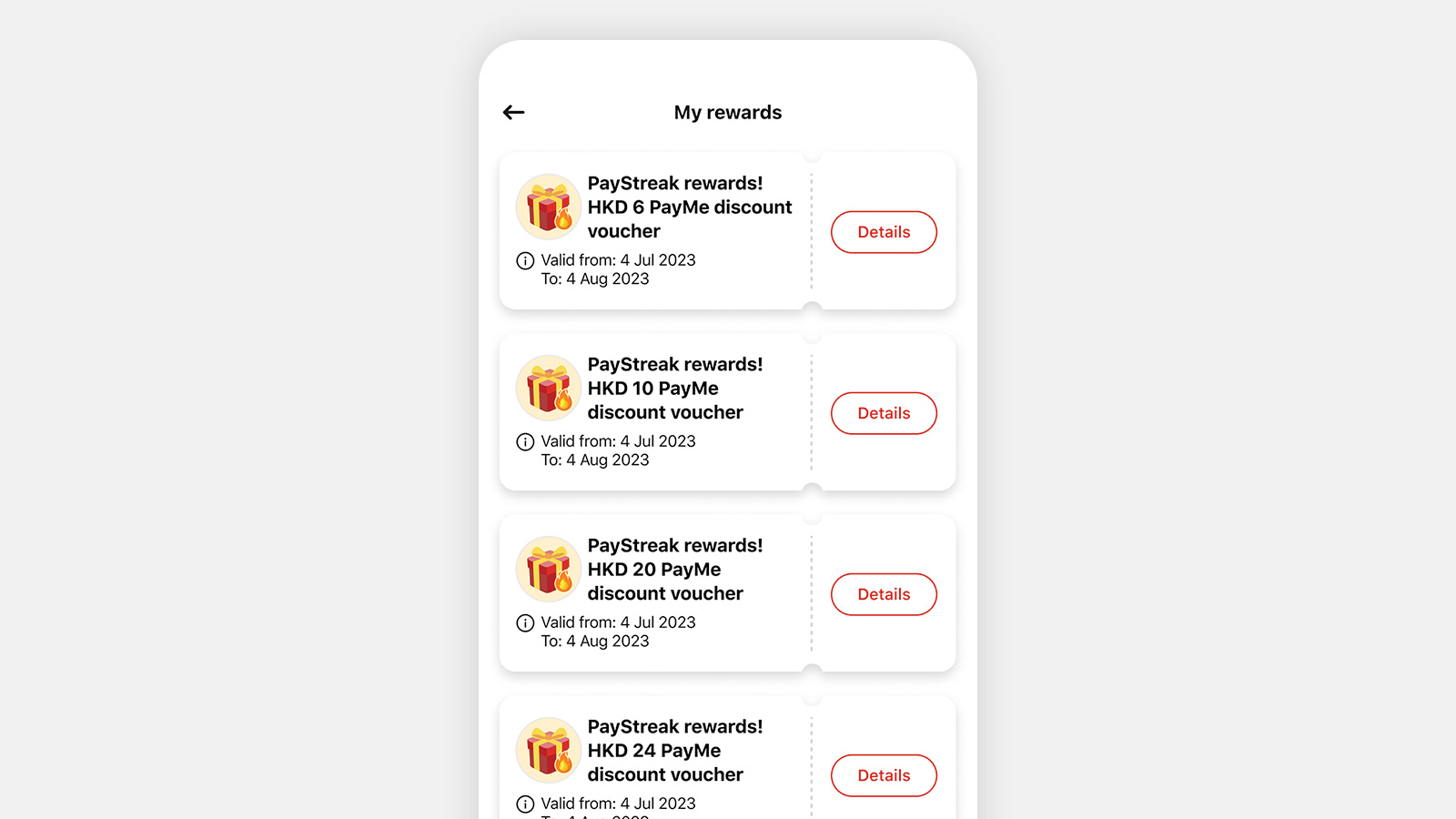

Enjoy exciting rewards with PayMe

With PayMe, easy payment is just a few taps away! Pay at plenty of places and grab surprise rewards right within the app. Check out our latest offers via the link below.

- Spend smarter with our exciting perksWatch this space for the next PayMe perks – they could be from your beloved go-to merchants!

- How to get startedLink your HSBC account to PayMe for easy wallet top-up to pay friends instantly and spend at merchants!

Discover opportunities in everyday banking

For children under 11 years of age

- If you have a child under 11 years of age[@accounts-under-age-18], you can set up an HSBC Children Savings Account in your name for your children and kick-start their financial education with this account

- Review monthly statements with your children, introducing them to essential banking aspects such as deposits, withdrawals, savings and interest, while helping them to manage their wealth

- Supervise your children's accounts 24/7, via online banking, mobile banking, ATMs and phone banking

Things you should know

Eligibility

Children below the age of 18[@accounts-under-age-18] are eligible for an HSBC Children Savings Account. Please also note the documents required (PDF).

How to apply

Book an appointment

Simply fill out our online form with a few personal details and we'll help you open your account at one of our branches.

Please note that to open an account, your parent or guardian needs to be present. If you are interested, please talk to your parent or guardian and ask them to book an appointment with us via the button below.

Apply at a branch

You can also visit the nearest HSBC branch with your parent/guardian to open your account.

Notes

The screen displays and the images of the website are for reference and illustration purposes only.