HSBC One - the digital wealth banking suite to help you achieve financial freedom

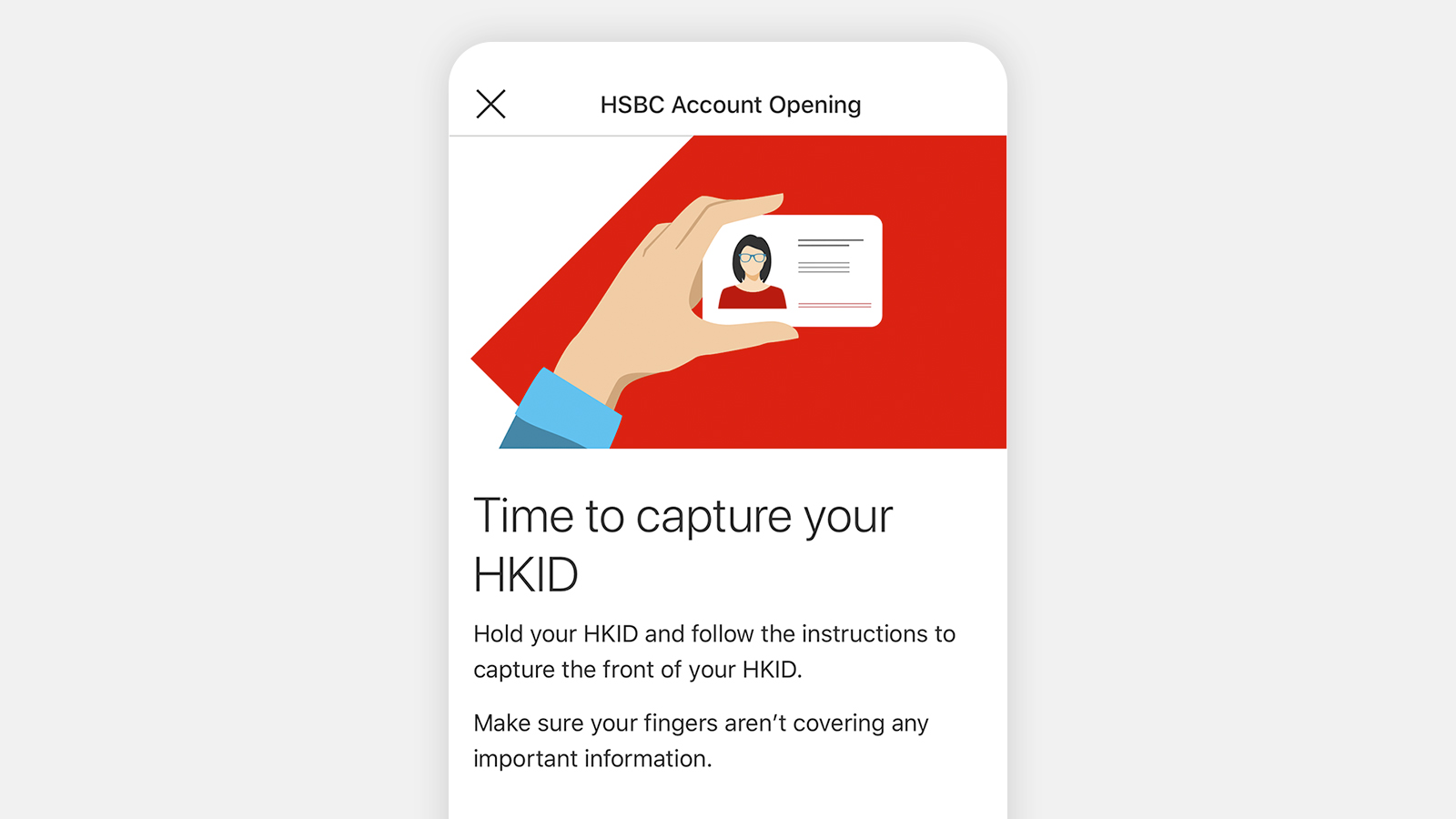

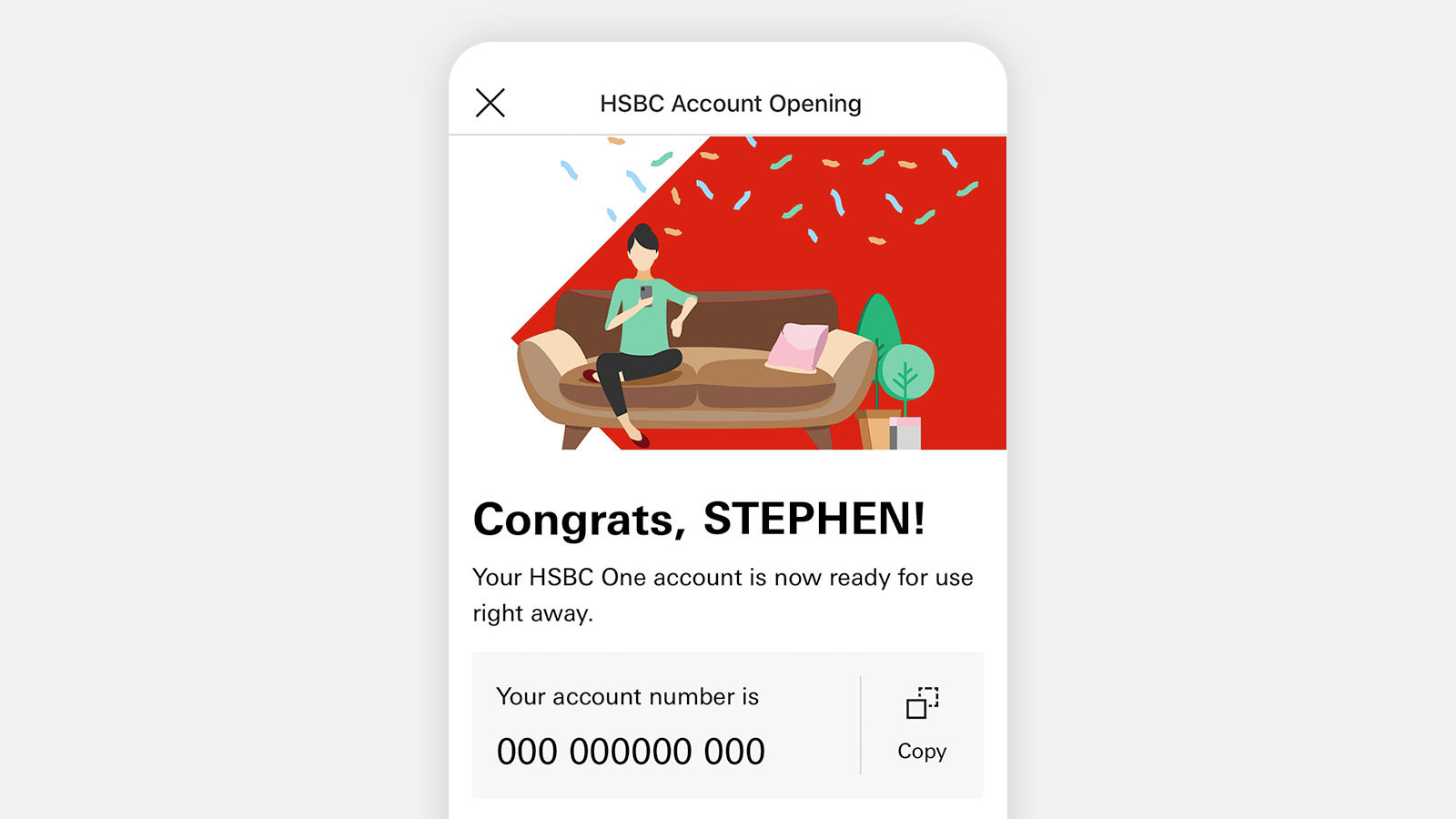

HSBC One lets you spend and save in 12 major currencies with just one account. You can invest or make time deposits and more, all without having to maintain a minimum total relationship balance with us. Experience it today—open an account on your mobile in just 5 minutes[@accounts-hsbc-one-5-min]!

Join HSBC One and start your legendary journey.

HSBC One believes if you want to be world number 1, you have to challenge yourself. We can guide your financial journey with groundbreaking, value-for-money tools. Be bold. Be yourself. Be the legend that you are.

Open an HSBC One account via HSBC HK App, earn up to HKD4,588[@accounts-offer-2024mar-rewards-details] worth of rewards and stand a chance to meet the world-class esports team – T1 and Faker[@accounts-offer-2024mar-league-of-One]! Terms and conditions apply.

Bank the way you want— with HSBC's most comprehensive digital banking services

Manage your money at your fingertips with one app

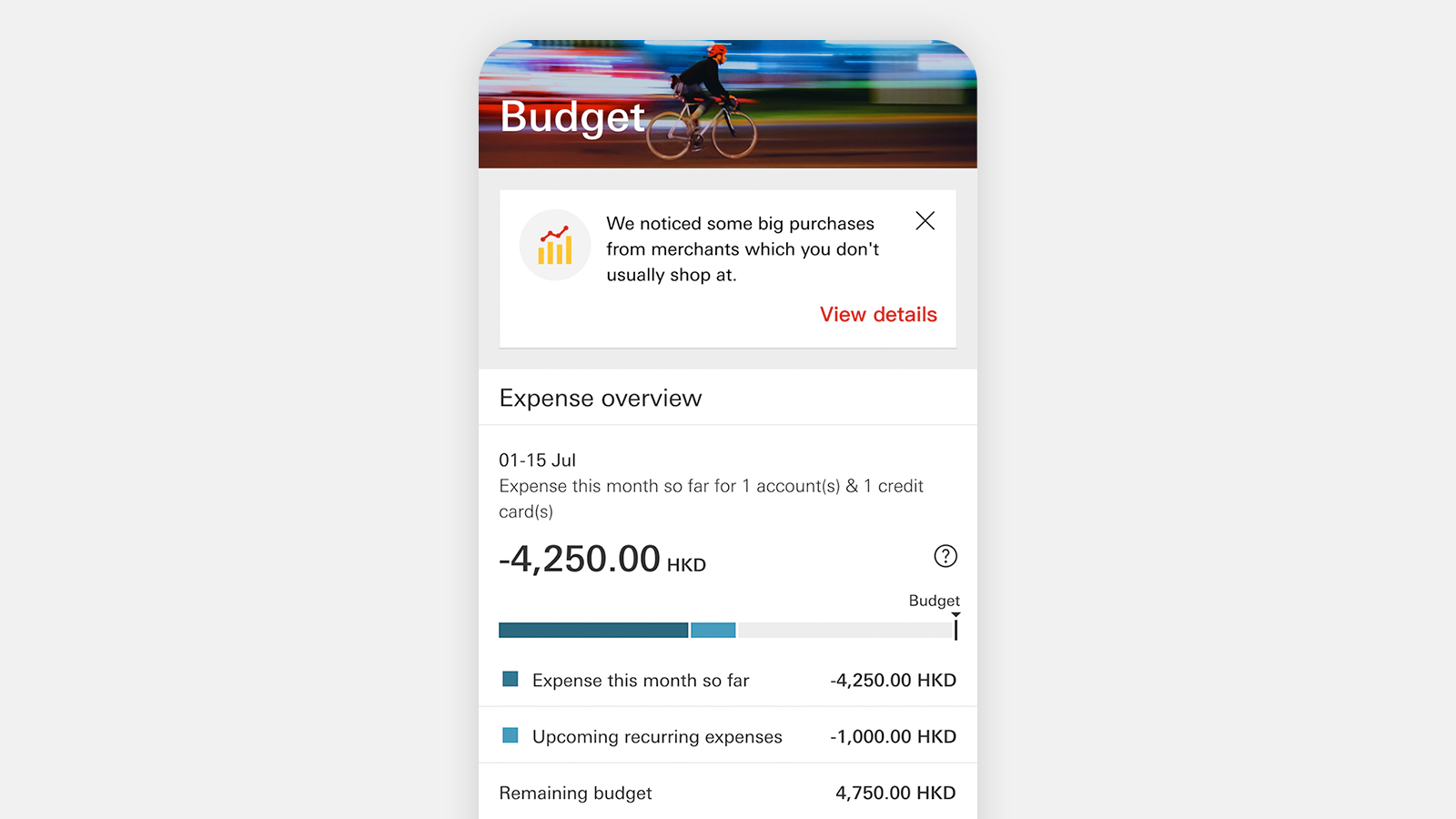

With the 'Budget' feature on the HSBC HK App, you can:

- automatically track expenses from all your HSBC bank accounts and credit cards

- understand your spending pattern and where you spend the most

- set a monthly expense budget to closely monitor your spending run rate and we'll remind you when you overspend

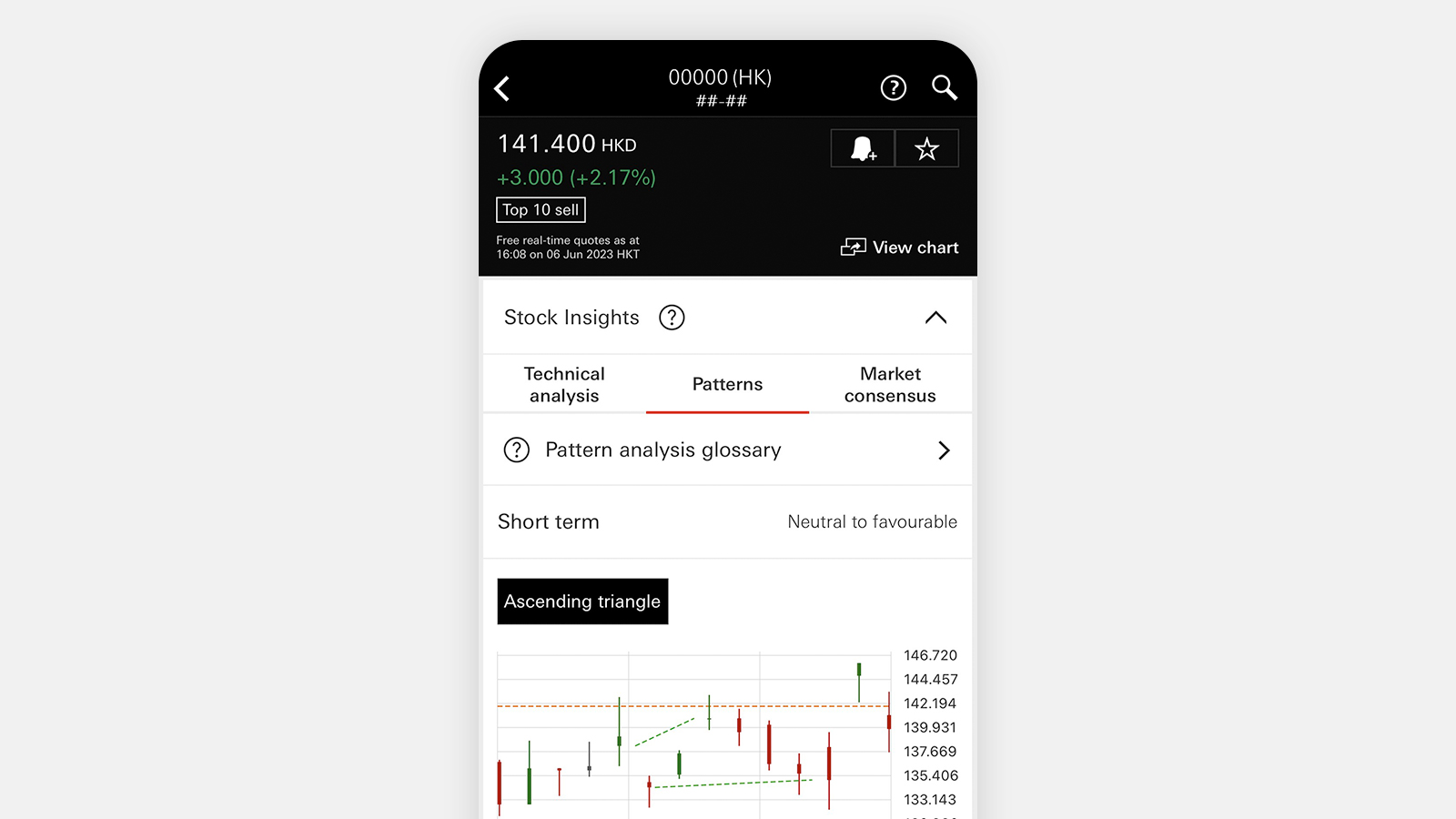

Access the right tools and information with our trusted investment platform

Looking to invest but deterred by high costs and low returns? With us, you can:

- check out the technical analysis, patterns and market consensus of stocks by accessing the Stock Insights function on HSBC HK Easy Invest app[@accounts-easy-invest]

- join HSBC Trade25[@investment-trade25-savings-rate]and start trading in HK, US and China A stock markets with a lifetime $0 commission[@investment-trade25-hkd300] and $0 platform fee. HKD25 per month is only required if you trade or hold stocks with us in the respective monthLimited time offer: Trade25 is not limited to those aged 18-25. Those aged 35 or below can also join now[@accounts-offer-2023jun-lifetime-t25-age35]!

- tailor your own diversified portfolio of fund investments with FlexInvest, starting from just HKD100

- level up your financial knowledge through our free 7-day Investment 101 email course or 'Wealth starter guide'

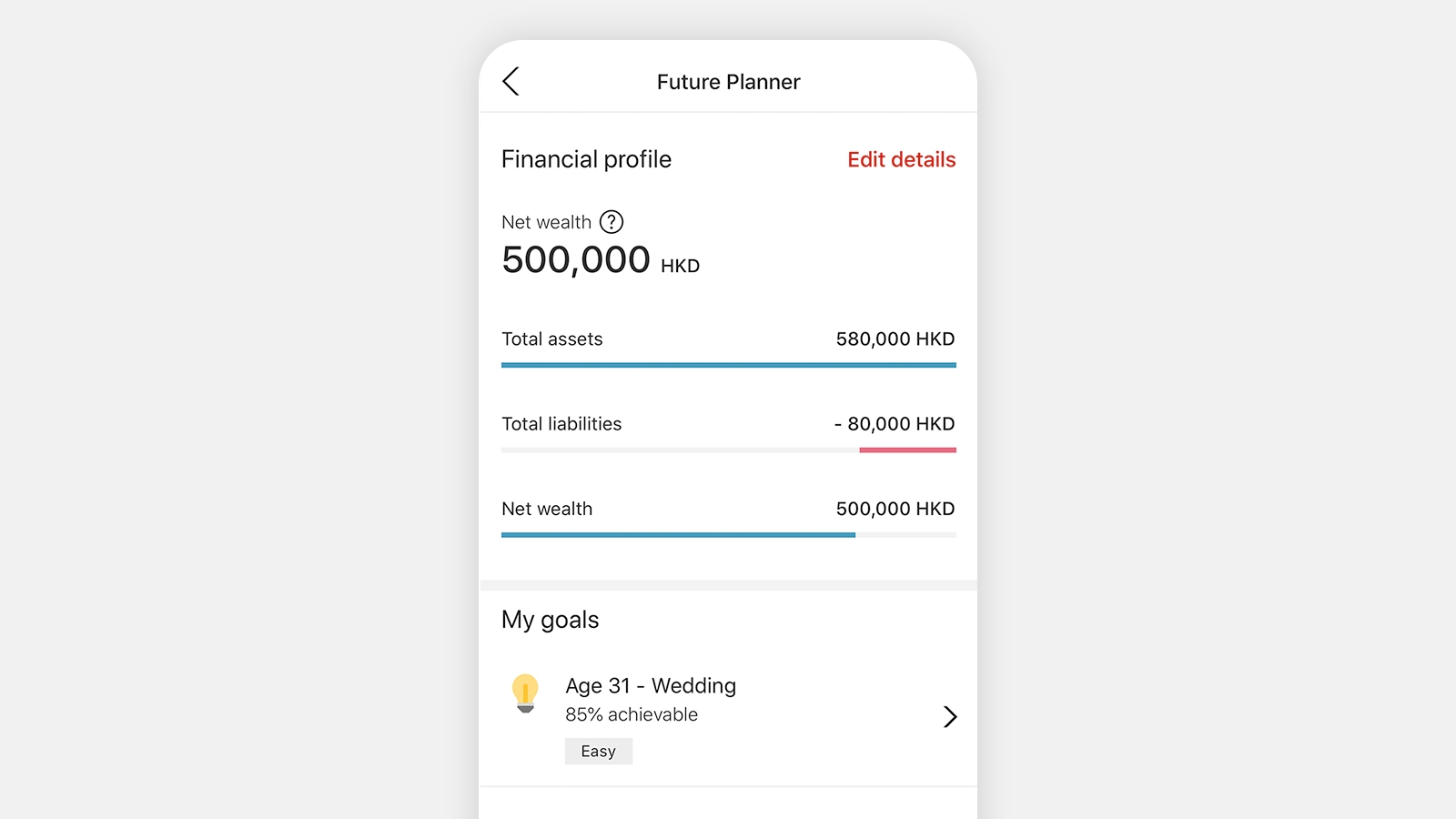

Forecast your future finance on mobile or with our wealth experts

Planning your financial future? You can:

- use Future Planner to project your finances for every stage of your life. We'll run real-time simulations and let you see how likely you could achieve your personal goals

- speak to a real person via 'Chat with us' on the HSBC website or HSBC HK App if you've got any wealth management and investment queries

Enjoy all-round protection with your policy always attended to

Live the life of your dreams, free of worry, with a wide range of insurance products from HSBC Life. Plus, you can:

- view your policy details and coverage on the HSBC HK App, any time—full disclosure, zero pressure

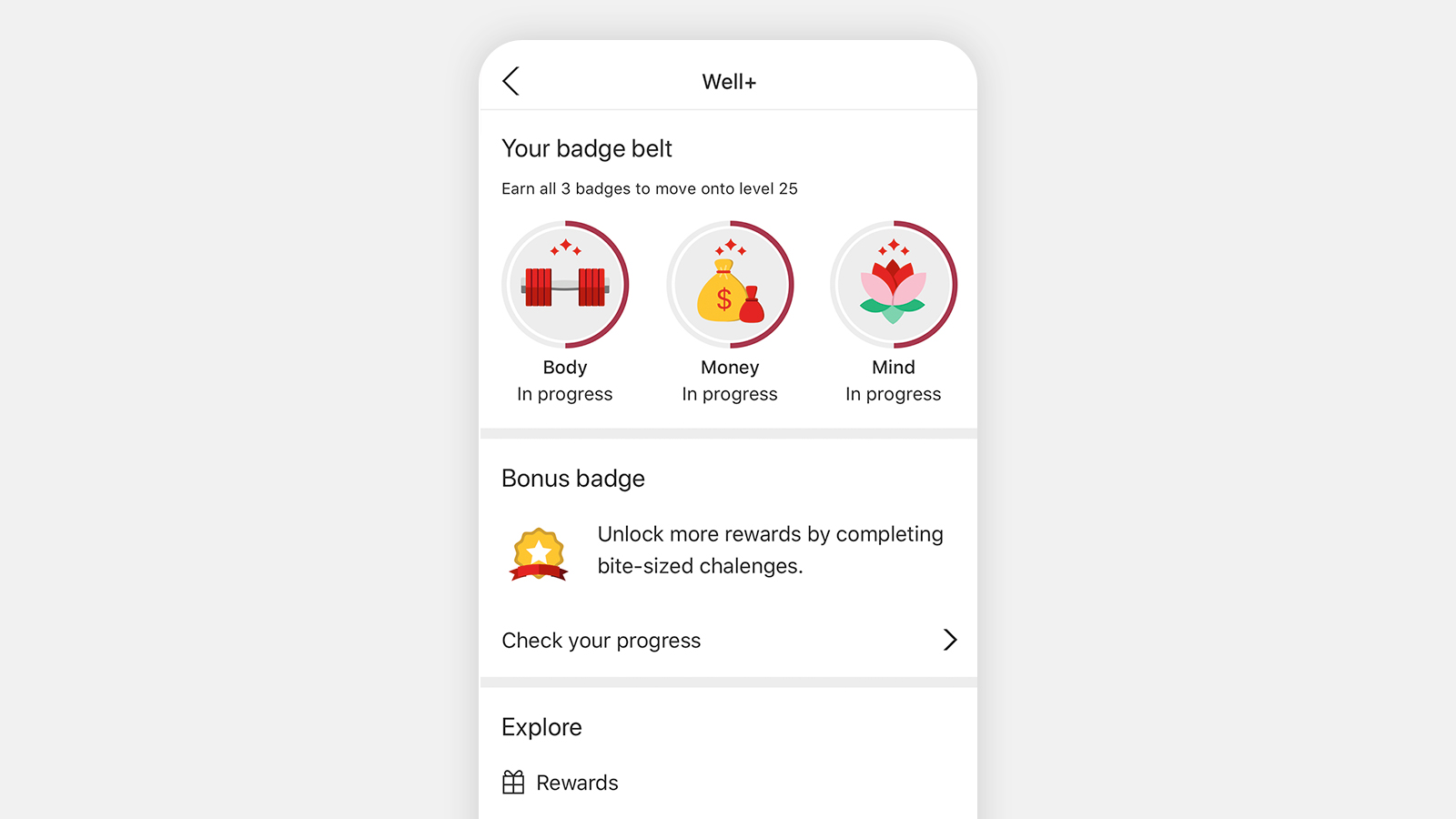

- join our wellness reward programme Well+ for free on HSBC HK app – available to all mobile banking app users. You can nurture your Body, Money and Mind by completing simple activities and earn up to $2,000 RewardCash[@accounts-wellplus-hkd2000-offer]

Get anytime, anywhere access to 12 major currencies[@accounts-12-fx-currencies] and travel with peace of mind

Planning your next holiday? With our multi-currency HSBC One account, you can:

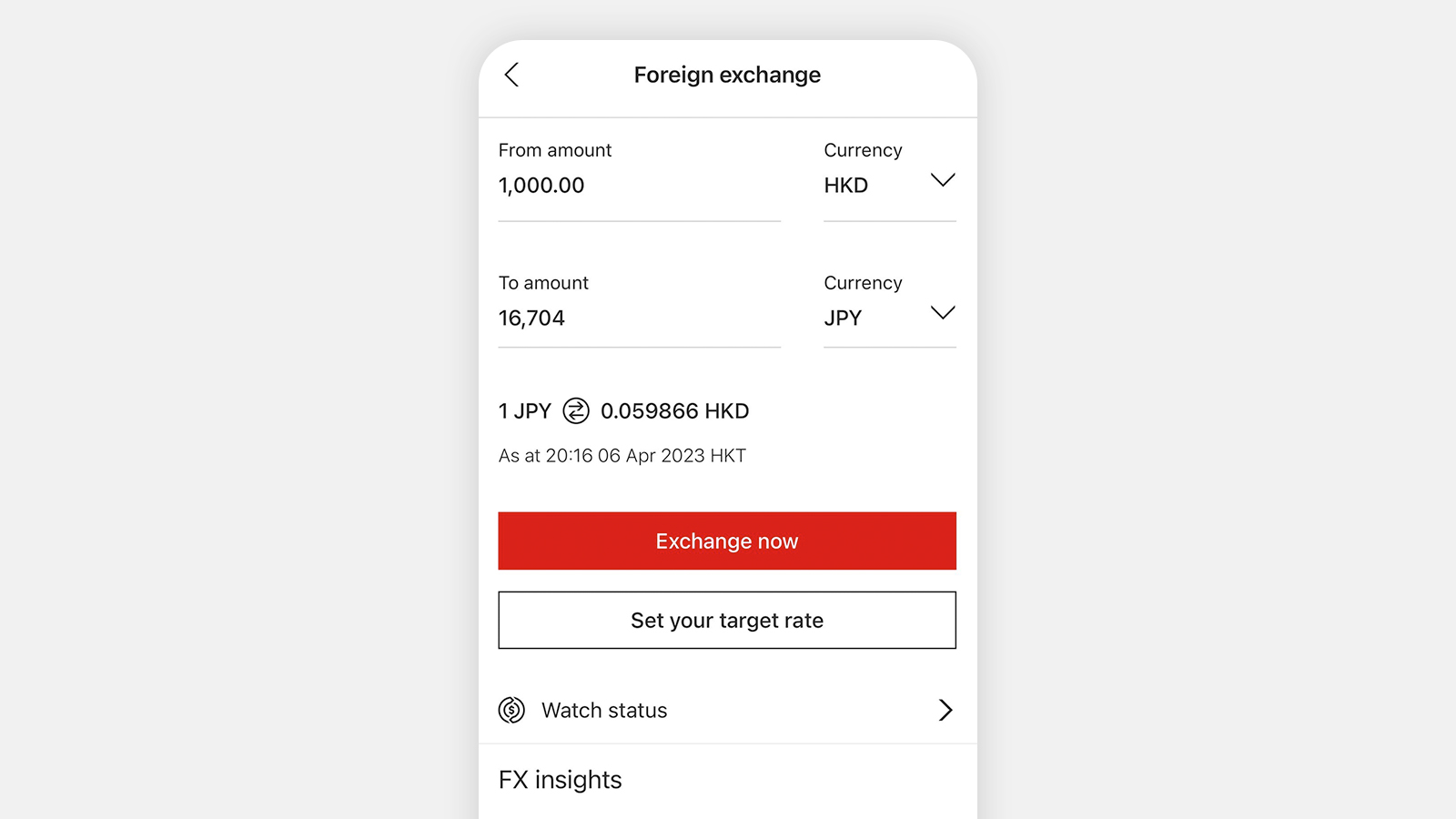

- make 24/7 exchanges for up to 11 major currencies[@accounts-hsbc-one-fx-currency] on the HSBC HK App, or set up FX Order Watch or rate alerts to save you the hassle of watching the market

- do more with your exchanged currencies abroad with our HSBC Mastercard® Debit Card. Shop, spend, or withdraw cash from HSBC ATMs worldwide, all while enjoying zero annual fees or handling fees

Red Hot Rewards - Earn rewards of your choice that match your lifestyle!

Earn these rewards and much more when you dine, shop, play and travel with HSBC credit cards:

- Earn up to 4% RewardCash[@accounts-red-card-rc] when you shop online and 1% RewardCash[@accounts-red-card-rc] on other local and overseas spending with the HSBC Red Credit Card

- HSBC Credit Card brings you the hottest year-round offer at over 10,000 dining and shopping hotspots

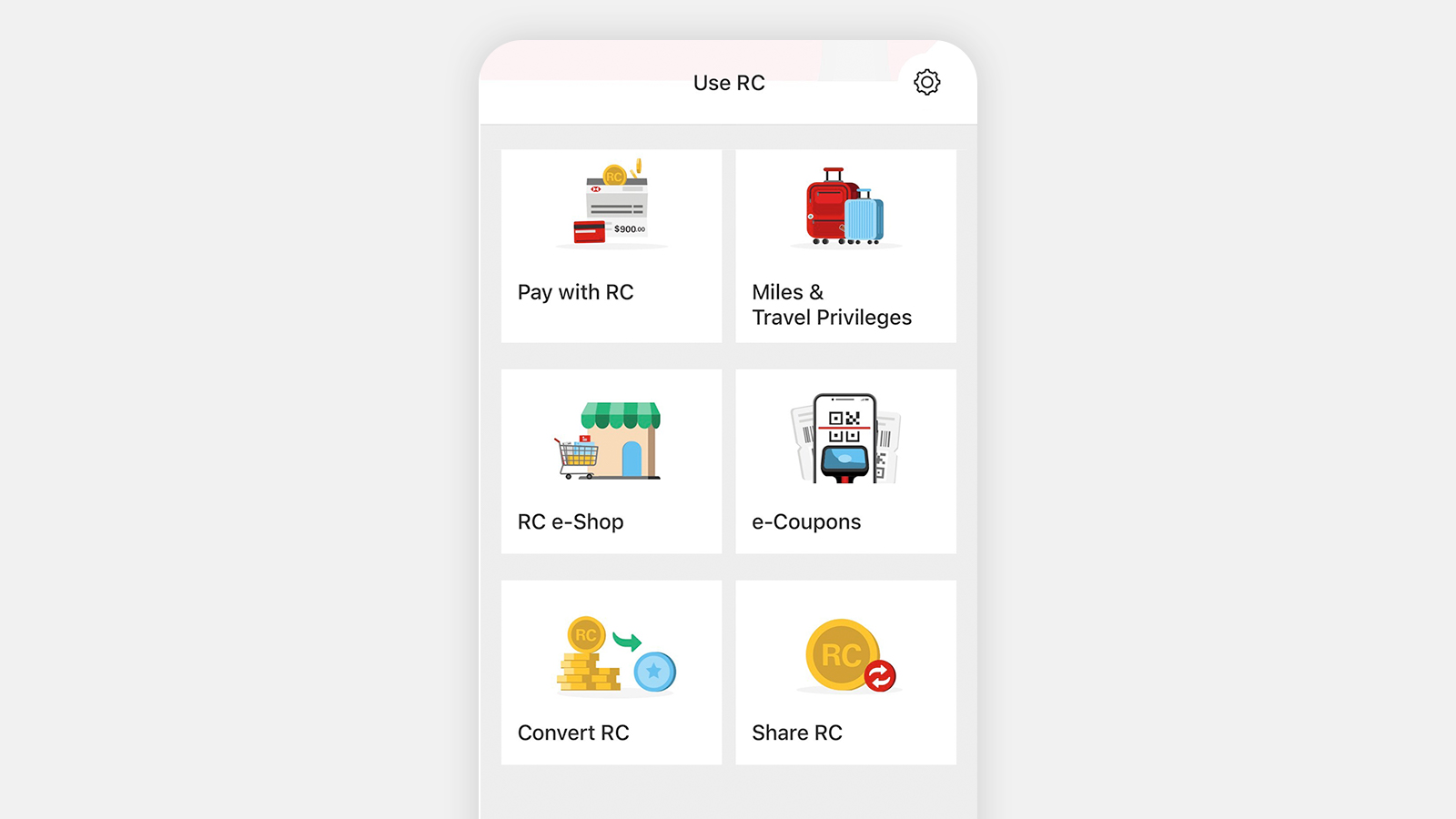

- Redeem your rewards with HSBC Reward+ at your choices – instantly convert your RewardCash to miles, gifts, merchant partner loyalty points or settle your credit card bills with just a few clicks

Already banking with us?

But not an integrated account holder? Not a problem. You can open an HSBC One account via mobile banking in minutes.