Your new international travel companion, the HSBC Jade Mastercard® Debit Card, has arrived. With a card built around 12 major currencies, you can spend locally and overseas, shop online and withdraw cash at ATMs worldwide, with zero exchange or withdrawal fees.

Why you'll love it

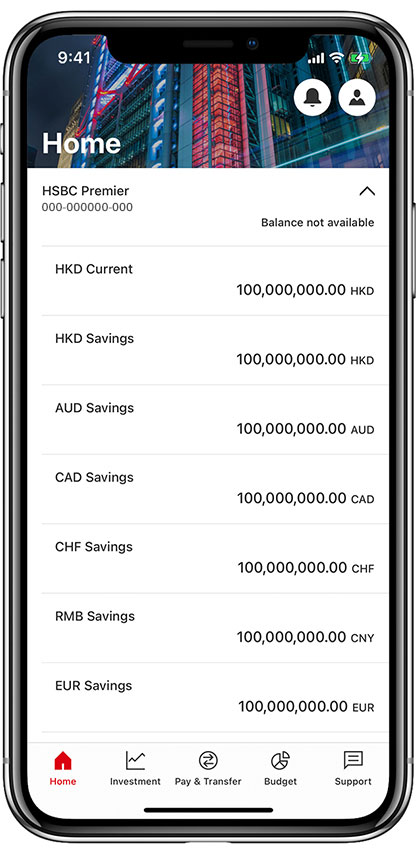

- Convenient spendingYour spending in 12 major currencies can be debited directly from the corresponding foreign currency deposits in your account, without any currency exchange. These currencies include HKD, USD, GBP, JPY, RMB, EUR, THB, AUD, NZD, SGD, CAD and CHF.

- $0 international FX feesIf you don't have enough FX funds in your account, your debit card will automatically conduct currency conversion to settle the transaction from your HKD account using HSBC's preferential FX rate for Jade clients, with zero exchange fees.

- Worldwide free cash withdrawalsWithdraw cash from HSBC Group ATMs and ATMs that carry the Mastercard/Cirrus logo anywhere in the world, for free.

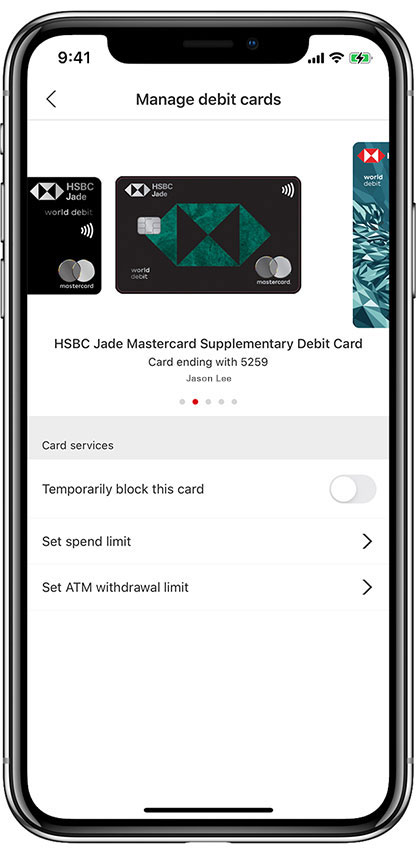

- Supplementary Debit Card for your loved onesA supplementary card extends the benefits of multi-currency and fee-free privileges to your loved ones.

- Earn on every purchase

Enjoy a 0.5% cash rebate on all eligible purchases, alongside the money you'll save with $0 foreign currency handling fee.

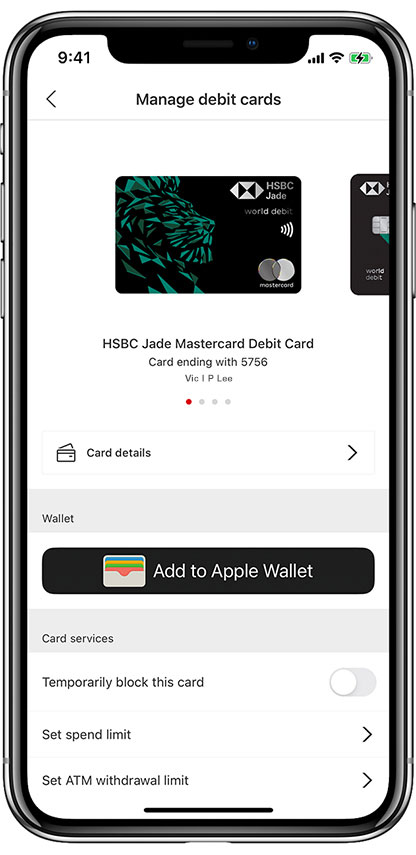

Offering greater control and ease of use, you can temporarily block / unblock your card instantly or set a spending limit on your card through the HSBC HK Mobile Banking app to better safeguard your account.

- Spend at your fingertips

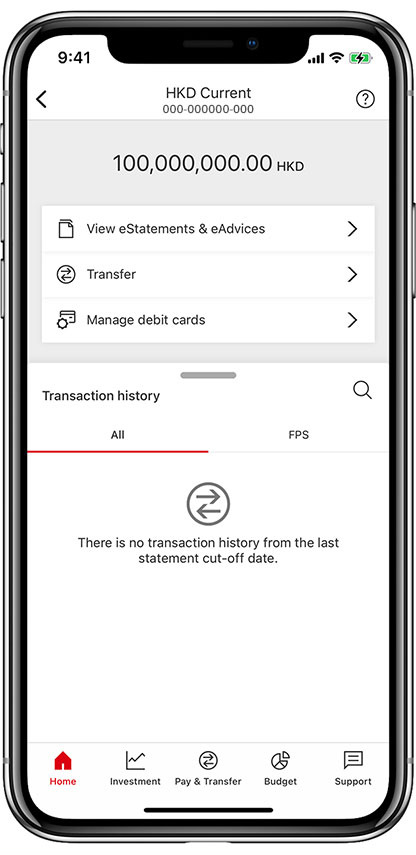

We’ve made online shopping simpler for you – you don’t even have to take out your physical card. Access your card information through the HSBC HK Mobile Banking app. You can also add it to Apple, Google and Samsung Pay to make purchases right away.

Manage FX, wherever you are

From your phone in seconds

Exchange currency instantly, 24/7, with the HSBC HK Mobile Banking app, so that before you spend on your Jade Mastercard Debit Card or withdraw cash, you would have exchanged at the best rates.

Set your own exchange rates

You can pre-set your target FX rates online, and we'll monitor the market for you. Once your target rate is reached, the selected amount and currency can be converted automatically for you.

Supplementary Debit Card for your loved ones

A truly international multi-currency Debit Card for your loved ones, no matter where they go around the world.