Currency exchange made easy, online and on mobile

We offer a wide range of services that cater to your currency exchange needs, including real-time exchanges, overseas remittances, investments to grow your money.

Key benefits

FX rewards – Earn more at every turn

Buy JPY at bargain rates — Almost at cost [@investment-fx-jpy-offer-at-cost]

Get the price-down deal on JPY exchange with FX spread at nearly 90% off [@investment-fx-jpy-offer-90-percent]! Use your exclusive FX coupon for even more savings. Log on to HSBC HK App now to check out our JPY rate and view your FX coupons. Exchange JPY now and spend with HSBC Mastercard® Debit Card abroad to earn extra up to 0.5% cash rebate[@investment-fx-mcdc-offer]!

Welcome offer – up to HKD1,888 cash rebate

As a new FX customer[@investment-fx-new-customer], get HKD50 cash rebate for every HKD50,000 or equivalent accumulated in FX transactions by 31 March 2026 - up to HKD500[@investment-fx-welcome-offer].

Plus, if total FX exchange transaction amount accumulates to HKD1,500,000 or equivalent, you'll get an extra HKD1,388 cash rebate, bringing the total reward up to HKD1,888.

Please note that transactions involving HKD to JPY conversions are excluded from this welcome offer.

Win chance(s) to get a 999.9 Gold Coin:

From now till 31 March 2026, register for 'FX Lucky Draw – Win a 999.9 Gold Coin' via Reward+ and accumulate HKD10,000 or equivalent in FX transactions to earn one lucky draw chance[@investment-fx-lucky-draw]. Prizes include a 1 tael 999.9 Gold Coin (10 winners) and $1,000 RewardCash (90 winners).

No limit to the number of entries - so exchange more for more chances to win!

Currency exchange for all your needs

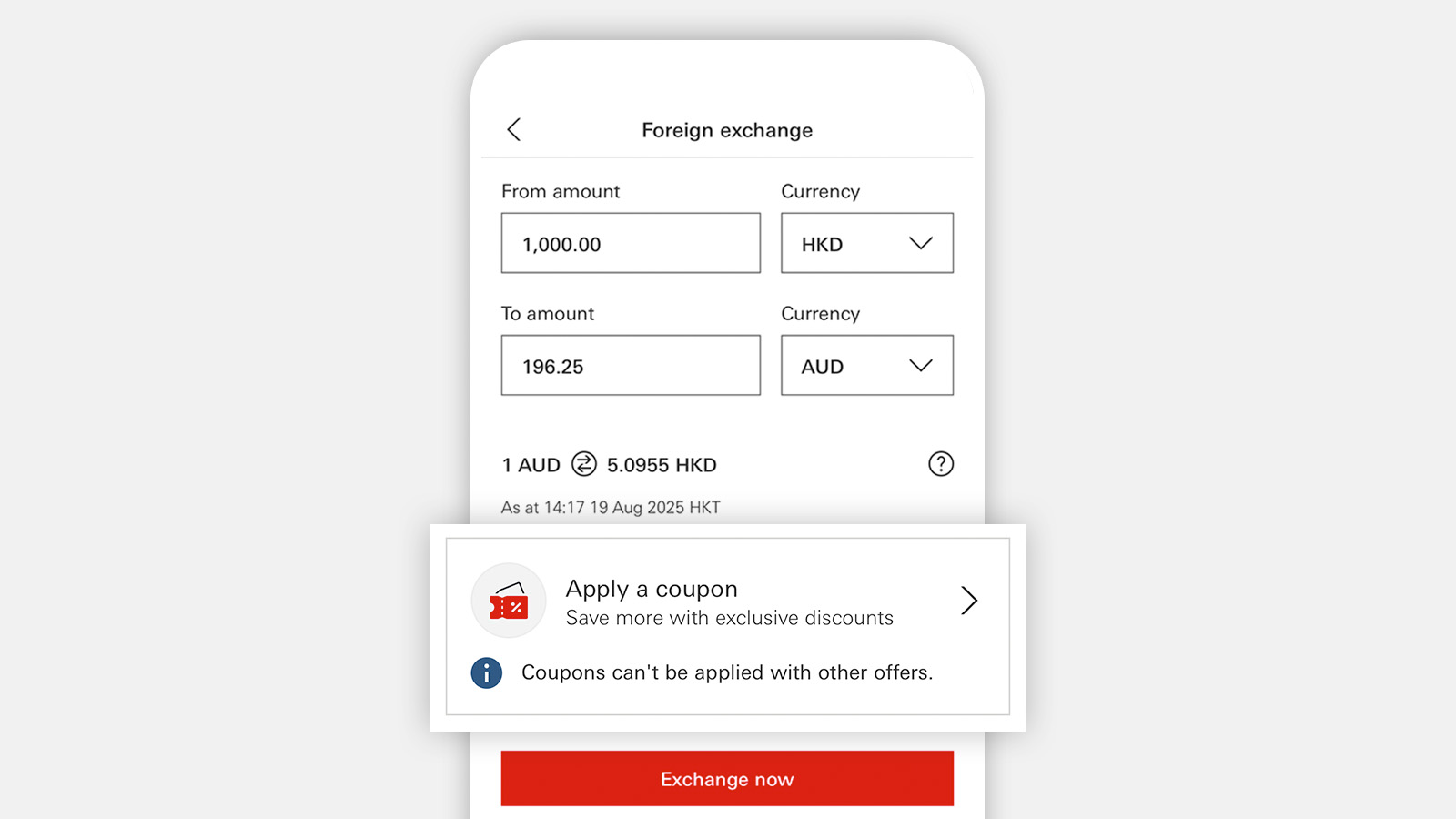

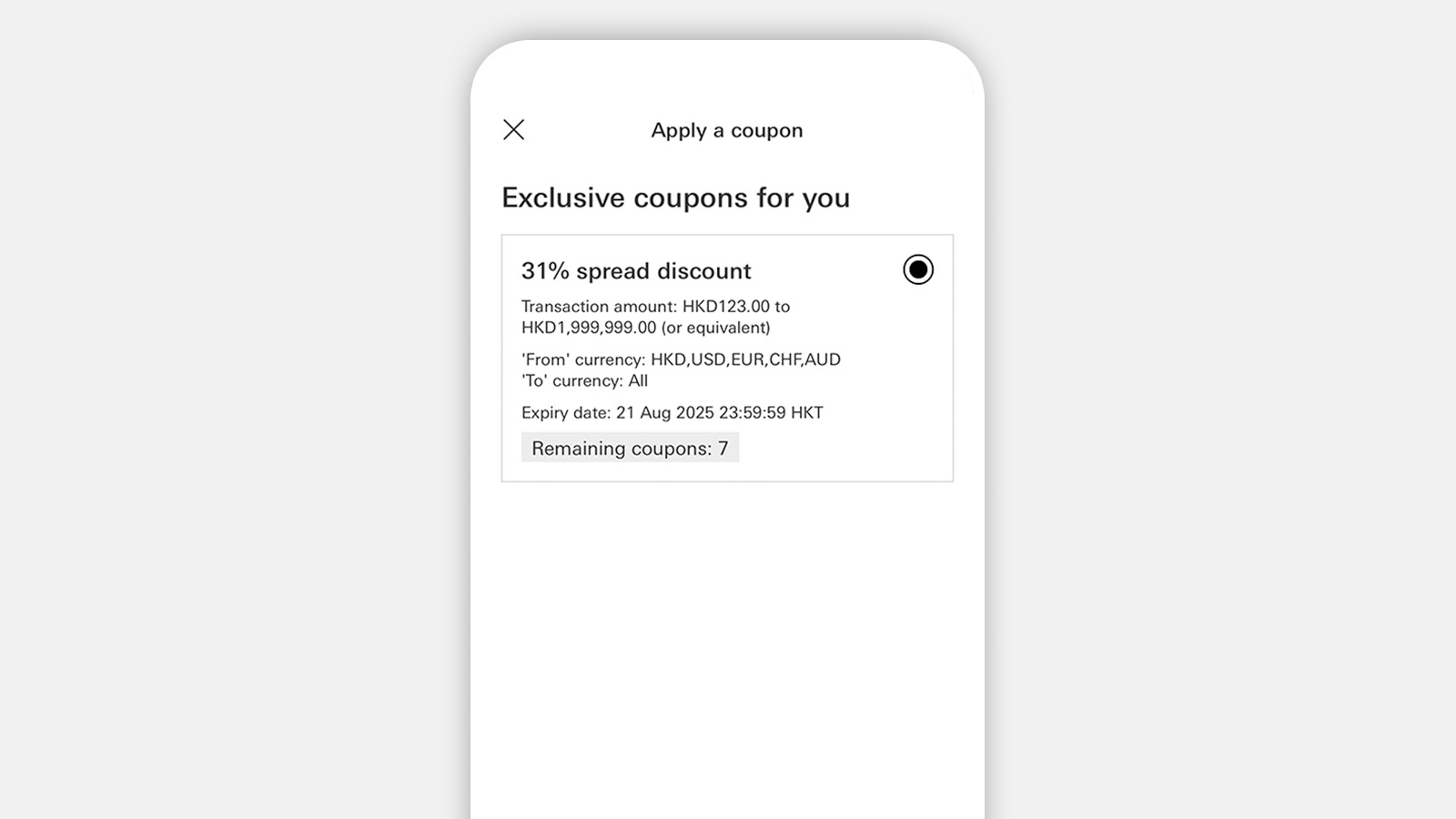

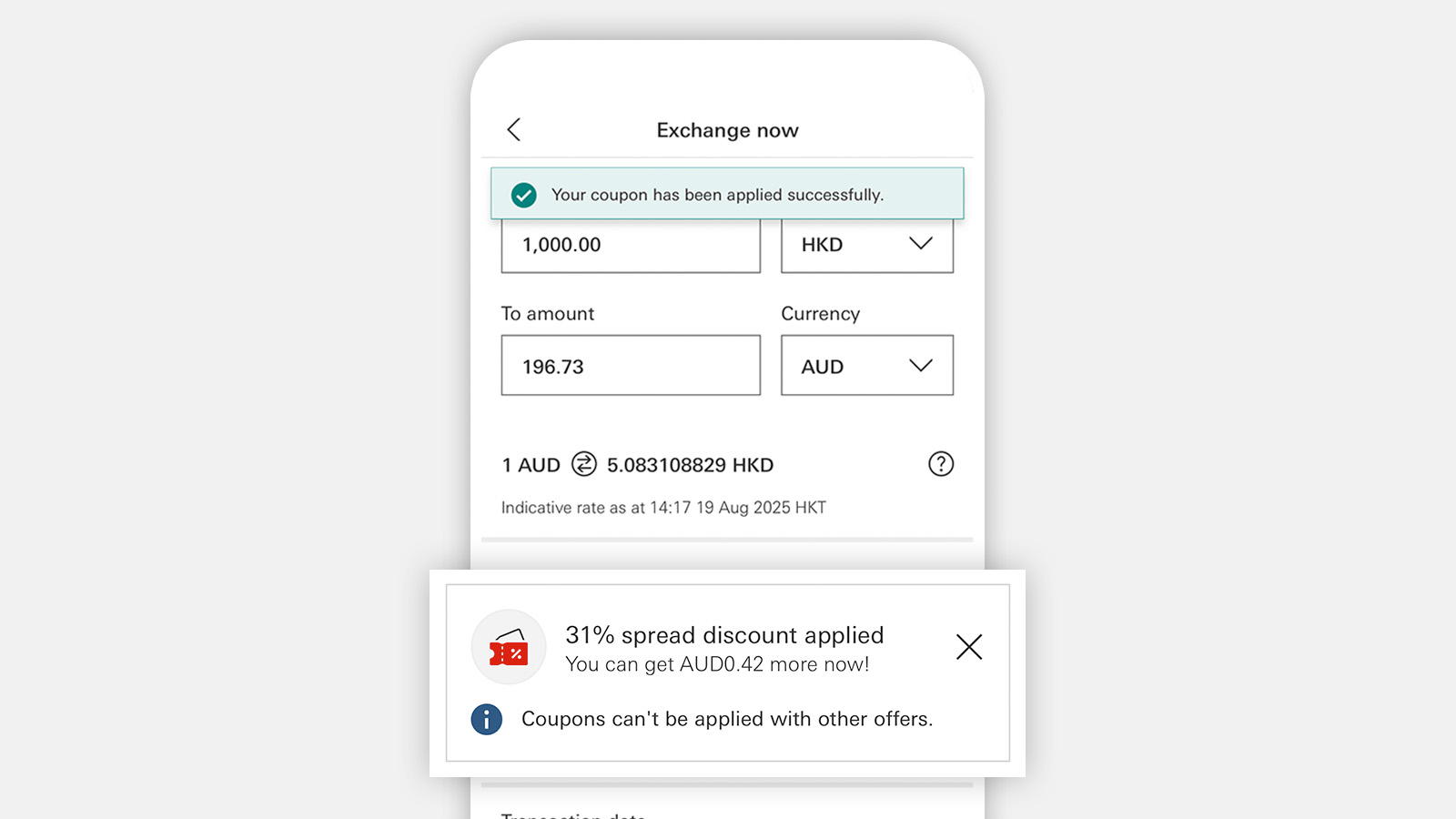

Get a personalised foreign exchange spread discount

- Get an instant spread discount when you exchange eligible currencies. Simply do so via HSBC HK App, and apply an exclusive FX coupon available to you.

Exchange currencies anytime[@24x7currencyexchange]

- Add your preferred currency pairs to your FX watchlist and easily monitor the market trends

- Access detailed FX charts with technical analyses to identify FX opportunities

- Manage and trade up to 11 major currencies[@24x7currencyexchange] with our all-in-one multi-currency accounts

- Trade currencies wherever and whenever, on mobile or online

- See how you can use our FX Order Watch service[@fxorderwatch] to set target rates—we'll notify you or help you convert the money[@24x7currencyexchange] once your target rate is reached, without any handling fees or hassle

Join HSBC Forex Club to enjoy great currency exchange pricing

- Enjoy tiered spread discounts based on accumulated amount in the accumulation period. The more the exchange amount, the greater your discount. Terms and conditions apply.

- Cover 12 major currencies by HSBC Forex Club

Transfer money overseas

- Make free[@hsbcglobaltransfers], instant transfers to HSBC accounts worldwide through our HSBC Global Transfers service

- Send money to other overseas accounts in over 200 countries and territories and more than 40 different currencies through our Telegraphic Transfer service via HSBC Online Banking or the HSBC HK Mobile Banking app

Spend and withdraw currencies easily

- Get the HSBC Mastercard® Debit Card to enjoy fee-free privileges and to debit directly from currencies in your HSBC account; what's more, get an additional 0.4% cash rebate when you spend online or overseas

- Withdraw RMB, JPY, USD or EUR at any of our RMB & Foreign currency ATMs across Hong Kong or visit our branches for other currencies

- HSBC Premier Elite and HSBC Premier customers can also preorder currencies online and collect them at their nearest HSBC Premier or HSBC Wealth Centre[@currencycollection]

Grow currency at a better interest rate

- Enjoy a deposit interest rate of up to 13% p.a. when you exchange currencies and place them in a 1-week time deposit via the HSBC HK Mobile Banking app. T&Cs apply.

Latest Currency Exchange insights

Daily FX Focus

Your daily dose of FX updates, where we give you the latest major currency directions

FX viewpoint

Our weekly commentaries with HSBC's views on where specific currencies are heading

Weekly FX highlights

A weekly wrap-up from our local analyst on what has happened in the FX market

Exchange rate calculator

The calculator uses the latest board rates for major foreign currency pairings. To see what preferential rates are available to you, please log on

Download the HSBC HK Mobile Banking app now

One app for all your currency exchange needs

Simply log on to the HSBC HK Mobile Banking app to start trading currencies on the go.

Learn more about the HSBC HK Mobile Banking app

Ready to start trading?

Trade currencies online

Log on to HSBC Online Banking to trade currencies 24/7.

Don't have an HSBC account?

You can open one via the HSBC HK Mobile Banking app to start using our currency exchange services in minutes.

Find out more

To learn more about investing in currencies with HSBC, check out our investment FAQs.

You may also interested in

Gold trading

Trade Wayfoong Statement Gold in just a few steps

Bonds / Certificates of Deposit (CDs)

Enjoy stable interest income through investing in bonds and certificates of deposit (CDs)

Stocks

Enjoy flexible, secure and competitive stock trading with HSBC

Unit Trusts

Invest in a diversified portfolio to achieve your financial goals