Learn to manage your money like a pro

You don't have to be a pro to make your money grow.

Whether you're looking for suitable ways to save or invest your money, we can help you get started with your journey to financial independence.

Handling your finances like the experts

Get a head start on your financial well-being, no matter if you've already started your career or you're still studying. Set yourself up for success today so you may achieve your financial goals in the future. To help you get on your way, we've put together some tips on saving, investing and protecting yourself.

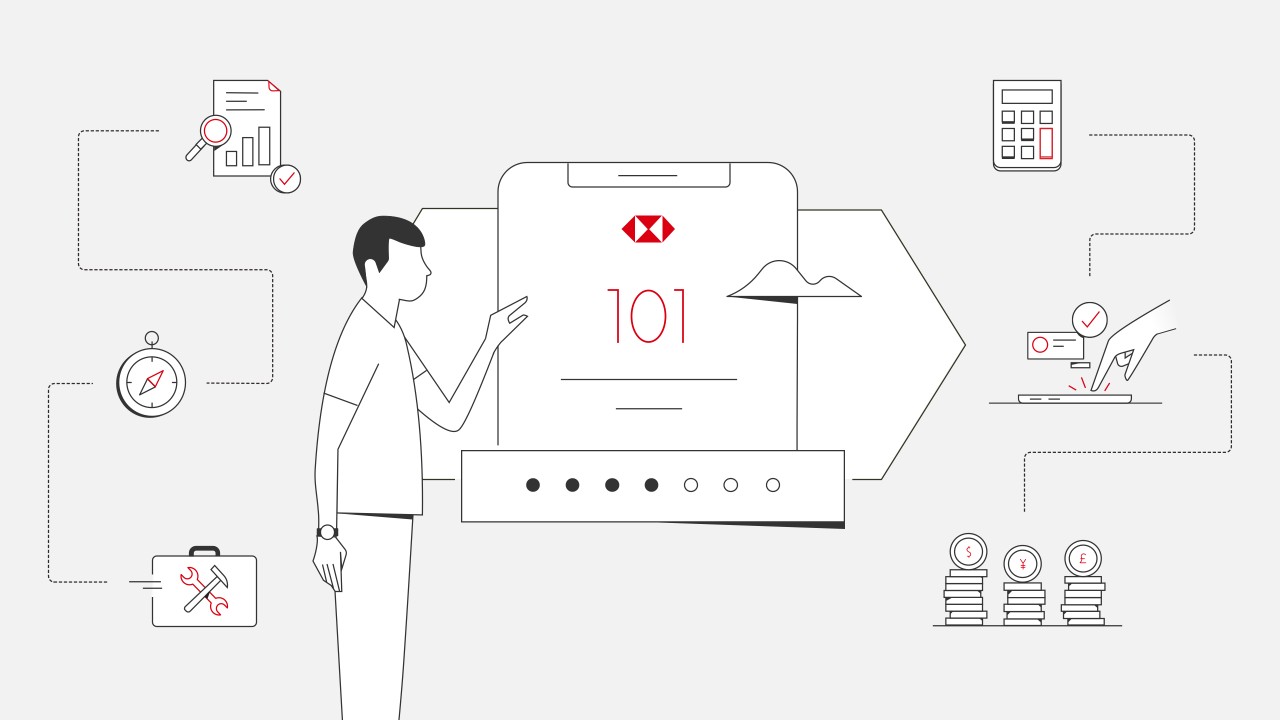

Learn to invest in 7 days with Investment 101

It's great that you're setting aside some of your money for the future. Now's the time to put it to work, instead of losing it bit by bit to inflation.

If you're serious about starting to invest, our simple course can teach you the basics in just a week, Sign up and get your first lesson today.

Chat with a Wealth Coach

You can get in touch with a Wealth Coach to:

- address any questions you might have about investment products and knowledge

- learn more about HSBC investment products

- make an appointment via 'Live Chat' or 'Chat with us' to find wealth solutions that are more suited to your needs

Explore our products

- Wealth made easyExplore apps and products built to help you start investing. Remember to check out the features and risks of any products before investing.

FlexInvest

Start making your own investments and buying unit trusts with as little as HKD100, right from the palm of your hand.

Stock Monthly Investment Plan (SMIP)

Make your investing a habit. The SMIP is a subscription that lets you start building your portfolio for as little as HKD1,000 a month.

Easy Invest

Take full control of your stock trading with Easy Invest. Trade stocks and get free market insights with just one easy-to-use app.

MPF TVC

Save on your taxes and build your retirement nest egg at the same time. Tax Deductible Voluntary Contributions (TVCs) let you make up to HKD60,000 worth of tax deductible contributions to your MPF each year.

Tools

Future Planner

Future Planner helps you make long-term financial plans holistically and discover your options for achieving your life goals

Risk Profiling Questionnaire

Take a few minutes to understand your investment needs and risk appetite.

FinFit

How financially fit are you? See how you measure up.

Sign up for our weekly insights newsletter

Receive HSBC's latest market updates directly in your inbox! Every Monday, we will share our latest views on major asset classes, recap what happened in the investment world, and give you all you need to make informed decisions.

Ready to start investing?

Don't have an HSBC account?

Learn more about HSBC One - an all-in-one account to handle all of your financial needs