At HSBC, we're always working to fight fraud and ensure the security of your funds and data. If we notice any suspicious activity on your account, we will reach out to you for clarification. Be assured that no matter why we contact you, we'll never ask you to provide sensitive information such as account log on credentials and passwords.

You can help fight fraud, too, by reporting any suspicious communications or account activity. If you believe you are a victim of any fraudulent activity, report it to us immediately. Telling us as soon as possible will help minimise the impact on you and your credit record.

What problem have you encountered?

What to do if you don’t recognise a transaction on your statement

It’s not necessarily a scam. There might be another reason for a charge you don't recognise. Check out our transaction dispute page to find out why the charge might look strange to you.

If you are still unsure about a transaction, please contact the concerning merchants, followed by reaching out to us.

If the problem remains unsolved and you suspect that the charge is fraudulent, please contact us immediately.

Reporting and enquiry hotline:

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

All other customers: (852) 2233 3000

Alternatively, you can email us at csv@hsbc.com.hk to report a problem.

What to do if you get an SMS alert from HSBC - and how to tell if it's genuine

Your credit card security is important to us. We're committed to enhancing our fraud detection system, and we’re always looking for the best ways to protect you from fraud.

So if we detect a suspicious transaction on your card, we'll send you an SMS alert.

Here's what to do if you receive one of these alerts, and how to check that the message is from us and not a fraudster.

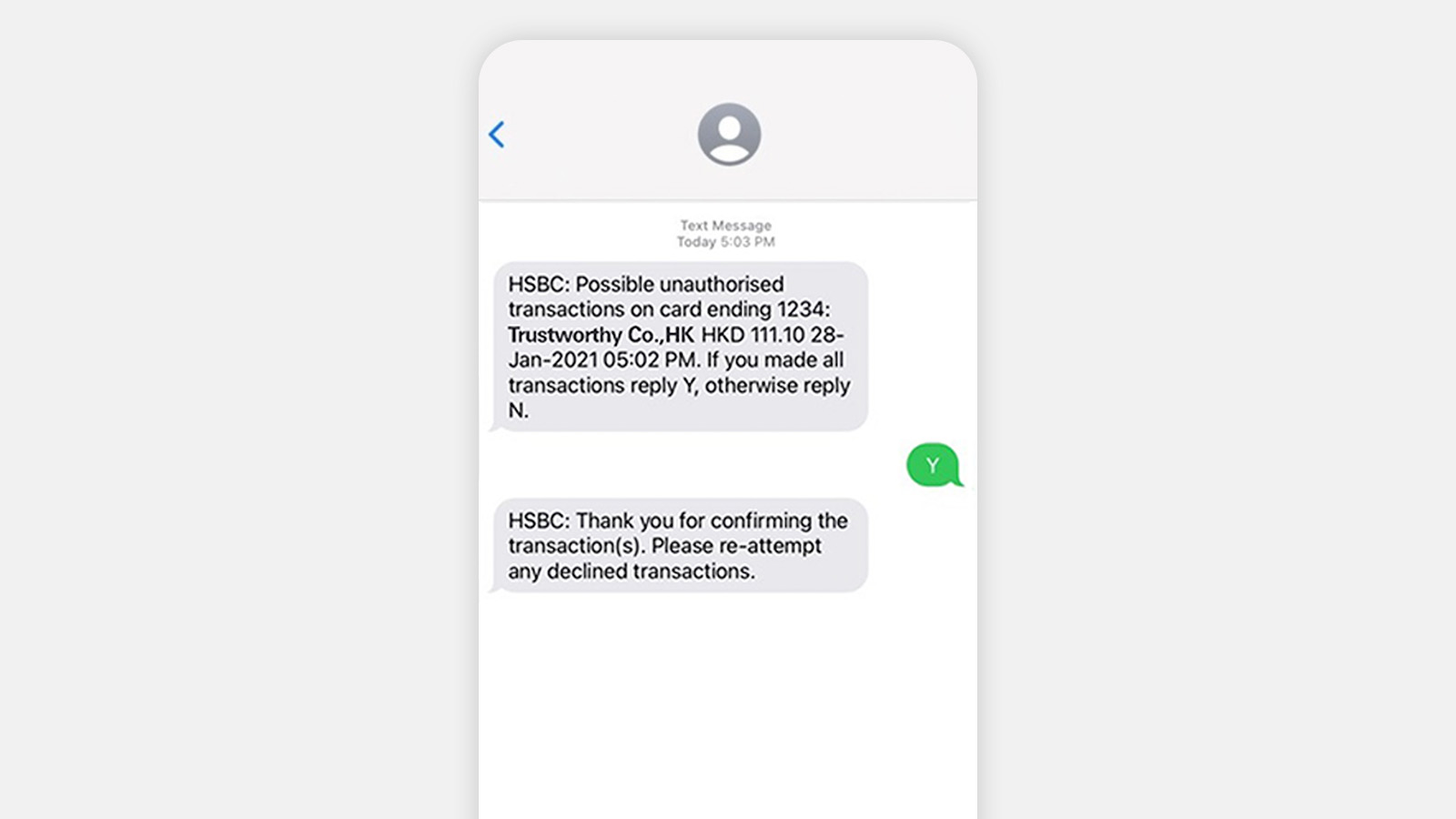

What is 2 Way SMS?

The purpose of this message is to confirm whether a transaction is genuine or not.

If you receive an SMS, just answer "Y" or "Yes" if you made the payment or "N" or "No" if you didn't.

Please don't share any sensitive personal information when replying to us.

Reply with 'Yes' or 'Y' if you recognise the transaction

Then check if the transaction is successful. On some occasions, payment may be declined due to security reasons. If that happens, you'll need to make the transaction again.

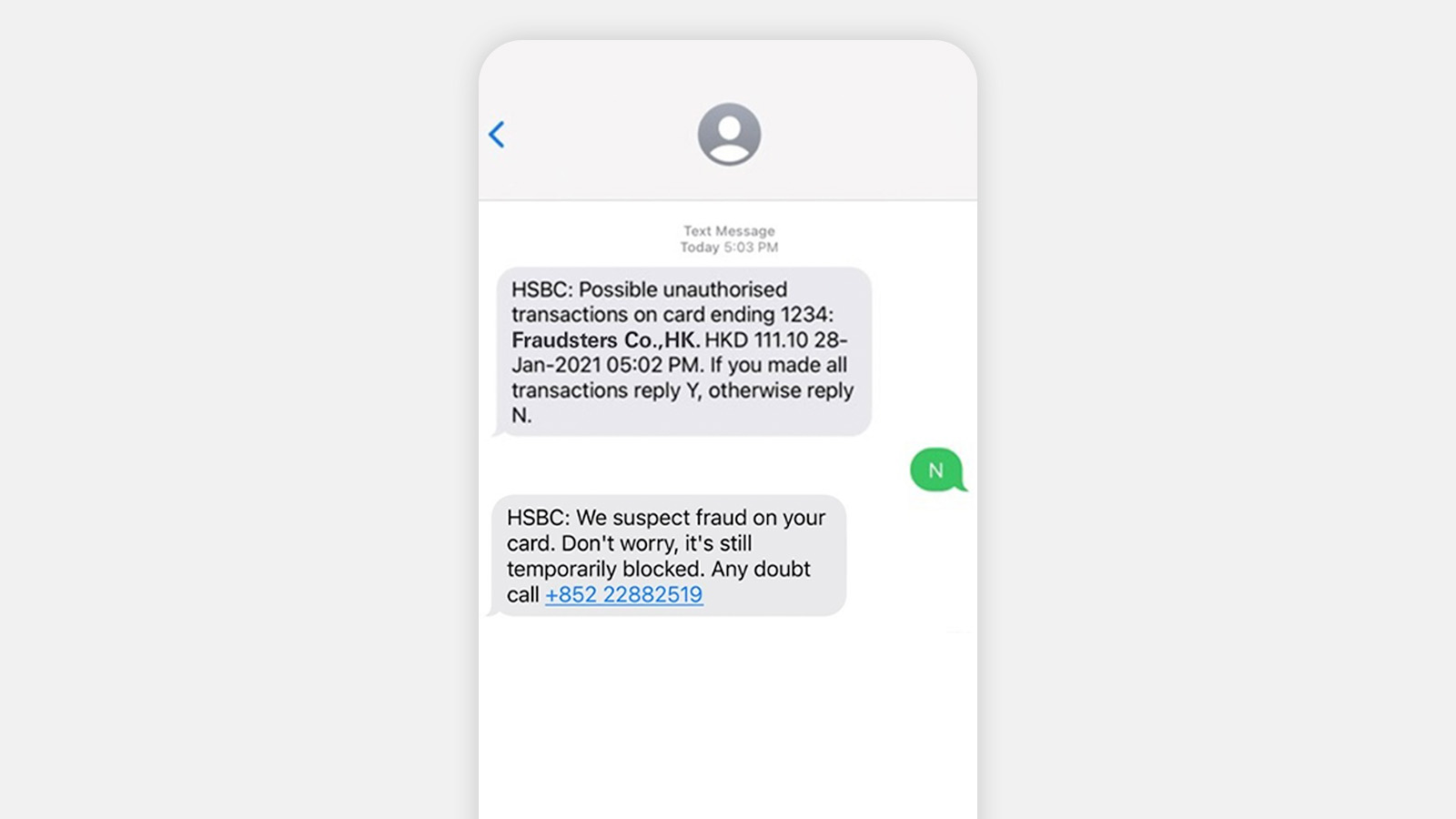

Reply with 'No' or 'N' if you do not recognise the transaction or the details are incorrect

We'll decline the transaction and block your card. We'll also reach out to you between 9am-10:30pm HKT to understand more about this. You can help fight fraud too. Get in touch with us immediately after you've responded with 'N'.

How to tell the difference between a real message from HSBC and a fraudulent message

Fraudsters might impersonate us and send you messages, asking you to provide sensitive personal information or click on a link.

We may send you alerts to keep you up to date on your account activities or to check that a transaction is genuine. However, we will never ask you to provide sensitive personal information such as your identity document number, credit card details (credit card number, expiry date, card verification value printed on the back of credit card), online banking passwords or one-time password (OTP).

If you receive an SMS asking for this kind of information, please stay alert, and:

- do not disclose any sensitive personal details

- do not reply to it or click any of the links

- contact us to verify or report the message

Reporting and enquiry hotline:

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

All other customers: (852) 2233 3000

Alternatively, report any suspicious texts or messages to us at phishing@hsbc.com. Just forward us the smishing text or website address (URL) you received. You'll receive an automated response from us when we've received your email.

What to do if you receive a suspicious email

If you receive an email that has a different look and feel from a typical HSBC email, or if the content seems very different than usual, do not reply or click on any links, or open any attachments. It could be an attempt at phishing.

Remember: HSBC will never send an email/SMS asking for sensitive information nor attach a link requesting you to log on to online banking. you can refer to our phishing page for more information on identifying fraudulent emails.

Please report any suspicious email to us immediately.

Reporting and enquiry hotline:

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

All other customers: (852) 2233 3000

Alternatively, forward the suspicious email you received to us at phishing@hsbc.com to report a problem. You'll receive an automated response from us when we've received your email.

What to do if you receive a suspicious call

If you receive a suspicious call or a pre-recorded audio message claiming to be from HSBC, hang up immediately and contact us to verify or report the call.

If you have disclosed sensitive personal information to the caller, the first thing to do after contacting us is to change your log on information. Carefully monitor any statements and notification letters from your bank and credit card regularly.

Please report anything unusual to us. You can refer to our bogus calls page for more information on identifying bogus calls.

Reporting and enquiry hotline:

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

All other customers: (852) 2233 3000

Alternatively, you can email us at csv@hsbc.com.hk to report a problem.

What to do if your credit card is lost or stolen

If you lost your credit card, or believe it might have been stolen or misused, please report it via the HSBC HK Mobile Banking app or HSBC Online Banking. Learn how to report a lost or stolen card.

You may also call our 24/7 Customer Service Hotline to report your lost or stolen card.

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

Other customers: (852) 2233 3000

If you are certain that your credit card is not lost or stolen, and you just can't remember where you left it, you can log on to HSBC HK Mobile Banking app or HSBC Online Banking and put a block on your credit card for up to 60 days.

Please be aware that blocking your card will not affect existing direct payments, regular auto-transfers, standing instructions and contactless transactions. You will still be held accountable for the transactions made. Please be careful with your spending.

Learn how to report or block a card.

What to do if your log on credentials have been disclosed

If you have disclosed any sensitive information such as log on credentials, passwords or security codes, or if you suspect your account has been misused, please call our hotline immediately to report the problem, and quickly check your transaction record to see if there's any unauthorized transactions. We can help temporarily suspend your account upon your consent to prevent further loss. You should also change your account passwords immediately.

Reporting and enquiry hotline:

HSBC Global Private Banking customers: (852) 2233 3033

HSBC Premier Elite customers: (852) 2233 3033

HSBC Premier customers: (852) 2233 3322

All other customers: (852) 2233 3000

Alternatively, you can email us at csv@hsbc.com.hk to report a problem.

Learn more

- How should I handle and report fraud?

- Three rules to prevent fraud

- How to identify bogus calls?