Making available to you any advertisements, marketing or promotional materials is part of our Bank’s ordinary course of securities dealing business. It shall not, by itself, constitute solicitation of the sale or recommendation of any investment products.

Investment involves risk. Notwithstanding the benefits of offer(s) mentioned herein, you should carefully consider the risks and features of any investment products (including but not limited to equities/exchange traded funds/exchange traded derivatives & structured products) or services mentioned herein to assess whether they are appropriate for you in view of your investment experience, objectives, financial resources and relevant circumstances. The price of investment products may move up or down. Losses may be incurred as well as profits made as a result of buying and selling investment products.

For Renminbi (RMB) products:

- There may be exchange rate risks if you choose to convert RMB payments made on the securities to your home currency.

- RMB products may suffer significant losses in liquidating the underlying investments if such investments do not have an active secondary market and their prices have large bid/ offer spreads.

- In general, RMB equity products are exposed to the usual kind of default risks that might be associated with equity products denominated in other currencies.

Investment Risk Disclosures

1. Risk of Securities Trading

The prices of securities fluctuate, sometimes dramatically. The price of a security may move up or down, and may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities.

2. Risk of Trading Futures and Options

The risk of loss in trading futures contracts or options is substantial. In some circumstances, you may sustain losses in excess of your initial margin funds. Placing contingent orders, such as "stop-loss" or "stop-limit" orders, will not necessarily avoid loss. Market conditions may make it impossible to execute such orders. You may be called upon at short notice to deposit additional margin funds. If the required funds are not provided within the prescribed time, your position may be liquidated. You will remain liable for any resulting deficit in your account. You should therefore study and understand futures contracts and options before you trade and carefully consider whether such trading is suitable in the light of your own financial position and investment objectives. If you trade options you should inform yourself of exercise and expiration procedures and your rights and obligations upon exercise or expiry.

3. Risk of Trading Growth Enterprise Market Stocks

Growth Enterprise Market (GEM) stocks involve a high investment risk. In particular, companies may list on GEM with neither a track record of profitability nor any obligation to forecast future profitability. GEM stocks may be very volatile and illiquid.

You should make the decision to invest only after due and careful consideration. The greater risk profile and other characteristics of GEM mean that it is a market more suited to professional and other sophisticated investors.

Current information on GEM stocks may only be found on the internet website operated by The Stock Exchange of Hong Kong Limited. GEM Companies are usually not required to issue paid announcements in gazetted newspapers.

You should seek independent professional advice if you are uncertain of or have not understood any aspect of this risk disclosure statement or the nature and risks involved in trading of GEM stocks.

4. Risks of Client Assets Received or held outside Hong Kong

Client assets received or held by the licensed or registered person outside Hong Kong are subject to the applicable laws and regulations of the relevant overseas jurisdiction which may be different from the Securities and Futures Ordinance (Cap.571) and the rules made thereunder.

Consequently, such client assets may not enjoy the same protection as that conferred on client assets received or held in Hong Kong.

5. Risk of Providing an Authority to repledge your Securities Collateral etc

There is risk if you provide the licensed or registered person with an authority that allows it to apply your securities or securities collateral pursuant to a securities borrowing and lending agreement, repledge your securities collateral for financial accommodation or deposit your securities collateral as collateral for the discharge and satisfaction of its settlement obligations and liabilities.

If your securities or securities collateral are received or held by the licensed or registered person in Hong Kong, the above arrangement is allowed only if you consent in writing. Moreover, unless you are a professional investor, your authority must specify the period for which it is current and be limited to not more than 12 months. If you are a professional investor, these restrictions do not apply.

Additionally, your authority may be deemed to be renewed (i.e. without your written consent) if the licensed or registered person issues you a reminder at least 14 days prior to the expiry of the authority, and you do not object to such deemed renewal before the expiry date of your then existing authority.

You are not required by any law to sign these authorities. But an authority may be required by licensed or registered persons, for example, to facilitate margin lending to you or to allow your securities or securities collateral to be lent to or deposited as collateral with third parties. The licensed or registered person should explain to you the purposes for which one of these authorities is to be used.

If you sign one of these authorities and your securities or securities collateral are lent to or deposited with third parties, those third parties will have a lien or charge on your securities or securities collateral. Although the licensed or registered person is responsible to you for securities or securities collateral lent or deposited under your authority, a default by it could result in the loss of your securities or securities collateral.

A cash account not involving securities borrowing and lending is available from most licensed or registered persons. If you do not require margin facilities or do not wish your securities or securities collateral to be lent or pledged, do not sign the above authorities and ask to open this type of cash account.

6. Risk of providing an authority to hold mail or to direct mail to third parties

If you provide the licensed or registered person with an authority to hold mail or to direct mail to third parties, it is important for you to promptly collect in person all contract notes and statements of your account and review them in detail to ensure that any anomalies or mistakes can be detected in a timely fashion.

7. Risk of Margin Trading

The risk of loss in financing a transaction by deposit of collateral is significant. You may sustain losses in excess of your cash and any other assets deposited as collateral with the licensed or registered person. Market conditions may make it impossible to execute contingent orders, such as "stop-loss" or "stop-limit" orders. You may be called upon at short notice to make additional margin deposits or interest payments. If the required margin deposits or interest payments are not made within the prescribed time, your collateral may be liquidated without your consent. Moreover, you will remain liable for any resulting deficit in your account and interest charged on your account. You should therefore carefully consider whether such a financing arrangement is suitable in light of your own financial position and investment objectives.

8. Risk of Trading Nasdaq-Amex Securities at The Stock Exchange of Hong Kong Limited

The securities under the Nasdaq-Amex Pilot Program ("PP") are aimed at sophisticated investors. You should consult the licensed or registered person and become familiarised with the PP before trading in the PP securities. You should be aware that the PP securities are not regulated as a primary or secondary listing on the Main Board or the Growth Enterprise Market of The Stock Exchange of Hong Kong Limited.

9. Additional Risk Disclosure for Futures and Options Trading

This brief statement does not disclose all of the risks and other significant aspects of trading in futures and options. In light of the risks, you should undertake such transactions only if you understand the nature of the contracts (and contractual relationships) into which you are entering and the extent of your exposure to risk. Trading in futures and options is not suitable for many members of the public. You should carefully consider whether trading is appropriate for you in light of your experience, objectives, financial resources and other relevant circumstances.

9.1 Futures

(i) Effect of "Leverage" or "Gearing"

Transactions in futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract so that transactions are "leveraged" or "geared". A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

(ii) Risk-reducing orders or strategies

The placing of certain orders (e.g. "stop-loss" orders, or "stop-limit" orders) which are intended to limit losses to certain amounts may not be effective because market conditions may make it impossible to execute such orders. Strategies using combinations of positions, such as "spread" and "straddle" positions may be as risky as taking simple "long" or "short" positions.

9.2 Options

(i) Variable degree of risk

Transactions in options carry a high degree of risk. Purchasers and sellers of options should familiarise themselves with the type of option (i.e. put or call) which they contemplate trading and the associated risks. You should calculate the extent to which the value of the options must increase for your position to become profitable, taking into account the premium and all transaction costs.

The purchaser of options may offset or exercise the options or allow the options to expire. The exercise of an option results either in a cash settlement or in the purchaser acquiring or delivering the underlying interest. If the option is on a futures contract, the purchaser will acquire a futures position with associated liabilities for margin (see the section on Futures above). If the purchased options expire worthless, you will suffer a total loss of your investment which will consist of the option premium plus transaction costs. If you are contemplating purchasing deep-out-of-the-money options, you should be aware that the chance of such options becoming profitable ordinarily is remote.

Selling ("writing" or "granting") an option generally entails considerably greater risk than purchasing options. Although the premium received by the seller is fixed, the seller may sustain a loss well in excess of that amount. The seller will be liable for additional margin to maintain the position if the market moves unfavourably.

The seller will also be exposed to the risk of the purchaser exercising the option and the seller will be obligated to either settle the option in cash or to acquire or deliver the underlying interest. If the option is on a futures contract, the seller will acquire a position in a futures contract with associated liabilities for margin (see the section on Futures above). If the option is "covered" by the seller holding a corresponding position in the underlying interest or a futures contract or another option, the risk may be reduced. If the option is not covered, the risk of loss can be unlimited.

Certain exchanges in some jurisdictions permit deferred payment of the option premium, exposing the purchaser to liability for margin payments not exceeding the amount of the premium. The purchaser is still subject to the risk of losing the premium and transaction costs. When the option is exercised or expires, the purchaser is responsible for any unpaid premium outstanding at that time.

10. Additional Risks common to Futures and Options

10.1 Terms and conditions of contracts

You should ask the firm with which you deal about the terms and conditions of the specific futures or options which you are trading and associated obligations (e.g. the circumstances under which you may become obliged to make or take delivery of the underlying interest of a futures contract and, in respect of options, expiration dates and restrictions on the time for exercise). Under certain circumstances the specifications of outstanding contracts (including the exercise price of an option) may be modified by the exchange or clearing house to reflect changes in the underlying interest.

10.2 Suspension or restriction of trading and pricing relationships

Market conditions (e.g. illiquidity) and/or the operation of the rules of certain markets (e.g. the suspension of trading in any contract or contract month because of price limits or "circuit breakers") may increase the risk of loss by making it difficult or impossible to effect transactions or liquidate/offset positions. If you have sold options, this may increase the risk of loss.

Further, normal pricing relationships between the underlying interest and the futures, and the underlying interest and the option may not exist. This can occur when, for example, the futures contract underlying the option is subject to price limits while the option is not. The absence of an underlying reference price may make it difficult to judge "fair value".

10.3 Deposited cash and property

You should familiarise yourself with the protections given to money or other property you deposit for domestic and foreign transactions, particularly in the event of a firm insolvency or bankruptcy. The extent to which you may recover your money or property may be governed by specific legislation or local rules. In some jurisdictions, property which had been specifically identifiable as your own will be pro-rated in the same manner as cash for purposes of distribution in the event of a shortfall.

10.4 Commission and other charges

Before you begin to trade, you should obtain a clear explanation of all commission, fees and other charges for which you will be liable. These charges will affect your net profit (if any) or increase your loss.

10.5 Transactions in other jurisdictions

Transactions on markets in other jurisdictions, including markets formally linked to a domestic market, may expose you to additional risk. Such markets may be subject to regulation which may offer different or diminished investor protection. Before you trade you should enquire about any rules relevant to your particular transactions. Your local regulatory authority will be unable to compel the enforcement of the rules of regulatory authorities or markets in other jurisdictions where your transactions have been effected. You should ask the firm with which you deal for details about the types of redress available in both your home jurisdiction and other relevant jurisdictions before you start to trade.

10.6 Currency risks

The profit or loss in transactions in foreign currency-denominated contracts (whether they are traded in your own or another jurisdiction) will be affected by fluctuations in currency rates where there is a need to convert from the currency denomination of the contract to another currency.

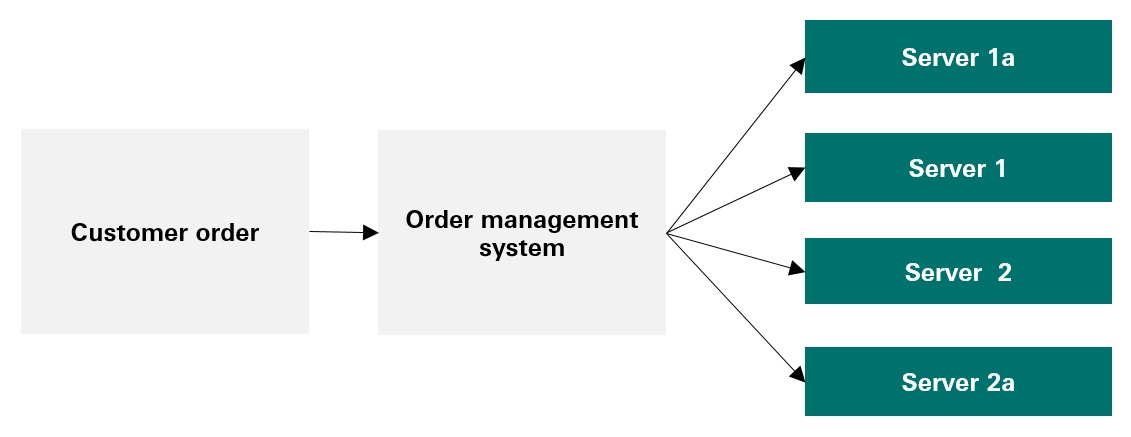

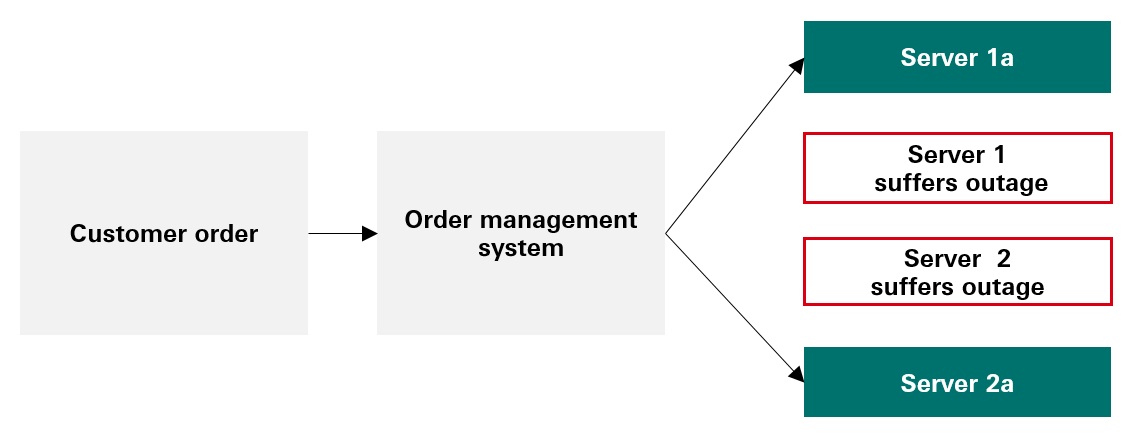

10.7 Trading facilities

Electronic trading facilities are supported by computer-based component systems for the order-routing, execution, matching, registration or clearing of trades. As with all facilities and systems, they are vulnerable to temporary disruption or failure. Your ability to recover certain losses may be subject to limits on liability imposed by the system provider, the market, the clearing house and/or participant firms. Such limits may vary: you should ask the firm with which you deal for details in this respect.

10.8 Electronic trading

Trading on an electronic trading system may differ from trading on other electronic trading systems. If you undertake transactions on an electronic trading system, you will be exposed to risks associated with the system including the failure of hardware and software. The result of any system failure may be that your order is either not executed according to your instructions or is not executed at all.

10.9 Off-exchange transactions

In some jurisdictions, and only then in restricted circumstances, firms are permitted to effect off-exchange transactions. The firm with which you deal may be acting as your counterparty to the transaction. It may be difficult or impossible to liquidate an existing position, to assess the value, to determine a fair price or to assess the exposure to risk. For these reasons, these transactions may involve increased risks. Off-exchange transactions may be less regulated or subject to a separate regulatory regime. Before you undertake such transactions, you should familiarise yourself with applicable rules and attendant risks.

11. Risk of Trading Warrants and Callable Bull/Bear Contracts

Warrants and Callable Bull/Bear Contracts (CBBCs) are structured products which involve derivatives.

You rely on the creditworthiness of the issuer of warrants and/or CCBCs. Subject to both the actual and perceived measures of the credit worthiness of its issuer and, there is no assurance of protection against a default by its issuer in respect of its payment obligations. Upon insolvency of the issuer, you may get nothing back and the potential maximum loss could be 100% of the investment amount and no return may be received.

You are warned that the prices of warrants and CBBCs may fall in value as rapidly as it may rise and holders may sustain a total loss of their investment. CBBCs have a mandatory call feature and may therefore be subject to early termination, upon which (i) investors in category N CBBCs will lose all of their investments in the CBBCs; and (ii) the residual value of category R CBBCs may be zero.

Before you purchase any warrants and/or CBBCs, you should ensure you understand the nature of warrants and/or CBBCs and carefully study the full details and risk factors set out in the relevant listing documents and, where necessary, seek professional advice before you invest in any of these products. You should also ensure that you fully understand the potential risks and rewards and independently determine that they are appropriate for you given your objectives, experience, financial and operational resources and other relevant circumstances. You should note that The Hongkong and Shanghai Banking Corporation Limited acting through its appointed liquidity provider may be the only market participant in HSBC-issued warrants and CBBCs.