Earn higher potential returns while protecting your capital at maturity[@investment-irrahowdoesitwork]

Capital Protected Investment – Currency Linked III (CPI III) could help you earn potentially higher returns than a traditional time deposit, from just HKD50,000. All while protecting your capital at maturity, no matter the market trends.

Key features

Protect your capital fully

Get back 100% of your capital at maturity[@investment-irrahowdoesitwork], regardless of how your chosen foreign currency performs

Choose from all major currencies

Select and invest in any major currency, available in bullish or bearish view

Earn potentially higher returns

Grow your money to fund your travel plans, retirement needs or education goals

Choose your term length

Enjoy more financial flexibility with term lengths spanning 1 to 15 months

Market snapshot

CPI III interest rate (p.a.)

| Deposit currency | Tenor |

Potential interest rate (p.a.) |

|---|---|---|

| USD | 1 months | 6.00% |

| GBP | 2 months |

3.41% |

| Deposit currency | USD |

|---|---|

| Tenor |

1 months |

| Potential interest rate (p.a.) |

6.00% |

| Deposit currency | GBP |

| Tenor |

2 months |

| Potential interest rate (p.a.) |

3.41% |

The contents of this table do not represent recommendations from HSBC. Customers should not base their investment decisions solely on the information herein. Please call (852) 2233 3733 or visit any HSBC branch in Hong Kong for more details on a Capital Protected Investment Deposit.

The above interest rates are indicative only and are the potential maximum interest rates. The interest rate will only be applied if the Deposit Currency moves along with the customer's bearish/bullish view. They are not guaranteed and are subject to revision as per prevailing market conditions.

How does CPI - Currency Linked III (CPI III) work?

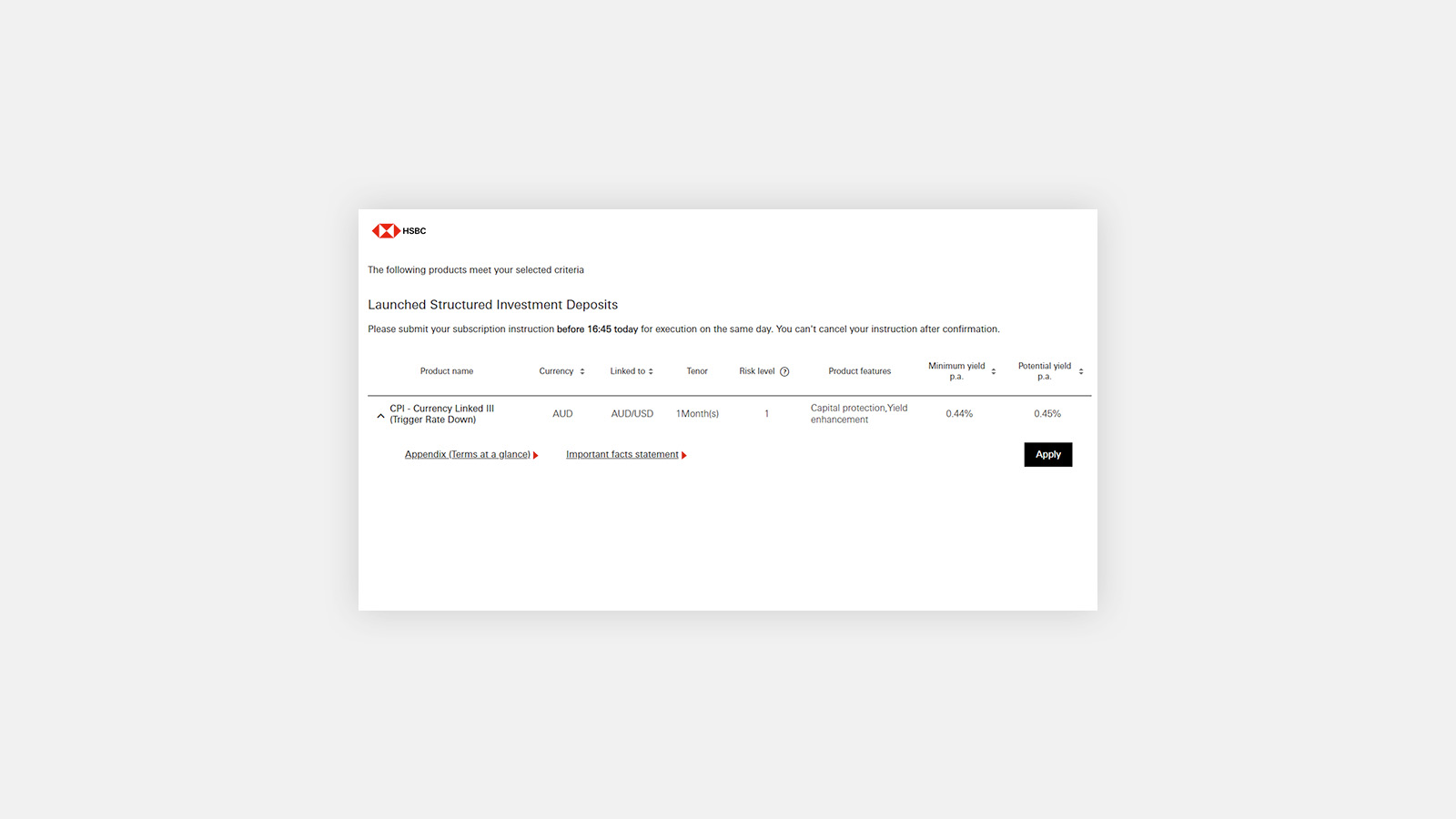

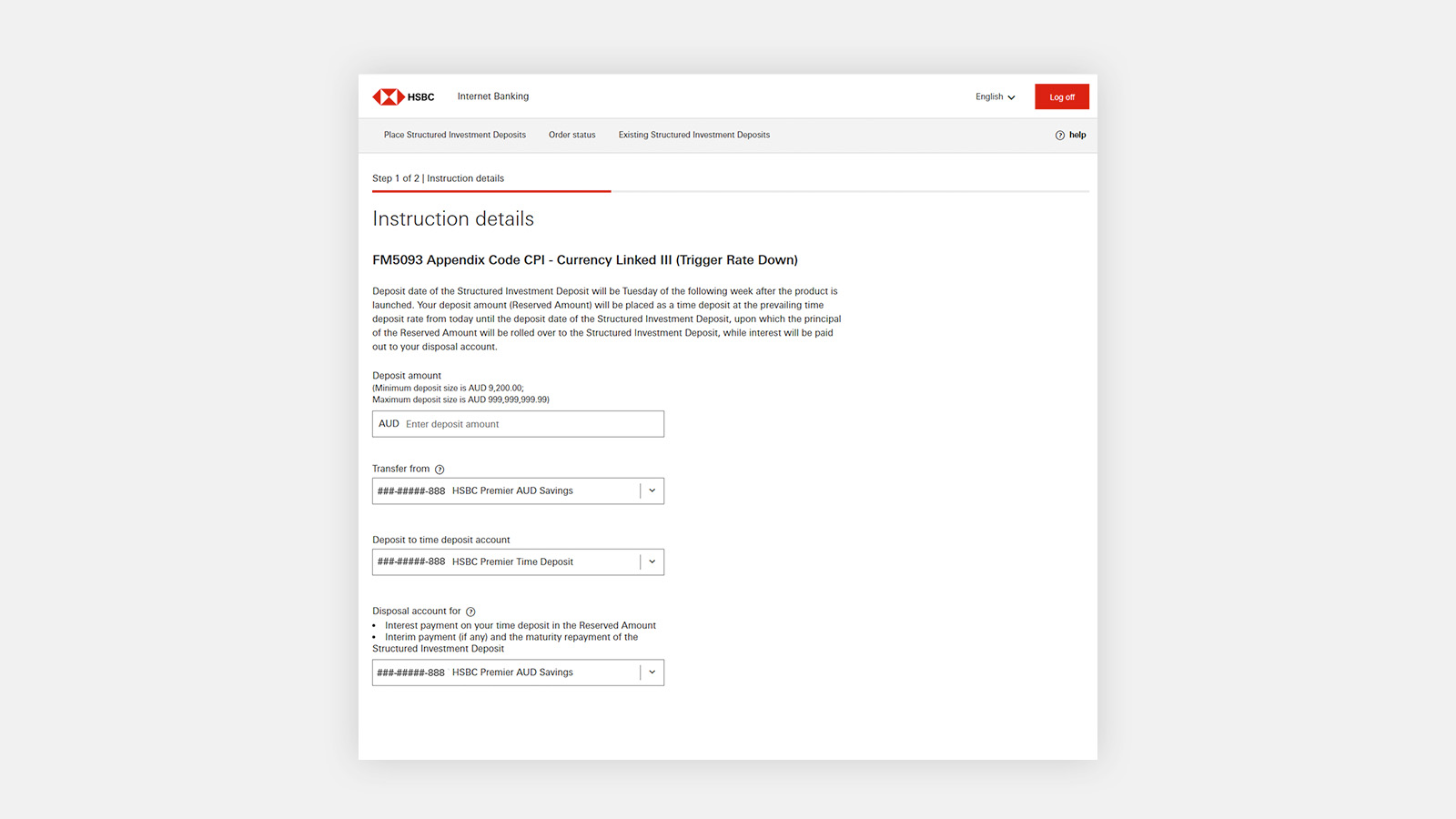

Here's an illustrative example of what could happen if you invest in a CPI III.

| Product details | Important dates | Payout upon maturity |

|---|---|---|

| Deposit Currency: GBP Linked Currency: USD Tenor: 6 months Deposit amount: £100,000 Spot exchange rate: 1.3190 Trigger rate: 1.3390 (Spot exchange rate + 0.02) |

Trade date: 17 Mar 202X Deposit date: 24 Mar 202X Maturity date: 24 Sep 202X Fixing time: 2pm HK time, 22 Sep 202X |

Best return: 100.37% of principal if GBP/USDfix† at fixing is at or above 1.3390 Minimum Return: 100.28% of principal if GBP/USDfix at fixing is below 1.3390 |

| Product details |

Deposit Currency: GBP Linked Currency: USD Tenor: 6 months Deposit amount: £100,000 Spot exchange rate: 1.3190 Trigger rate: 1.3390 (Spot exchange rate + 0.02) |

|---|---|

| Important dates |

Trade date: 17 Mar 202X Deposit date: 24 Mar 202X Maturity date: 24 Sep 202X Fixing time: 2pm HK time, 22 Sep 202X |

| Payout upon maturity |

Best return: 100.37% of principal if GBP/USDfix† at fixing is at or above 1.3390 Minimum Return: 100.28% of principal if GBP/USDfix at fixing is below 1.3390 |

†GBP/USDfix is the spot rate for conversion of USD into GBP on relevant FX reference page

Fees and charges

Generally, you won't be charged any additional fees when you invest in our capital-protected structured products. Any operational, administrative and hedging costs, etc. are covered when we calculate the return income and other variables of the CPI.

Ready to start investing?

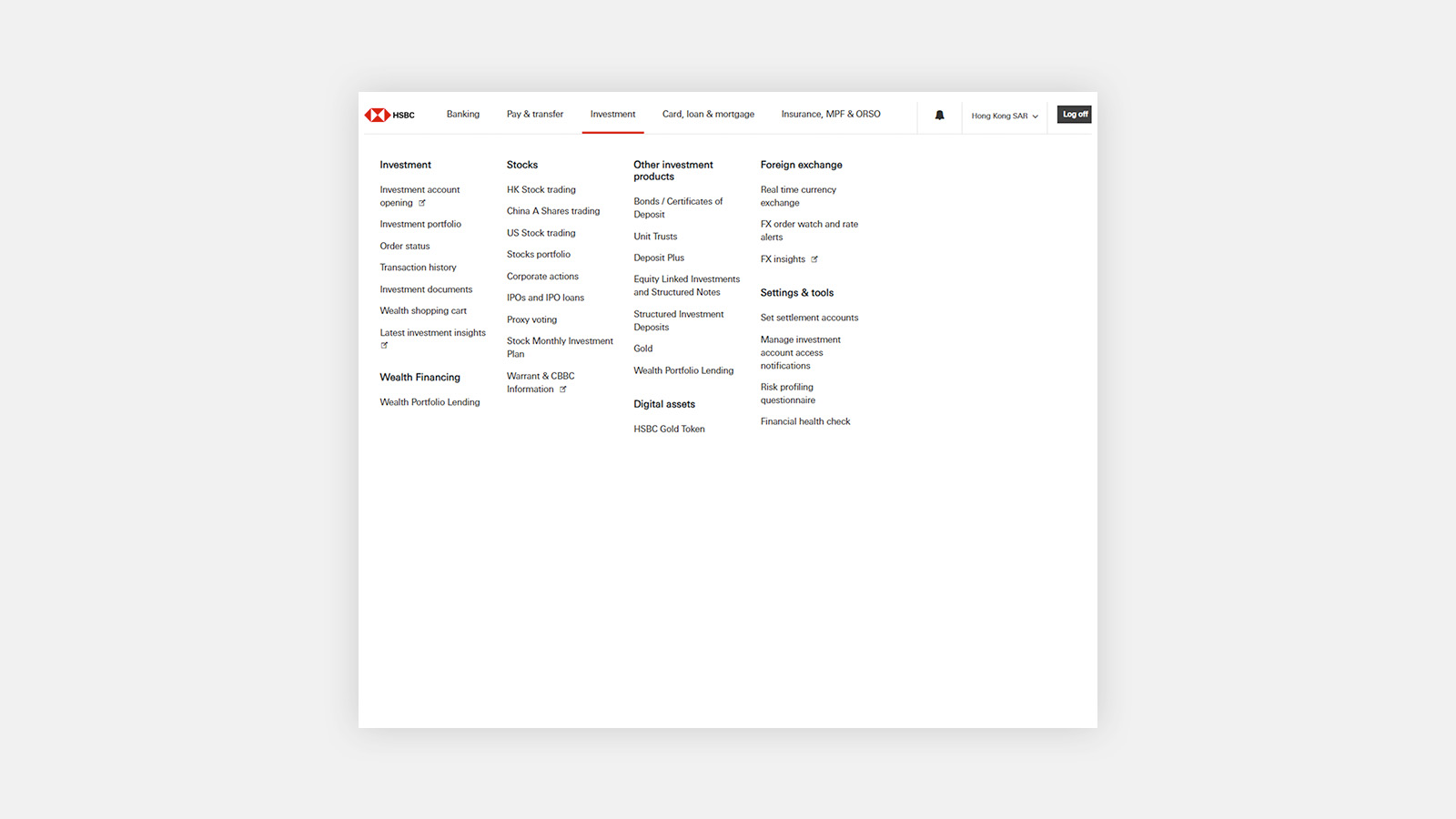

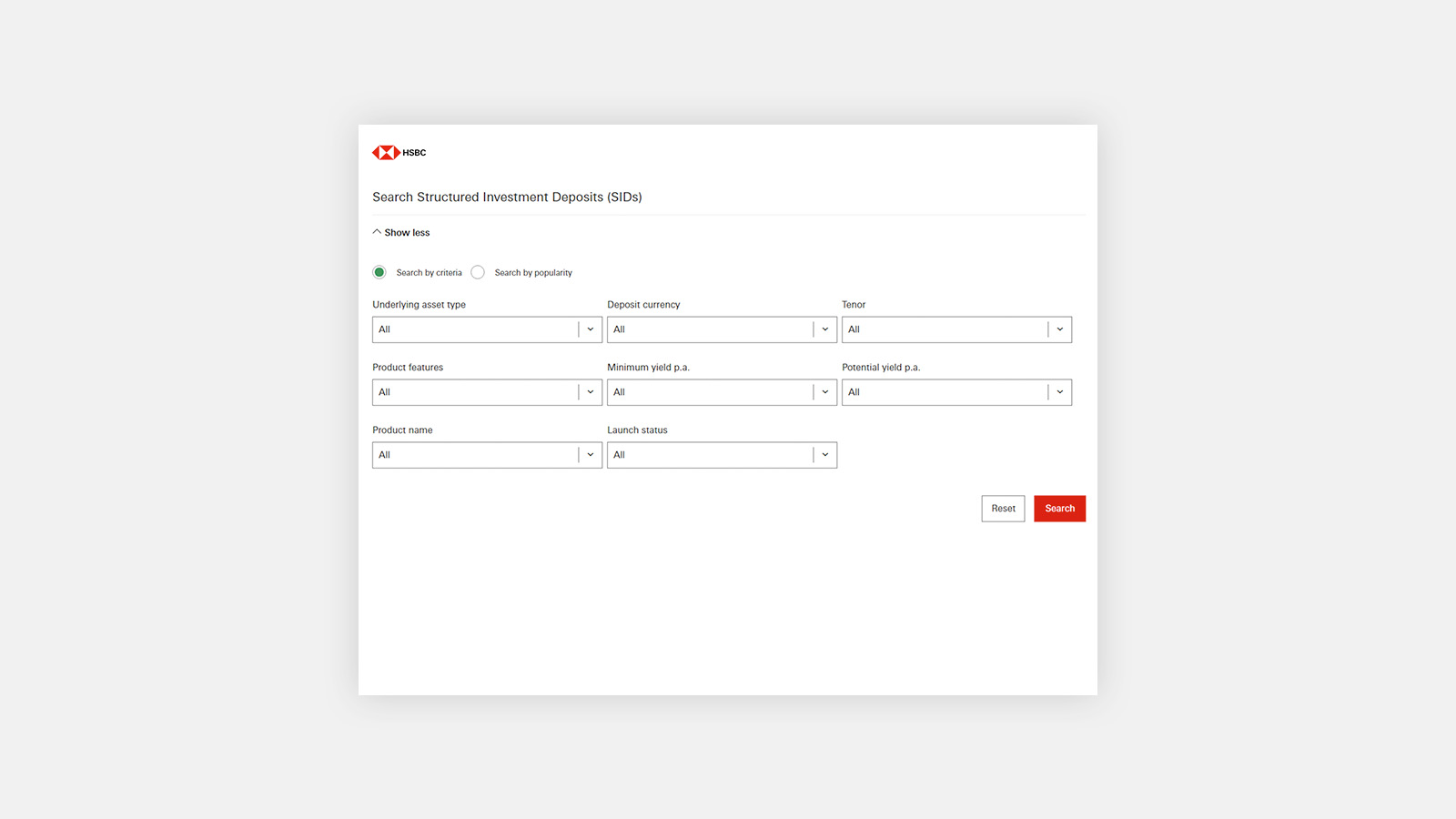

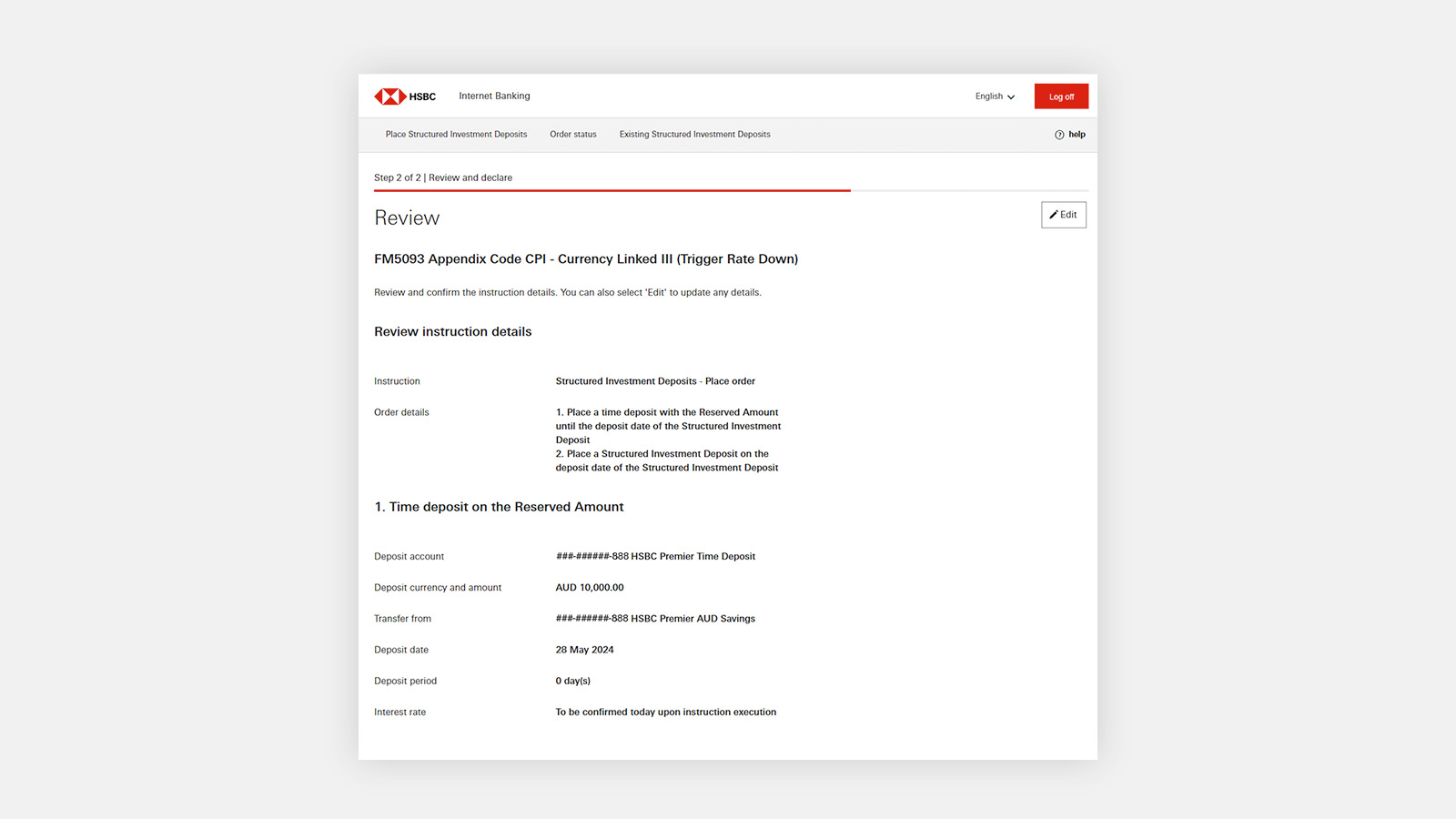

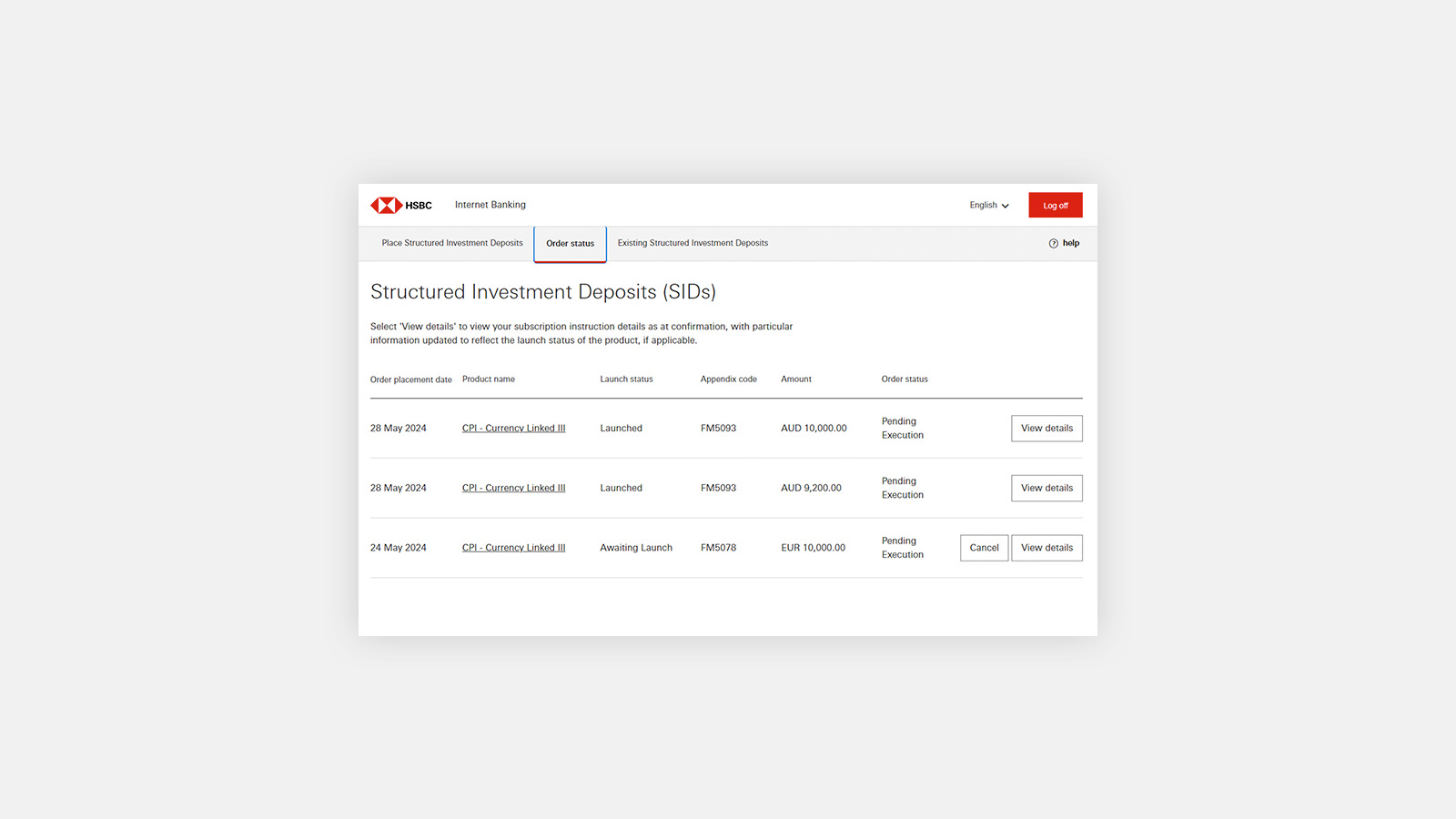

Via HSBC Online Banking

Log on to HSBC Online Banking now to get started.

Need help?

You can call us on (852) 2233 3733 if you have any enquiries about investments. Lines are open between 9:00am and 6:00pm, Mondays to Fridays; and between 9:00am and 1:00pm on Saturdays, except on public holidays.

Find out more

You may also be interested in

How does Capital Protected Investment – Currency Linked III (CPI III) work?

See how a Capital Protected Investment – Currency Linked III (CPI III) may work for you and what payouts you may receive

Equity-linked investments

Tap into the potential of Hong Kong and US equity market movements and earn higher potential income even when the market is range-bound

Deposit Plus

Capture currency market opportunities to generate interest and increase potential return starting from HKD5,000