What is an Equity-linked Investment?

An Equity-linked Investment (ELI) could help you capture potential wealth opportunities even when the market is volatile or stagnant. It could give you the chance to generate potential investment returns linked to the performance of Hong Kong or US underlying equities[@investment-selected-products-only], available with 100% protection or a chance to buy stocks at a price lower than the initial spot price.

US listed securities[@investment-selected-products-only] are now available as underlyings for non-principal protected ELIs. Explore our brand new online platform that allows you to customise your own Equity-linked Investments. Investment involves risk.

Key features

Earn higher potential returns

Earn higher potential returns than with traditional time deposits, depending on the movement of underlying equities

Soften negative market impact

ELI cushions you from negative market conditions with principal protected or knock-in (airbag feature).

Choose your preferred underlyings and tenor

Access more than 250 Hong Kong and US listed securities[@investment-selected-products-only] with tenor lengths from 3 months to 3 years, depending on your needs and circumstances

Seize market opportunities at ease

An alternative for those who may find it hard to time the market, with capability to customise[@customiseowneli] your product

Invest in ELIs online easily

Our award-winning Equity Linked Investments (ELI) online trading platform makes investing simpler and more convenient.

- 100% principal protected and non-principal protected solutions available

- Customise your own product online[@investment-selected-products-only],[@customiseowneli] with access to more than 250 Hong Kong and US listed securities[@investment-selected-products-only]

- Use Scenario Analysis[@investment-selected-products-only] to view possible payouts of the specific product selected

- Guided journeys and filters to narrow down products according to you selection criteria

- Reference underlying past performance

How does a non-principal protected ELI work?

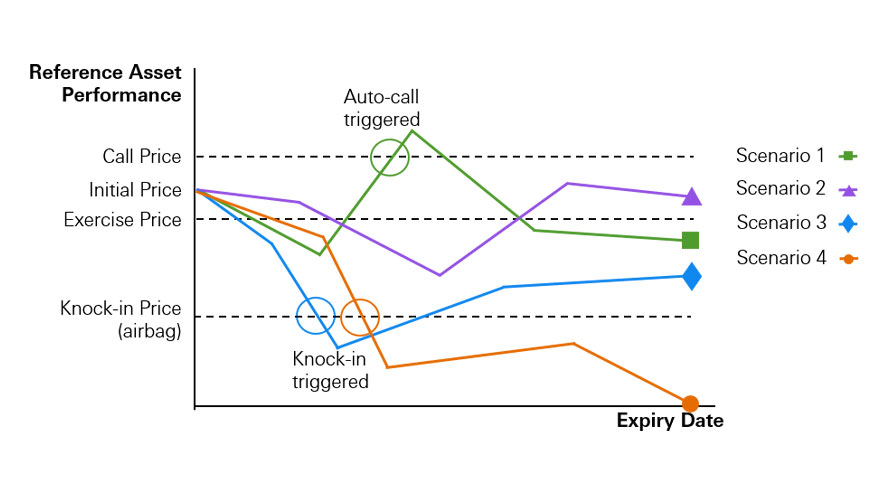

A non-principal protected Equity-linked Investment (ELI) is a type of structured product. Its investment return is directly linked to the performance of a single underlying equity or a basket of up to 4 underlying equities.

A non-principal protected ELI is typically a short to medium-term investment product that may provide potential yield enhancement. On top of this potential interest, you could either receive 100% of your initial principal investment or stock delivery of the worst-performing stock at a discounted price lower than the initial spot price upon maturity.

But in the worst case scenario, the stock price can drop to 0 which means that the stock you receive can be worth nothing and will lose the entire investment.

You can also check out the Scenario tab for a specific product on the ELI online trading platform and view possible scenarios, illustrated with dynamic payout calculation.

Fee and charges

You won't be charged a subscription fee. However, other charges may apply.

If the Hong Kong underlying stock is to be delivered on the settlement date, you will be charged:

- a stamp duty of 0.1% of the transaction amount of the underlying stock deliverable at the value of the exercise price (rounded up to the nearest dollar).

- a deposit transaction charge of HKD5 per board lot of the underlying stock deposited into your investment services/securities account, at a minimum charge of HKD30 and maximum of HKD200

For other securities services, the standard securities charges will apply as advised by us when you open the account or when we notify you periodically with reasonable prior notice before the revisions.

If you have any questions, please visit us at your nearest branch.

Ready to explore ELIs?

HSBC investment account holders

Log on to HSBC Online Banking now to get started.

Don't have an HSBC investment account?

You can open an investment account on the HSBC HK Mobile Banking app and start trading with us in minutes.

Award-winning structured products and platform

Wealth Management Platform of the Year – Hong Kong

HSBC won the top award of 'Wealth Management Platform of the Year – Hong Kong' at the Asian Banking & Finance Retail Banking Awards 2022

Excellence Performance in ESG Investing Products

HSBC won the top award for 'ESG Investing Products' at the Bloomberg Businessweek – Financial Institution Awards in 2022

Structured Products Distributor of the Year

HSBC has been awarded the 'Structured Products Distributor of the Year' at the Bloomberg Businessweek – Financial Institution Awards in 2022

Find out more

You may also be interested in

How does a non-principal protected Equity-linked investment (ELI) work?

See how a non-principal protected equity-linked investment (ELI) may work for you through different scenarios

Private placement notes

Access bespoke structures and guaranteed launches of globally popular and customised indices, HK and US equities—exclusive for HSBC Premier Elite Professional Investors only

Deposit Plus

Capture currency market opportunities to generate interest and increase potential return starting from HKD5,000