Benefits

- Advance transaction date for up to 45 days1 – you can also view and delete the future dated transactions

- Now, you can pay credit card bills of other banks2 with your HSBC credit card – simplify your credit card repayment by consolidating all payments to your HSBC credit card. You can settle your outstanding balances conveniently in just a few taps, with a 1% bill payment handling fee4 (minimum HKD120).

Pay a bill

Download and log on to HSBC HK Mobile Banking app, or log on to Online Banking to get your bills paid without hassle.

Pay government bills with FPS

You can now use FPS to settle Government General Demand Note as well as the bills issued by the following government departments:

- Environmental Protection Department - Waste Disposal Charging Scheme

- Gov Bill - Food and Environmental Hygiene Department - Market Stall Rent

- Hongkong Post Bill Payment

- Inland Revenue Department

- Lands Department (Government Rent and/or Premium Instalment)

- Legal Aid Department

- Marine Department

- Rating and Valuation Department (Rates and/or Government Rent)

- Water Supplies Department

- Working Family and Student Financial Assistance Agency (Student Finance Office – Student Loan Repayment)

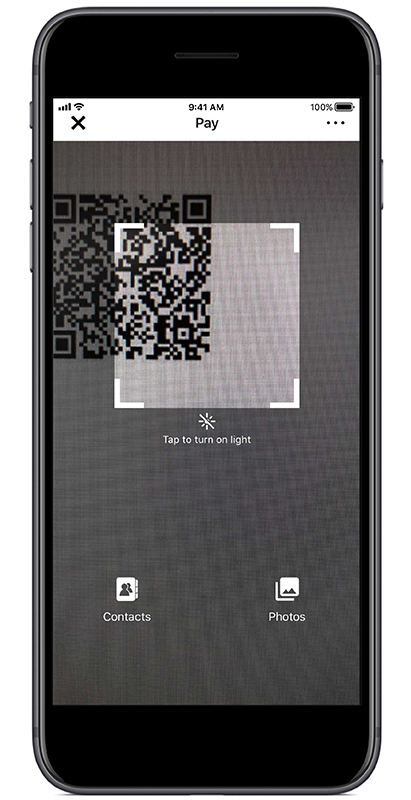

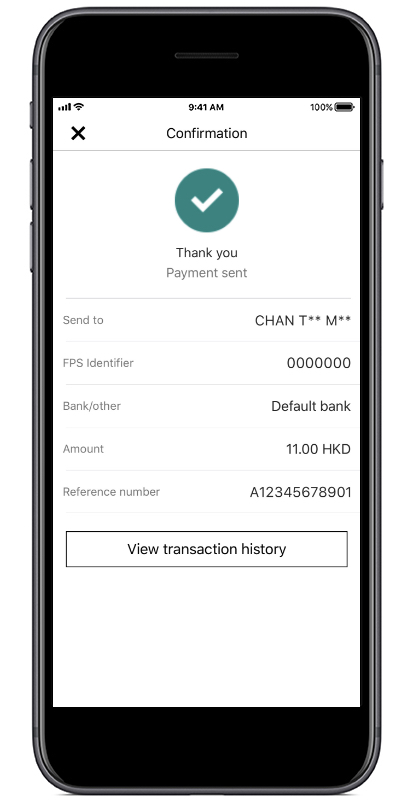

Simply open the HSBC HK Mobile Banking app and scan the QR code printed on your bill to settle payment instantly.

Say goodbye to long queues!

Key benefits

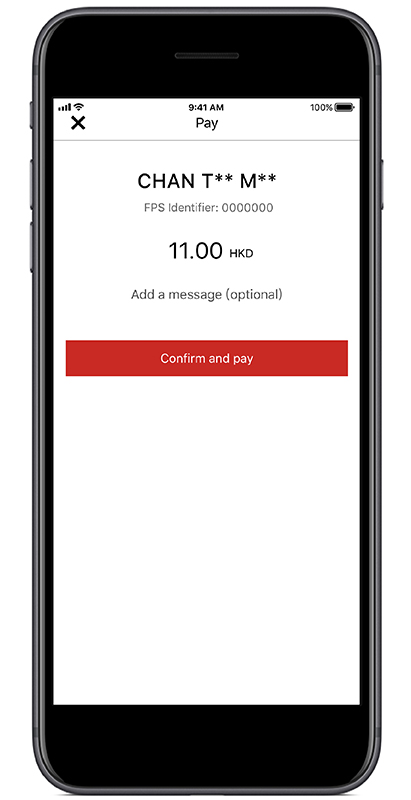

- Scan QR code for instant transfers

- Pay your bills anytime, anywhere

- Skip the queues

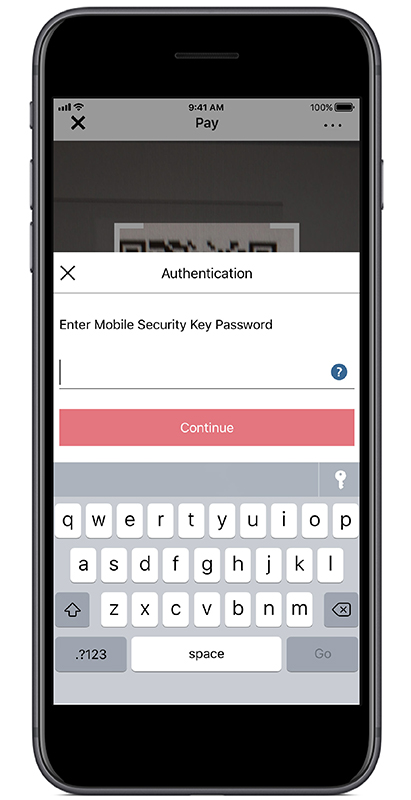

How to pay bills with FPS QR code

Notes :

- Up to 13 days if pay by credit card.

- Please refer to the merchant list in the above section for the merchants that accept credit cards for bill payment. Tax payments, policy loan repayments to insurance companies and payments to finance companies are not eligible for earning RewardCash. Please refer to the 'RewardCash Programme Terms and Conditions' for details.

- Classic, Gold or HSBC UnionPay Dual Currency credit cards do not qualify as designated credit cards. RewardCash will be awarded only on the first HKD10,000 in eligible online bill payments made in each monthly statement cycle. T&Cs apply. Please refer to the "RewardCash Programme Terms and Conditions" for details.

- Please refer to the 'Bank tariff guide for HSBC Wealth and Personal Banking Customers' for details of the bill payment handling fee. The Bank reserves the right to amend the finance charge and other fees and charges.