Table of contents

- HSBC Online Banking FAQs

- Logon IDs, Passwords and Identification Numbers FAQs

- eStatements and eAdvice FAQs

- eBill Service FAQs

- e-Cheque Services FAQs

- Security Device FAQs

- PIN-protected Security Device - Functionality FAQs

- PIN-protected Security Device - PIN Set up / PIN reset FAQs

- PIN-protected Security Device - Activation FAQs

- Transaction Signing FAQs

- Collection FAQs

Online Banking

What services can I access through Online Banking?

We offer two log on options for Online Banking, to give you greater flexibility and convenience.

With memorable answer and password, you can access these services:

Account information

- eStatement and eAdvice

- Real-time account balance

- Transaction history

Banking services

- Transfers (to yourself or to registered accounts)

- Apply debit card

- Time deposits

- Foreign currency exchange

- Mortgage services

- MPF/ ORSO services

Insurance services

- Insurance policy overview

- Family Protector

- Travel insurance

- FirstCare Plus Medical insurance

- Hospital Cash insurance

- Accident insurance

- Home insurance

- Fire insurance

- Helper insurance

- Motor insurance

With Mobile Security Key or Security Device log on, you can access all memorable answer and password services, plus:

Banking services

- Transfers (to non-registered accounts)

- Global View (HSBC Jade/Premier/One customers only)

- Bill payment

- ATM PIN Request

- Account opening

- Credit card PIN request

- Chequebook ordering

Investment services

- Investment portfolio overview

- Wealth management portfolio overview

- Stocks trading

- IPO

- Corporate actions

- Stocks alerts

- Stock monthly investment plan

- Unit trusts

- Unit trust monthly investment plan

- Deposit Plus

- Equity Linked Investments and Structured Notes

- Structured investment deposits

- Bonds / Certificates of Deposit

- Gold trading

- Credit card application

- Virtual card spending limit change

- Personal loan application

- Credit card limit increase

- Block and unblock card

- Octopus AAVS

- Report lost and card replacement

- Card activation

Personal Settings

- eAlert service registration

- Update personal information

- autoPay set up or modification

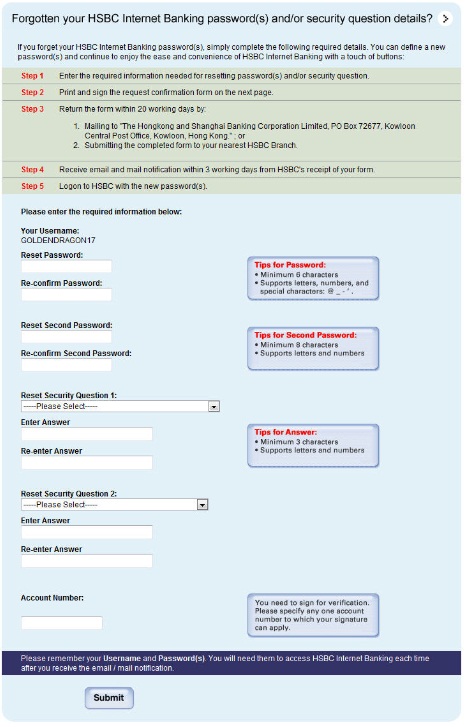

Logon IDs, Passwords and Identification Numbers

What if I forget my Personal Internet Banking username?

Please call us on:

HSBC Jade customers

(852) 2233 3033

HSBC Premier customers

(852) 2233 3322

Other customers

(852) 2233 3000

eStatements and eAdvice

What is the eStatements and eAdvice service? What are the benefits?

By signing up for this service you can manage your statements and advice messages through mobile or online banking anytime, anywhere.

This environmentally friendly service helps you cut paper clutter. You'll also get your account information faster. You still have the option to print eStatements and eAdvice for your records and can also save the files to your computer.

- Free of charge

- Simple to use - simple online service registration and automatic registration for newly-opened accounts.

- Secured platform - single secured platform for various account statements and advices.

- Timely and convenient - access your eStatements anytime, anywhere once they are uploaded. You can view and download* eStatements up to 7 years (84 months), and eAdvice for the past 3 months.

*Available on online banking only

- Thoughtful reminders - get push notification, email and/or SMS alerts when the latest eStatements are uploaded.

eBill Service

What is the Electronic Bill Presentment and Payment service (EBPP)?

EBPP is a one-stop platform for receiving, paying and managing bills via Online Banking.

e-Cheque Services

How does e-Cheque work?

e-Cheque is issued and presented in digital form therefore the entire process works electronically. You can manage e-Cheque by log on to HSBC Online Banking, via HSBC website, or through the "e-Cheque Drop Box" on the HKICL website (HK Interbank Clearing Ltd).

Security device

What is a Security Device?

A Security Device is an electronic device to generate a special, one time Security Code. You must enter the Security Code to access services under the "Security Device Logon Mode", such as securities trading and transfer to non-registered accounts.

Security Device has been selected by HSBC as the technology that best meets our customers' need for flexibility and portability. Please refer to the section New Security Device - Functionality for details.

PIN-protected Security Device - Functionality

Why has HSBC introduced the new Security Device?

HSBC commits to protecting the security of our HSBC Online Banking customers. As a leader in Online Banking security, we are delighted to introduce a new PIN-protected Security Device with enhanced security. The new Security Device has a PIN lock which minimizes the chance of unauthorised use and protects you against possible online threats.

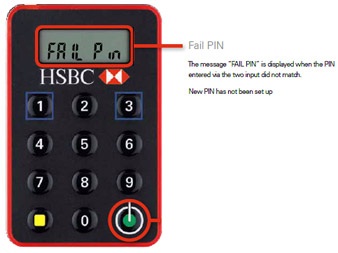

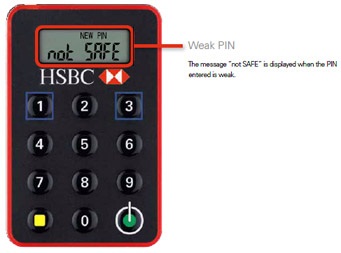

PIN-protected Security Device - PIN Set up / PIN reset

Why do I need to set up a PIN for the new Security Device?

The HSBC Security Device is unique and with an enhanced level of security with a PIN lock which minimizes the chance of unauthorized use and protects you against possible online threats. For added security, you will have to set a PIN during activation and this PIN will be required to unlock your device before use. You MUST set up the PIN before using the Security Device.

PIN-protected Security Device - Activation

What should I do when I receive the new Security Device?

Upon receipt of the new Security Device, you are required to set up your PIN and activate it immediately or within 30 days from the issue date of the letter enclosed with your new Security Device. Otherwise, you will not be able to log on to HSBC Online Banking

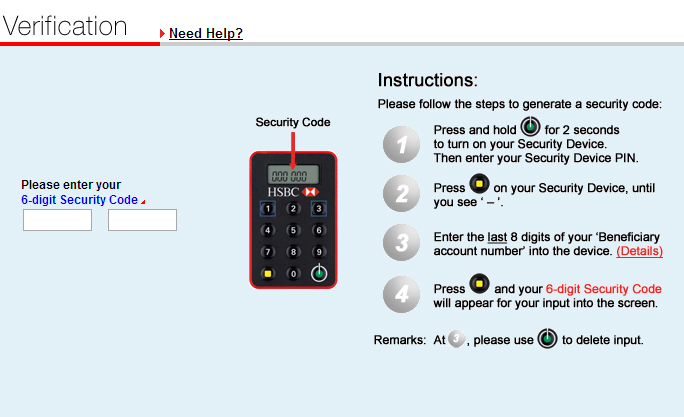

Transaction Signing

How does inputting customer specific information into the Security Device increase the security level in online banking?

The new device requires customer to input information specific to the transaction (e.g. account number) into the device to generate a Security Code. With this transaction signing function, the transfer will only be made to the account specified by the customer.

Collection

How do I view my overdue account?

You can access to your overdue account in your account dashboard in online banking.