Offer For New Investment Customer

$0 brokerage on stock purchases for new investment customers

Enjoy $0 brokerage fee for China A shares purchases through digital channels for customers newly open Investment account

Investment involves risks. Terms and conditions apply. The standard brokerage fee will be charged upfront and subsequently rebated to your account within 12 months after the eligible period.

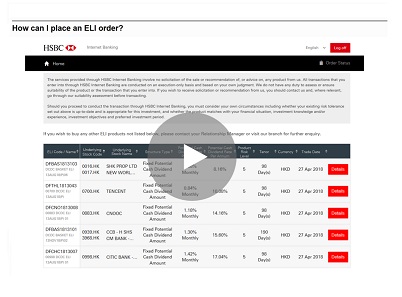

New ELI Online Platform

Explore Renminbi Services

Deposit and withdraw renminbi with a simple, flexible savings account that gives you easy access.

Earn interest from your daily balance.

- Earn bonus interest1 on your account if your Total Relationship Balance is HKD1,000,000 or above

- Easy to set up standing instructions to make regular payments automatically

Put your renminbi in a safe place for a fixed time, earning higher interest than in an easy access account.

Start your savings account with just RMB10,000.

- A range of tenors to suit you, from one week to one year

- 24-hour access to your account via phone, online and mobile

- Gives you convenient renminbi services if you have ties to China

Straightforward day-to-day banking in renminbi.

Manage your money and issue cheques.

- Issue cheques in renminbi

- No maximum balance

- Access your account 24 hours a day via HSBC Personal Internet Banking or phone banking

Note:

3Renminbi Current Account for Hong Kong residents is i) to issue cheques in Hong Kong with any amount and ii) to retailers across Guangdong Province (including Shenzhen) for consumer spending with up to RMB80,000 amount for each cheque and maximum amount of RMB80,000 in total for settlement per day. In the event that the total amount of all the cheques issued by the same customer in Guangdong Province (including Shenzhen) presented on a particular clearing day exceed RMB80,000, one or more of the cheques will be returned in order to keep the total settlement amount of the relevant cheques for the day to be within the limit of RMB80,000. A Return Cheque Fee will be levied. Renminbi Cheques can be issued to individuals & companies in Hong Kong with a valid renminbi account which can accept renminbi cheque deposits. Please check that the individual or company is willing to accept renminbi Cheques as a means of payment. Renminbi denominated cheques issued by non-Hong Kong residents are for use in Hong Kong only and are not for use in the Mainland.

Trade renminbi-denominated securities listed in Shanghai and Hong Kong on one integrated trading platform.

- Stay ahead of market trends with a variety of options, including A shares listed on the Shanghai Stock Exchange (SSE) through Shanghai-Hong Kong Stock Connect, renminbi-denominated securities and a range of ETFs (Exchange Traded Funds) listed on the Stock Exchange of Hong Kong Limited (SEHK)

- A range of A shares listed on SSE to allow you to tap into growth opportunities in China directly

- Invest in various renminbi-denominated ETFs listed on SEHK invested in China A shares, gold and renminbi bond markets, help you to connect with Chinese corporates and commodities

- Dual Tranche, Dual Counters securities listed on SEHK offer customers the flexibility of trading the same ETF in either Hong Kong dollar or renminbi

- Investment Risk Disclosures and Disclaimers for renminbi investment products apply4

Disclaimer

The Bank does not provide investment advice. Investment involves risk. The price of securities may move up or down. This information is neither a recommendation, an offer to sell, nor solicitation of an offer to purchase any investment.

Bonds / Certificates of Deposit (CD) can deliver a relatively stable and predictable stream of income and potentially deliver a better financial return than cash.

You can spread your risk by investing in bonds and diversifying your portfolio.

- Get access to the rapidly growing renminbi offshore markets via direct investment in dim sum bonds / CD

- A range of quality bonds issued by governments, quasi government bodies, corporations and other issuers with tenor from three months to five years

- Minimum investment as low as RMB10,000

- Investment Risk Disclosures and Disclaimers for renminbi investment products apply4

Important Risk Warning

- Bonds are an investment product. The investment decision is yours but you should not invest in bonds unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Bonds / Certificates of Deposit (CDs) are not equivalent to time deposits.

- CDs are not protected deposits, and they are NOT protected by the Deposit Protection Scheme in Hong Kong.

- Issuer's Risk - you rely on the issuer's creditworthiness. Bonds/CDs are subject to both the actual and perceived measures of creditworthiness of the issuer. There is no assurance of protection against a default by the issuer in respect of the repayment obligations. In the worst case scenario (e.g. insolvency of the issuer), you might not be able to recover the principal and coupon, if applicable, and the potential maximum loss could be 100% of invested amount and no coupon received.

Risk Disclosure

- Bonds and CD are mainly for medium to long term investment, not for short term speculation. You should be prepared to invest your funds in Bonds/CD for the full investment tenor; you could lose part or all of your investment if you choose to sell Bonds/CD prior to maturity.

- It is the issuer to pay interest and repay principal of Bonds/CD. If the issuer defaults, the holder of Bonds/CD may not be able to receive back the interest and principal. The holder of Bonds/CD bears the credit risk of the issuer and has no recourse to HSBC unless HSBC is the issuer itself.

- Indicative price of Bonds/CD are available and Bond/CD price do fluctuate when market changes. Factors affecting market price of bonds/CD include, and are not limited to, fluctuations in Interest Rates, Credit Spreads, and Liquidity Premiums. The fluctuation in yield generally has a greater effect on prices of longer tenor Bonds/CD. There is an inherent risk that losses may be incurred rather than profit made as a result of buying and selling Bonds/CD.

- If you wish to sell Bonds/CDs, HSBC may repurchase it based on the prevailing market price under normal market circumstances, but the selling price may differ from the original buying price due to changes in market conditions.

- There may be exchange rate risks if you choose to convert payments made on Bonds/CD to your home currency.

- The secondary market for Bonds/CD may not provide significant liquidity or may trade at prices based on the prevailing market conditions and may not be in line with the expectations of holders of Bonds/CD.

- If Bonds/CD are early redeemed, you may not be able to enjoy the same rates of return when you re-invest the funds in other investments.

For renminbi debt instruments

- Renminbi debt instruments are subject to interest rate fluctuations, which may adversely affect the return and performance of the renminbi products.

- Renminbi products may suffer significant losses in liquidating the underlying investments if such investments do not have an active secondary market and their prices have large bid/offer spreads.

- You could lose part or all of your investment if you choose to sell you renminbi bonds prior to maturity.

By pooling your investments in a fund you can diversify your investments in both renminbi onshore and offshore markets.

You can invest a lump sum or contribute monthly using the Unit Trust Monthly Investment Plan (UTMIP).

- Get access to the rapidly growing renminbi onshore (via RQFII funds) and offshore (via dim sum bond funds) markets

- Gain potential returns and opportunities for growth with dividend distribution options

- Minimum investment of RMB10,000 only

- Investment Risk Disclosures and Disclaimers for renminbi investment products apply4

Important Risk Warning

- Unit Trusts (UT) are investment products and some may involve derivatives. The investment decision is yours but you should not invest unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- UT is not equivalent to time deposits.

- Investors should not make investment decisions based on this material alone.

- In the worst case scenario, the value of the UT may be worth substantially less than the original amount you have invested (and in an extreme case could be worth nothing).

- Investment involves risk. Please refer to the offering documents of the respective funds for details, including risk factors. The price of units or shares and the income from them may go down as well as up and any past performance figures shown are not indicative of future performance. The information contained on this website is intended for Hong Kong residents only and should not be construed as a distribution, an offer to sell, or a solicitation to buy any securities in any jurisdiction where such activities would be unlawful under the laws of such jurisdiction, in particular the United States of America. Please refer to the Unit Trust disclaimer for further important details.

- The information contained in this document and the content relating to the Funds and Unit Trust Offer have not been reviewed by the Securities and Futures Commission of Hong Kong or any regulatory authority in Hong Kong.

If you want the opportunity to capitalise on your market view you can choose a structured product for your investments.

- 100% protection of capital at maturity5

- Potential periodic coupon payments or higher interest return at maturity

- A range of terms choices up to 24 months

- Get returns of up to 5% p.a.6

- Investment Risk Disclosures and Disclaimers for renminbi investment products apply4

5This product is designed to return your original capital at maturity, however, if the Bank becomes insolvent or default on its obligations under this product, you could suffer a total loss of your deposit amount, please refer to 'Credit risk of the Bank' in the offering document of Capital Protected Investment Deposit for details.

6The above Capital Protected Investment Deposit coupon is indicative as of 30 July 2014 for a 2-year tenor. It is not guaranteed and is subject to revision, as per prevailing market conditions. Terms & Conditions apply.

Important Risk Warning

- Capital Protected Investment Deposit (CPI) is a structured product which may involve derivatives. The investment decision is yours but you should not invest unless the intermediary who sells it to you has explained to you that the product is suitable for you having regard to your financial situation, investment experience and investment objectives.

- CPI is not equivalent to time deposit.

- CPI is not protected deposits, and is NOT protected by the Deposit Protection Scheme in Hong Kong.

- Issuer's Risk - you rely on the issuer's creditworthiness. CPI is subject to both the actual and perceived measures of creditworthiness of the issuer. There is no assurance of protection against a default by the issuer in respect of the repayment obligations. In the worst case scenario (e.g. insolvency of the issuer), you might not be able to recover the principal and interest/ coupon, if applicable, and the potential maximum loss could be 100% of invested amount and no coupon received.

Capital Protected Investment Deposit(CPI) Risk Disclosure

- Credit risk of the Bank - CPI is not secured by any collateral. When you invest in this product, you will be relying on the Bank's creditworthiness. If the Bank becomes insolvent or defaults on its obligations under this product, you can only claim as an unsecured creditor of the Bank. In the worst case, you could suffer a total loss of your deposit amount.

- Currency risk - If the deposit currency is not your home currency, and you choose to convert it back to your home currency upon maturity, you may make a gain or loss due to exchange rate fluctuations.

- Risk of early termination by the Bank - The Bank shall have the discretion to uplift a Deposit or any part thereof prior to the Maturity Date (subject to the deduction of such break costs or the addition of such proportion of the return or redemption amount, which may result in a figure less than the original principal amount of the Deposit) if it determines, in its sole discretion, that this is necessary or appropriate to protect any right of the Bank to combine accounts or set-off, or any security interest, or to protect the Customer's interests.

- Market risk - The return of CPI will depend upon the exchange rates of currency pair against trigger rate at the fixing time on the fixing date. Movements in exchange rates can be unpredictable, sudden and drastic, and affected by complex political and economic factors. You must be prepared to take the risk of earning the lower payout/no return (if exchange rate performs against expectation) on the money invested.

- Derivatives risk - CPI is embedded with FX option(s). Option transactions involve risks. If the exchange rate of the currency pair performs against expectation at the fixing time on the fixing dates, you can only earn zero / the minimum payout of the structure.

- Limited potential gain - The maximum potential gain is limited to the sum of the coupons on the deposit, when exchange rate of currency pair at fixing time on the fixing dates moves in line with your anticipated direction.

- Not the same as buying the linked currency - Investing in CPI is not the same as buying the linked currency directly.

- Liquidity risk - CPI is designed to be held until maturity. You do not have a right to request early termination of this product before maturity. Under special circumstances, the Bank has the right to accept your early redemption request at its sole discretion and on a case by case basis. The Bank will provide an indication of the redemption price upon such request. Your return upon such early redemption will likely be lower than that if the deposit were held until maturity and may be negative.

Important Information

Please note that Structured Investment Deposit is not available for persons who are US citizen / with US nationality, are US resident or US tax payer, or have a US address (e.g. primary mailing, residence or business address in the US).

You may find it useful to have renminbi available so you can make the most of opportunities when they arise for investing or making the most of currency movements.

9Customers must have a valid Renminbi Savings Account for the Renminbi Switching instructions to be effected. Renminbi Switching Service is available only to HSBC Premier, HSBC One, Personal Integrated Account customers, Renminbi Savings Account, HK Dollar Statement Savings Account and Combinations Statement Savings Account customers.

10Renminbi notes exchange services are applicable to notes of RMB50 denomination or above only.

Transfer funds from your renminbi account with HSBC in Hong Kong to other renminbi account within or outside Hong Kong12.

- Set up standing instructions easily with Personal Internet Banking

- Transfer up to RMB80,000 per day from your renminbi account with HSBC in Hong Kong to your renminbi account under the same name in China13

- No limit on renminbi remittance amount to other countries/regions outside China

- Global Transfers14 is exclusive for HSBC Global Private Banking / HSBC Premier Elite / HSBC Premier / HSBC One customers. Customers can make near real-time transfer of renminbi between self-named accounts and transfer renminbi to HSBC account overseas anytime.

12Remittance in RMB will be subject to the local regulation of the country/region you are remitting to.

13Customers' (who are Hong Kong residents) daily outward remittance amount may be checked by the renminbi clearing bank. The account name of your beneficiary account in the Mainland must be identical with your HSBC Renminbi savings account, including joint account. Renminbi funds that have been remitted to your renminbi account under the same name in the Mainland and which have not been withdrawn may, after appropriate verification, be remitted back to your renminbi savings account under the same name in Hong Kong. Conditions may apply including those specified by the bank concerned in the Mainland.

14Transfers of renminbi from Hong Kong account can only be made to renminbi accounts in the receiving country via Global Transfer (this service is not applicable to accounts with Mainland China as the receiving country).

Use one card at home, in China and beyond. Enjoy financial control and protection from exchange rate fluctuations between Hong Kong dollars and renminbi.

- One card, two currencies – Hong Kong dollars and renminbi

- Allocate your credit limit flexibly across both currencies

- Earn air miles with the Mileage Programme

- Earn RewardCash through Red Hot Rewards

Year-round benefits

Get travel and medical assistance in China

Withdraw Renminbi At Selected ATMs

Which accounts allow you to withdraw renminbi?

- HKD account (Passbook Savings Account, Current Account, SuperEase Account, HSBC Premier, HSBC One or Personal Integrated Account) recorded on your ATM card.

- Renminbi Savings account under the Integrated Account (HSBC Premier, HSBC One or Personal Integrated Account) recorded on your ATM card.

What is the maximum you can withdraw?

- Up to HKD40,000 equivalent.

What does it cost?

- There is no handling fee.

Manage Your Renminbi

Foreign currency management tools

FX daily focus

Daily FX updates enable you to grasp current market trends

Related Services

Foreign Currency Savings Account

Foreign Currency Savings Account

Foreign Currency Time Deposit

Lock away your money for a set period of time and earn higher interest than a savings account.

Transfers and Payments

Transfer funds to any account in Hong Kong, China and around the world, make bill payments or set up standing instructions easily and quickly.

Pre-order foreign currency

Save time by ordering your currency for your travels in advance. Order and pick up in a branch.

Applicable to HSBC Global Private Banking, HSBC Premier Elite and HSBC Premier customers only

Help and Support

Contact us

By phone

HSBC Global Private Banking customers call

(852) 2233 3033

HSBC Premier Elite customers call

(852) 2233 3033

HSBC Premier customers call

(852) 2233 3322

Other customers call

(852) 2233 3000