Tax deduction arrangement for tax deductible voluntary contributions

Starting from 1 April 2019, making contributions into tax deductible voluntary contributions (TVC) account may be deducted from your taxable income when you report your personal income tax. Since the year of tax assessment 2019/2020, this maximum limit is HKD60,000 per tax assessment year, and is shared between TVC and premiums paid to certain qualifying annuity products. Any claim for tax deduction will be first applied to TVC before other qualifying annuity premiums.

The actual tax saving depends on your own circumstances. The following table provides an illustration on how much you may save in tax with different level of contributions into TVC during a tax assessment year1.

| TVC (HKD) |

Assuming your top progressive tax rate is 2% |

Assuming your top progressive tax rate is 6% |

Assuming your top progressive tax rate is 10% |

Assuming your top progressive tax rate is 14% |

Assuming your top progressive tax rate is 17% |

|---|---|---|---|---|---|

| 2,500 | 50 |

150 | 250 | 350 | 425 |

| 5,000 |

100 | 300 | 500 | 700 | 850 |

| 10,000 |

200 | 600 | 1,000 |

1,400 |

1,700 |

| 30,000 |

600 | 1,800 |

3,000 |

4,200 |

5,100 |

| TVC (HKD) |

2,500 |

|---|---|

| Assuming your top progressive tax rate is 2% |

50 |

| Assuming your top progressive tax rate is 6% |

150 |

| Assuming your top progressive tax rate is 10% |

250 |

| Assuming your top progressive tax rate is 14% |

350 |

| Assuming your top progressive tax rate is 17% |

425 |

| TVC (HKD) |

5,000 |

| Assuming your top progressive tax rate is 2% |

100 |

| Assuming your top progressive tax rate is 6% |

300 |

| Assuming your top progressive tax rate is 10% |

500 |

| Assuming your top progressive tax rate is 14% |

700 |

| Assuming your top progressive tax rate is 17% |

850 |

| TVC (HKD) |

10,000 |

| Assuming your top progressive tax rate is 2% |

200 |

| Assuming your top progressive tax rate is 6% |

600 |

| Assuming your top progressive tax rate is 10% |

1,000 |

| Assuming your top progressive tax rate is 14% |

1,400 |

| Assuming your top progressive tax rate is 17% |

1,700 |

| TVC (HKD) |

30,000 |

| Assuming your top progressive tax rate is 2% |

600 |

| Assuming your top progressive tax rate is 6% |

1,800 |

| Assuming your top progressive tax rate is 10% |

3,000 |

| Assuming your top progressive tax rate is 14% |

4,200 |

| Assuming your top progressive tax rate is 17% |

5,100 |

**Maximum tax saving up to HKD 10,200 for making HKD 60,000 of TVC**

*The above figures are for illustrative purposes only and are not a guarantee on how much tax you will save by contributing to TVC. You are advised to exercise caution in relation to tax matters and above figures. If you are in doubt about your own tax status, you should obtain independent professional advice.

To facilitate the tax deduction claim under your personal income tax filing, HSBC MPF will provide you with a TVC summary around 10 May after the end of the each year of assessment (i.e. before the end of a period of 40 days from the beginning of the next tax assessment year commencing on 1 April). Like tax deduction for mandatory contributions, you are responsible for claiming your tax deduction in your personal income tax return and keeping track of when the maximum tax deductible amount is fully utilised. If you are in doubt of your tax position, please consult your own tax advisor.

1A tax assessment year runs from 1 April to 31 March of the following year. Assumes payment of TVC contribution will not change the progressive tax rate.

HOW much does TVC help towards my retirement saving?

Let’s check out a few scenarios. For a person starting to contribute TVC every year at 35 until his retirement at the age of 65:

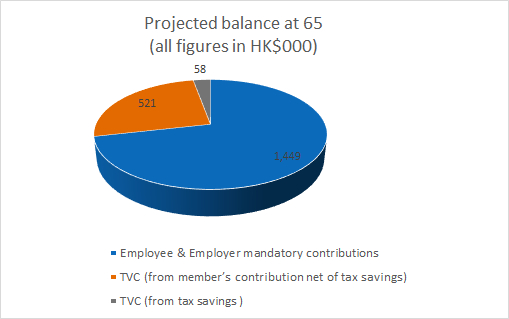

Scenario 1

Monthly Relevant Income = HK$25,000;

Annual TVC amount = HK$12,000;

Progressive tax rate = 10%

Projected balance at the age of 65 = HK$2,028,000

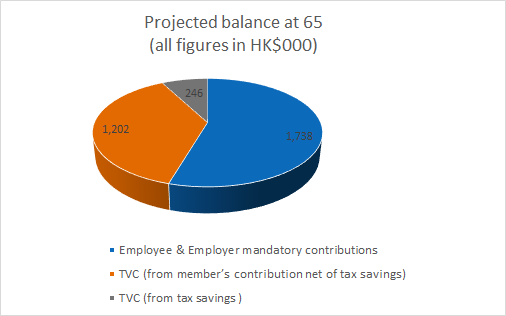

Scenario 2

Monthly Relevant Income = HK$40,000;

Annual TVC amount = HK$30,000;

Progressive tax rate = 17%

Projected balance at the age of 65 = HK$3,186,000

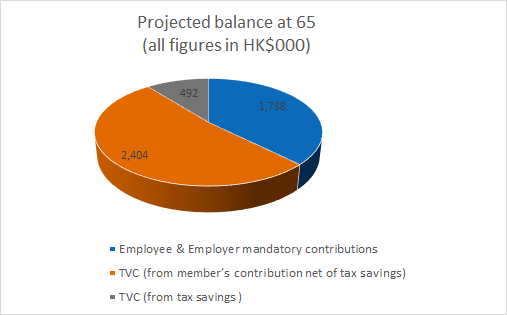

Scenario 3

Monthly Relevant Income = HK$40,000;

Annual TVC amount = HK$60,000;

Progressive tax rate = 17%

Projected balance at the age of 65 = HK$4,634,000

Remarks:

- The tax savings from TVC (which would otherwise be payable to the Hong Kong Inland Revenue Department) plus the member’s contribution net of tax saving are equal to the total projected TVC amount of member at the age of 65.

- ‘Projected balance at the age of 65’ represents the total amount of projected TVC amount and the projected employee & employer mandatory contributions amount. The amount are for illustrative purpose only and do not represent the actual balance. See assumption below.

The projection is based on the following assumptions:

- Assume 3% p.a. investment return and no inflation.

- Assume the maximum tax deductible amount set by Inland Revenue Department remains at HKD60,000 for each tax assessment year.

- Assume the relevant income, annual TVC amount and top progressive tax rate remains unchanged in each tax assessment year.

Always remember – The earlier you start saving, the more the compound effect works in your favour.

Important information

Important notes

- The information shown in this webpage is for illustrative purpose only. You are advised to exercise caution in relation to tax matters and this webpage. It is not intended to provide any form of tax advice. HSBC does not provide tax advice. If you are in doubt about any of the contents of this webpage, you should obtain independent professional advice.

- The information contained here is for reference only and will be updated without notice. The provisions of the Mandatory Provident Fund Schemes Ordinance, other applicable legislation/regulations and guidelines or announcements published by the Mandatory Provident Fund Schemes Authority shall prevail for any information on MPF system. If you are in doubt about the meaning or the effect of the contents of this website, you should seek independent professional advice.

- lnvestment involves risks. Past per performance is not indicative of future performance. The value of financial instruments, in particular stocks and shares, and any income from such financial instruments, may go down as well as up. For further details including the product features and risks involved, please refer to the MPF Scheme Brochure.