Managing your MPF

HSBC MPF offers you a comprehensive set of services making it easy to manage and monitor your MPF.

Explore Understanding MPF

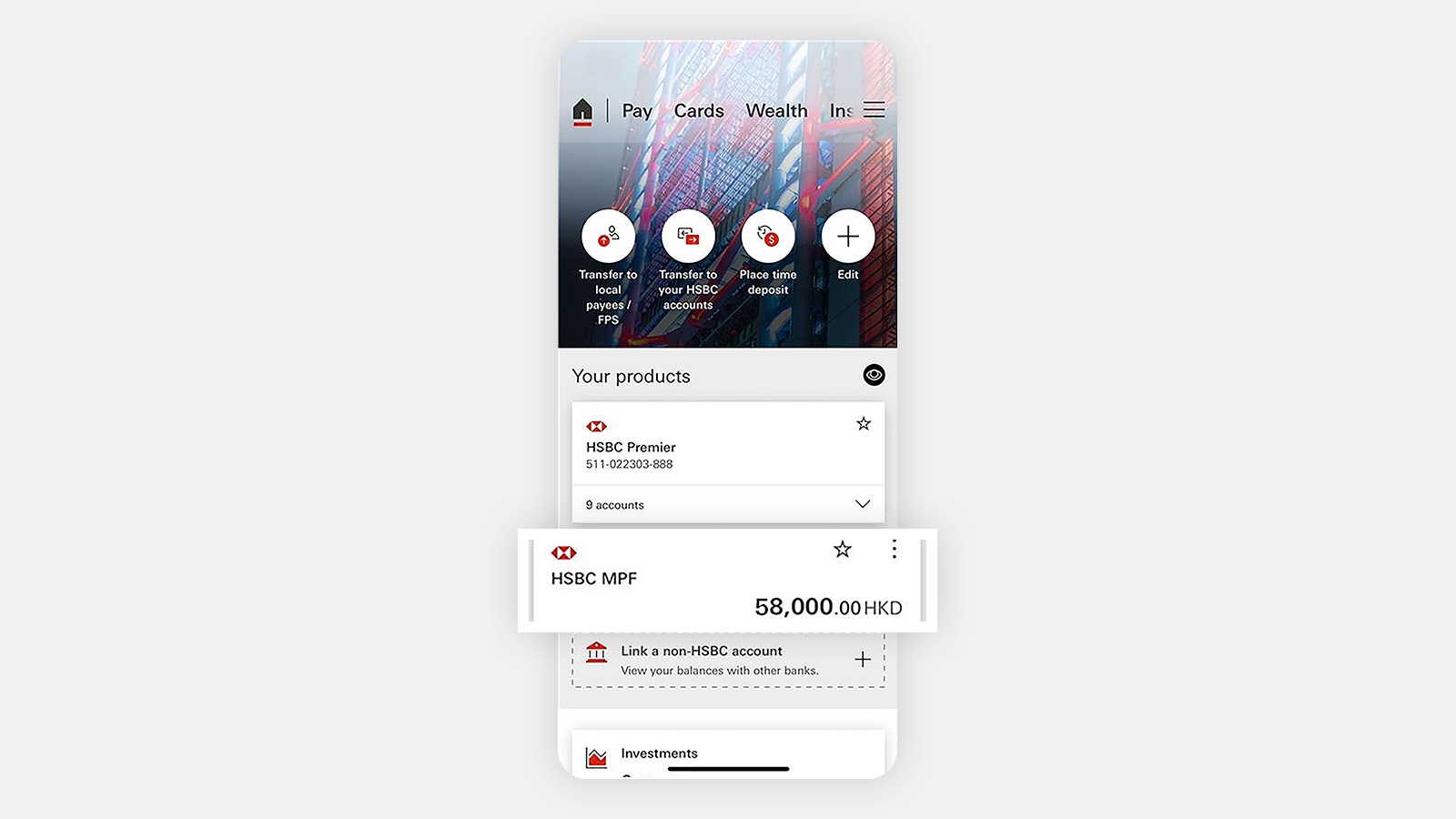

Manage MPF account(s) at your fingertips

Total wealth management

View your MPF account(s) together with all other banking accounts, and fulfil different banking needs in one go.

Comprehensive eServices with mobile experience

Manage your MPF scheme at ease through electronic channels anytime, anywhere.

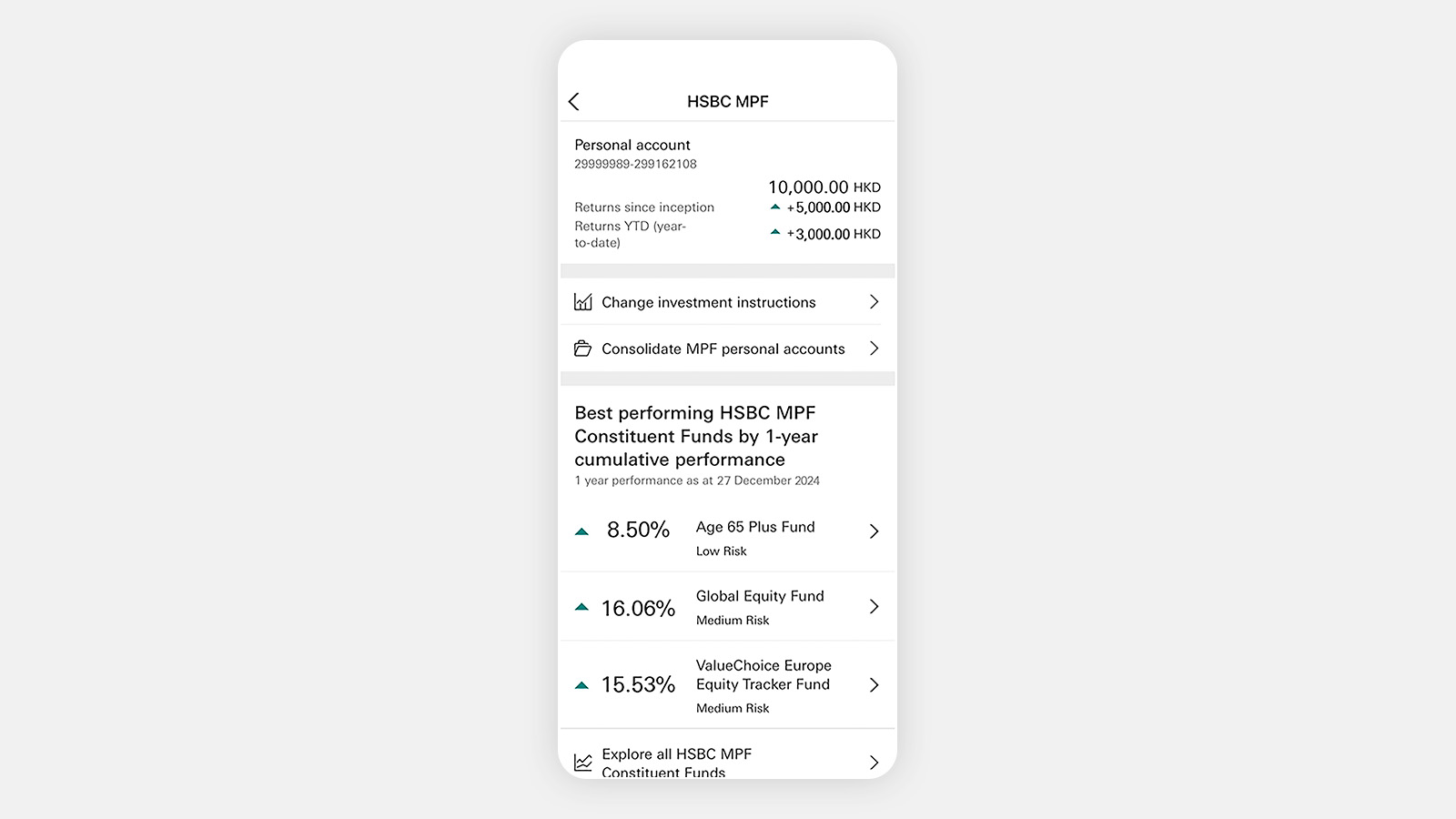

Fund performance at a glance with easy account management

View top funds’ performance and conduct fund switching via simple steps.

Member Quick Guide – Manage your MPF scheme via electronic channels without any hassle

HSBC HK Mobile Banking app:

Click "HSBC MPF" to manage your MPF account(s)

On HSBC MPF homepage, you can:

- View MPF account balances and returns

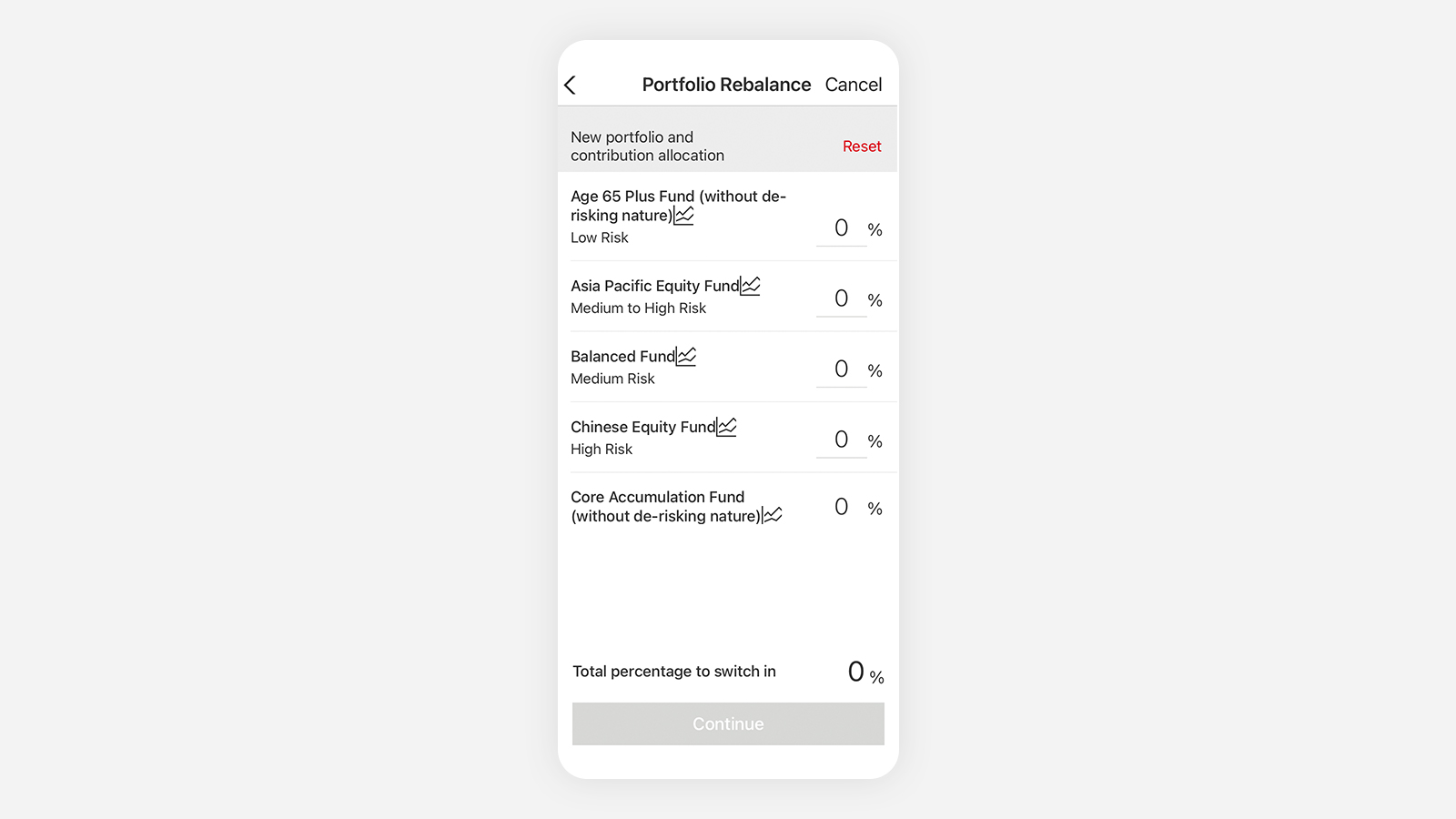

- Change MPF investment instructions

- Review best performing funds

Make simple instructions to change your investment allocation

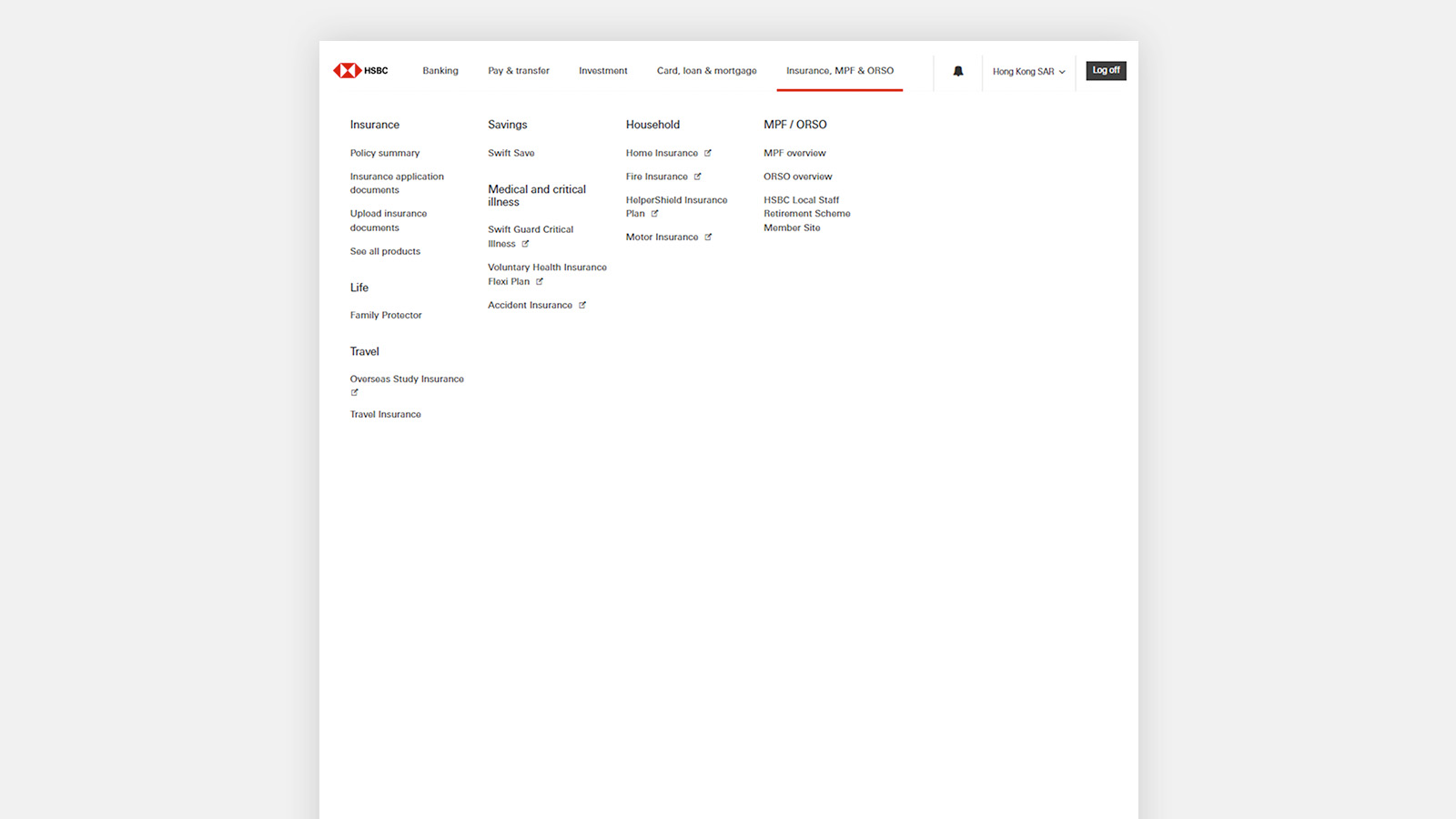

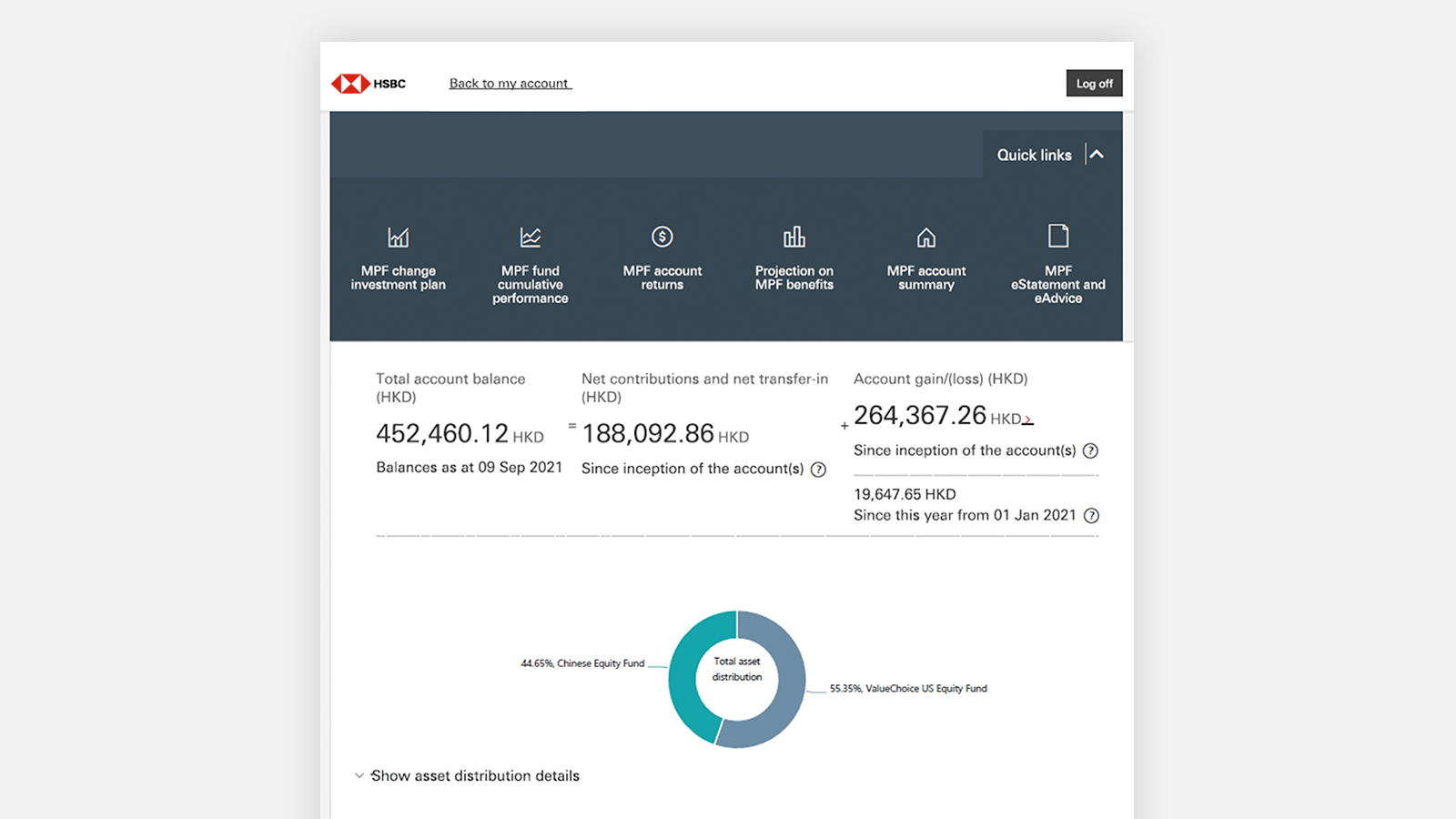

HSBC Online Banking:

Click "MPF overview" under "Insurance, MPF & ORSO " to manage your MPF account(s)

On homepage, you can: |

|

|

|

|

- Change MPF investment instructions

- Review MPF fund cumulative performance

- View MPF account balances and returns

- View projection on MPF benefits

- Read MPF account summary

- Review MPF eStatement and eAdvice*

* Only applicable to members who have registered for this service.

Download HSBC HK Mobile Banking app to experience now

Employer Quick Guide – Make MPF contributions smarter with your mobile

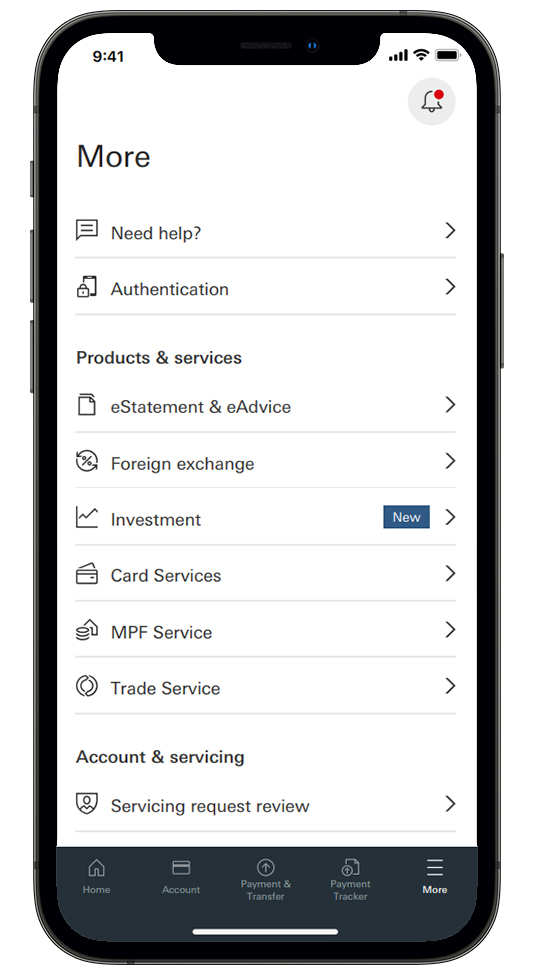

HSBC HK Business Express mobile app:

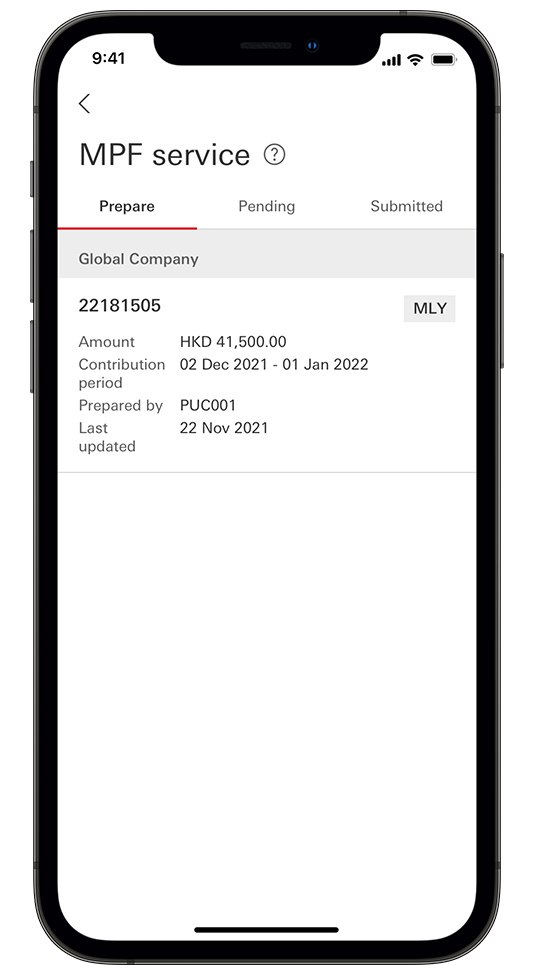

Click “More” at the right bottom corner of the HSBC HK Business Express mobile app homepage. Then select “MPF service” on the subsequent page

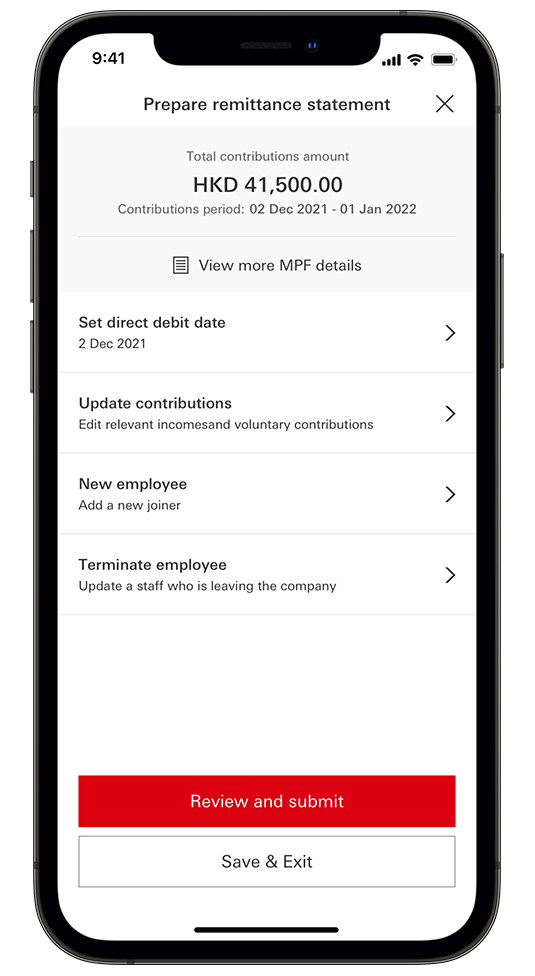

Prepare and submit MPF Remittance Statements, and view contribution history

Make simple instructions to modify employee details

Download HSBC HK Business Express mobile app now to experience now

Default Investment Strategy

Find out more about the MPF default investment arrangement.

Quarterly fund fact sheet [PDF]

A report on the investment objectives, portfolio allocation and holdings, and market commentary for each Constituent Fund.

Understanding the MPF Member Benefit Statement

A summary of account movements for the current financial year and since you joined the scheme.

MPF Hotlines

HSBC MPF Member Hotline: +852 3128 0128

HSBC MPF Employer Hotline: +852 2583 8033

Our member hotline is a 24-hour interactive voice response system allowing members to manage their MPF accounts.

Write to us

Find out more about making enquiries, complaints and providing feedback.

Visit a branch with MPF services

Find your nearest branch offering an MPF drop-in box and MPF services and enquiries.

Additional information

Select your MPF account

Important information

Important notes

- The information contained in this website is for reference only and will be updated without notice. The provisions of the Mandatory Provident Fund Schemes Ordinance, other applicable legislation/regulations and guidelines or announcements published by the Mandatory Provident Fund Schemes Authority shall prevail for any information on MPF system. If you're in doubt about the meaning or the effect of the contents of this website, you should seek independent professional advice.

- Investments involve risks. Past performance is not indicative of future performance. The value of financial instruments, in particular stocks and shares, and any income from such financial instruments, may go down as well as up. For further details including the product features and risks involved, please refer to the MPF Scheme Brochure.

- The content shared by this webpage should not be viewed as investment recommendation and advice. You should seek professional analysis and advice before making any decisions related to the information shared in this webpage.

- The MPF eServices in HSBC HK Business Express mobile app and Business Internet Banking are intended for use by HSBC commercial banking customers with MPF account(s) in Hong Kong.

- The screen displays are for reference and illustration purposes only.

- Apple, the Apple logo, iPhone, iPad, iPod touch, Touch ID and Face ID are trademarks of Apple Inc., registered in the US and other countries/regions. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC. Android is a trademark of Google LLC.

- Other Terms and Conditions apply. Please refer to each app webpage and go to the relevant links provided above for details.